From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market: Rebar Production Surge & Export Shifts Signal Opportunities Despite Price Dip

China’s steel market presents a mixed landscape. Increased domestic rebar output contrasts with declining sheet/plate exports, demanding agile procurement strategies. The news article “China’s rebar output up 0.3 percent in January-August 2025” directly reflects a potential oversupply situation domestically, while “China’s steel sheet/plate exports down significantly in Aug, almost stable in Jan-Aug 2025” highlights international demand fluctuations. No direct connection could be established between these news articles and the provided satellite observed activity data. However, “China’s steel bar exports increase by 52.2 percent in January-August 2025” indicates a strong external market for specific steel bar products, which can be indirectly related to overall production activity.

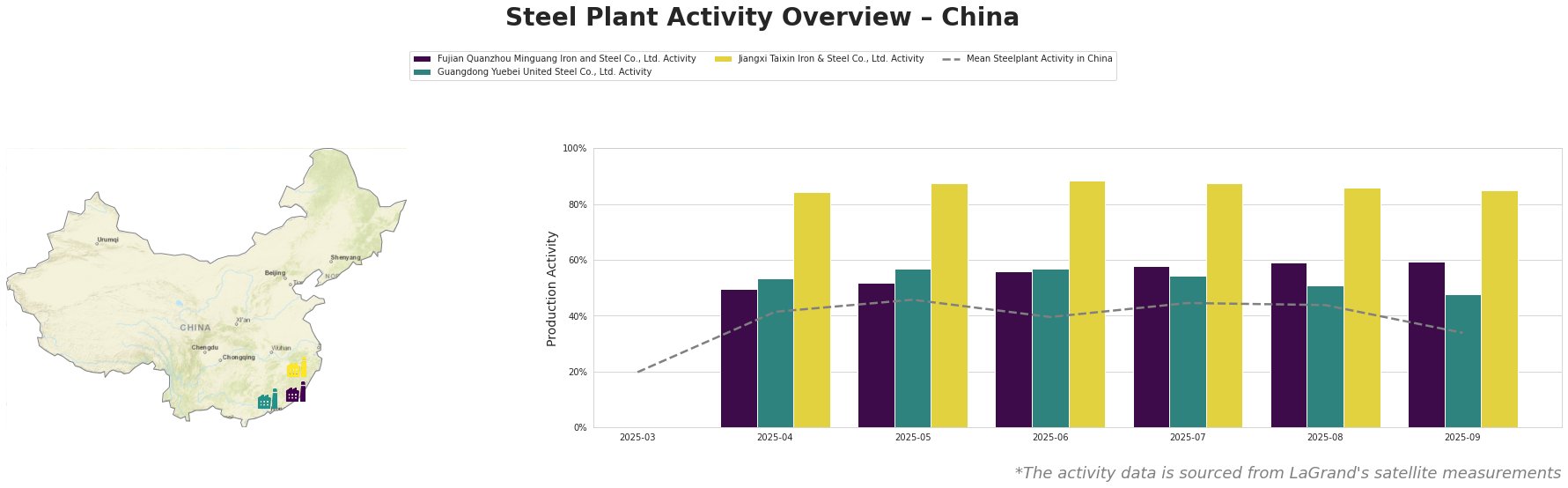

Observed activity levels across several Chinese steel plants show varying trends:

The mean activity level across all observed plants peaked in May at 46% and then decreased to 34% by September. Fujian Quanzhou Minguang Iron and Steel Co., Ltd. consistently operated above the mean, reaching a peak of 60% activity in September. Guangdong Yuebei United Steel Co., Ltd.’s activity closely mirrored the mean trend but remained consistently higher, peaking at 57% between May and June, followed by a drop to 48% in September. Jiangxi Taixin Iron & Steel Co., Ltd. consistently exhibited the highest activity levels, plateauing around 87% from May to August, and showing a slight decrease to 85% in September. No direct connection between the observed fluctuations in activity levels and any of the provided news articles could be established.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., an integrated BF-BOF steel plant with a 2550 ttpa crude steel capacity, primarily produces finished rolled products like rebar and wire rod. The plant has maintained activity levels above the mean, reaching 60% in September, indicating robust production. This trend aligns with the increased rebar production reported in “China’s rebar output up 0.3 percent in January-August 2025“, but no direct link can be confirmed.

Guangdong Yuebei United Steel Co., Ltd., also an integrated BF-BOF steel plant alongside EAF capacity, focuses on rebar production with a 2000 ttpa crude steel capacity. Its activity, peaking at 57% in May and June, declined to 48% in September. This decline could be linked to the decrease in domestic rebar prices in August as stated in “China’s rebar output up 0.3 percent in January-August 2025“, leading to production adjustments, though no direct connection is confirmed.

Jiangxi Taixin Iron & Steel Co., Ltd., with a 1000 ttpa crude steel capacity solely from EAF production, produces wire and rod. Its consistently high activity levels, peaking at 88% in June and remaining around 85% in September, suggest strong demand for its products. This potentially mirrors increased wire rod output of “China’s rebar output up 0.3 percent in January-August 2025“, with a 2.0% increase from January to August 2025, but no direct relationship can be validated.

Given the news article “China’s rebar output up 0.3 percent in January-August 2025” indicating increased domestic rebar production coupled with the news article “China’s steel sheet/plate exports down significantly in Aug, almost stable in Jan-Aug 2025” which indicates an export decrease and rebar price declines, steel buyers should:

- Negotiate Rebar Prices: The news of increased rebar production coupled with the satellite data indicating stable production levels at rebar-producing plants like Guangdong Yuebei United Steel Co., Ltd., albeit with a slight September decrease, suggests potential downward pressure on domestic rebar prices. Procurement teams should leverage this oversupply to negotiate more favorable pricing with suppliers.

- Explore Steel Bar Procurement: Given the significant surge in steel bar exports noted in “China’s steel bar exports increase by 52.2 percent in January-August 2025,” buyers seeking these products should secure contracts promptly, anticipating potential supply constraints and price increases due to heightened export demand.