From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Shows Mixed Signals: Export Adjustments and Plant Activity Shifts

China’s steel market presents a complex picture. While the news article “China’s semis exports down 14% in June from May, H1 volume hits record 5.9 million mt” indicates a recent decline in semi-finished steel exports, potentially signalling reduced demand from overseas, this does not immediately correlate with observed activity levels at specific plants based on satellite data. Further, the news article “China’s steel scrap imports down 5.32 percent to 133,800 mt in H1” reports on decreased scrap imports, which could impact EAF-based steel production costs and strategies.

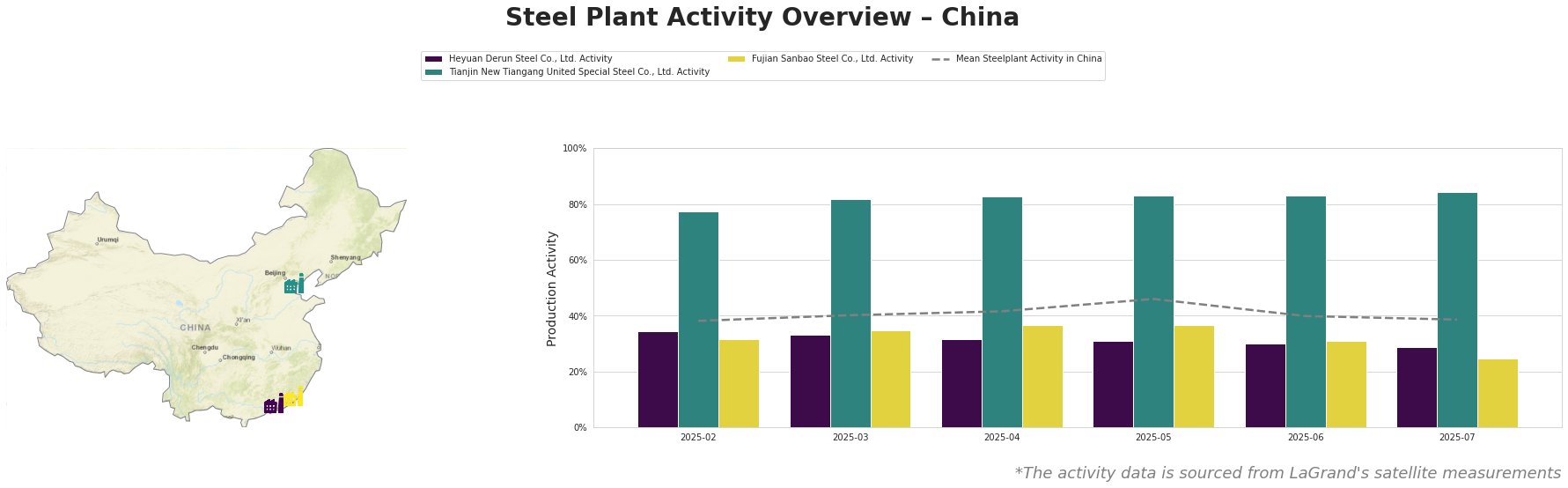

Overall, average steel plant activity in China shows a peak in May at 46% and a moderate decline to 39% in July.

Heyuan Derun Steel Co., Ltd., located in Guangdong and operating exclusively with EAF technology with a crude steel capacity of 1.2 million tonnes, has consistently operated below the average activity level in China. Its activity decreased steadily from 34% in February to 29% in July. This decline may be linked to the decreased steel scrap imports reported in “China’s steel scrap imports down 5.32 percent to 133,800 mt in H1“, as EAF-based steelmaking relies heavily on scrap.

Tianjin New Tiangang United Special Steel Co., Ltd., an integrated BF-BOF steel plant in Tianjin with a crude steel capacity of 4.5 million tonnes, maintains a consistently high activity level, fluctuating only slightly between 78% and 84% during the observed period, significantly above the national average. There is no clear connection between the stable high activity at this plant and the news articles provided.

Fujian Sanbao Steel Co., Ltd., an integrated BF-BOF steel plant in Fujian with both BOF and EAF production capabilities and a crude steel capacity of 4.62 million tonnes, showed a decrease in activity from a peak of 37% in April and May to 25% in July. This represents the most significant drop among the observed plants. No direct connection to the provided news articles can be established.

Evaluated Market Implications:

The decrease in scrap imports and the corresponding activity decrease at Heyuan Derun Steel Co., Ltd. suggests potential regional supply constraints for hot rolled rebar and billet in Guangdong. Steel buyers should closely monitor price fluctuations and lead times for these products in the region. It is recommended to diversify suppliers and secure contracts with plants less dependent on steel scrap or located in regions with more stable scrap supply chains. The high and stable activity at Tianjin New Tiangang suggests a reliable supply of angle steel and continuous casting billet from this source. The drop in activity at Fujian Sanbao Steel Co., Ltd. warrants monitoring, particularly for buyers relying on corrosion-resistant hot-rolled coils, billets, hot-rolled ribbed steel bars, hot-rolled round steel bars, high-strength fasteners and steel strands.