From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Resilient Despite Production Cuts: Coking Coal Imports Surge

China’s steel market presents a mixed picture of reduced production alongside increased coking coal imports, indicating a potential shift in sourcing strategies. The trend aligns with data from the news article “China reduced iron ore production by 3.2% y/y in January-October“, indicating China’s ongoing efforts to reduce steel production. However, we cannot explicitly link this trend directly to the satellite-observed changes in plant activity levels.

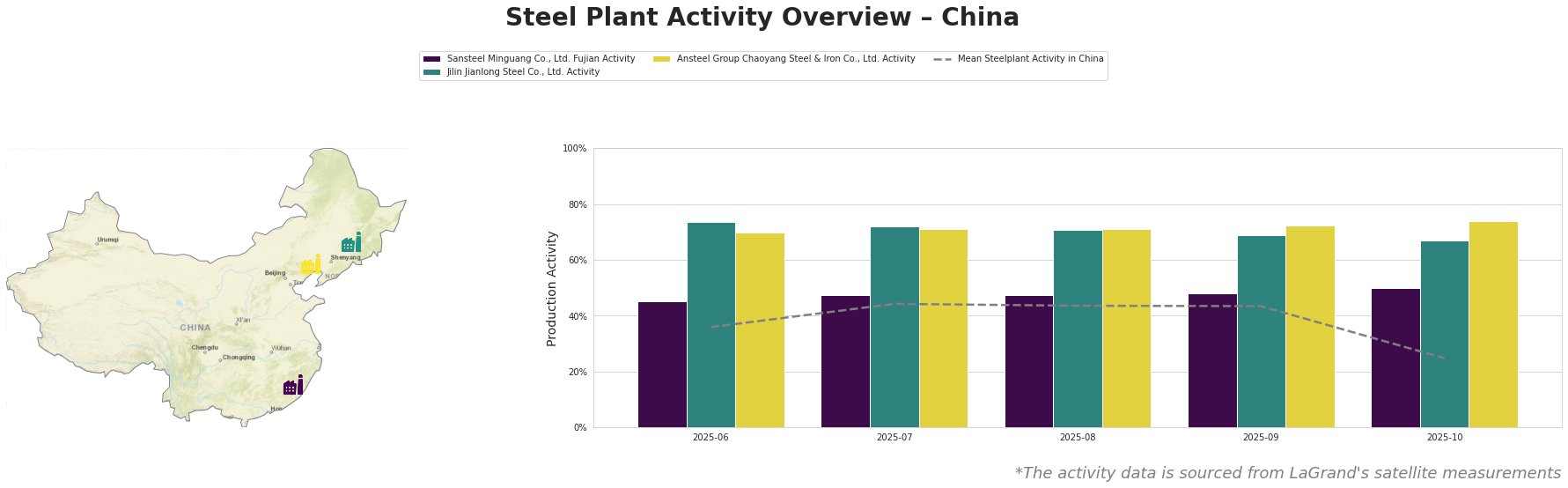

The mean steel plant activity in China experienced a significant drop in October, falling to 25.0% from 43.0% in September, reflecting a broader trend of reduced steel production. Activity levels at Jilin Jianlong Steel and Ansteel Group Chaoyang Steel & Iron remained relatively high compared to the national average, while Sansteel Minguang also showed a notable rise, especially in October.

Sansteel Minguang Co., Ltd. Fujian, an integrated BF-based steel plant with a crude steel capacity of 6.8 million tonnes, mainly produces finished rolled products such as steel plates, round bars, and construction steel. Observed activity rose from 45% in June to 50% in October, contrasting the sharp drop in mean activity levels across China, but aligning with their focus on construction steel. The increase might reflect a strategic emphasis on maintaining production for key infrastructure projects, however a direct causal link cannot be established.

Jilin Jianlong Steel Co., Ltd., with a 3 million tonne crude steel capacity, specializes in high-end products like automotive structural steel and pipeline steel. Its activity levels remained consistently high, fluctuating between 67% and 74% from June to October. There is no immediate indication that this plant has been impacted by the production cuts referenced in “China reduced iron ore production by 3.2% y/y in January-October“.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., another integrated BF-BOF producer focused on steel plate and pipe, has demonstrated robust activity, increasing from 70% in June to 74% in October. This consistent high level of output, similar to Jilin Jianlong Steel, does not appear to correlate with overall production declines reported in “Global steel production fell by 5.9% y/y in October“.

The news article “China increased its imports of coking coal by 6.4% y/y in October” suggests that, despite decreased steel production, demand for coking coal remains robust, potentially signaling anticipation of future increases in steel output and shifts in production mix.

Evaluated Market Implications:

The activity data, coupled with the news of increased coking coal imports and reduced iron ore production, suggests a possible scenario where China is optimizing its steel production by potentially favoring higher-margin products or strategically stockpiling resources. While the news article “Global steel production fell by 5.9% y/y in October” highlights an overall decrease in global production, the sustained activity at plants like Jilin Jianlong and Ansteel Chaoyang indicates that certain segments of the Chinese steel industry remain resilient.

- Procurement Action: Given the increased coking coal imports, and a possible reduced steel production in the near term, steel buyers should prioritize securing long-term contracts with suppliers of specialized steel products (automotive, pipeline, and high-grade plate) to mitigate against potential price increases driven by supply adjustments, especially those relying on Jilin Jianlong and Ansteel Chaoyang, due to their high utilization rates.