From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market: Rebar Price Gains Despite Iron Ore Volatility Signal Strong Demand

China’s steel market shows a positive trend with rising rebar prices despite iron ore price fluctuations, indicating robust demand. The price increases reported in “MOC: Average rebar price in China up 0.4 percent in November 24-30” and “NBS: Local Chinese rebar prices up 0.9 percent in late November 2025” contrast with the volatility described in “Iron ore prices hit four-month lows in November“. While the news articles highlight price movements and contributing factors, a direct relationship to satellite-observed plant activity cannot be definitively established from the provided information.

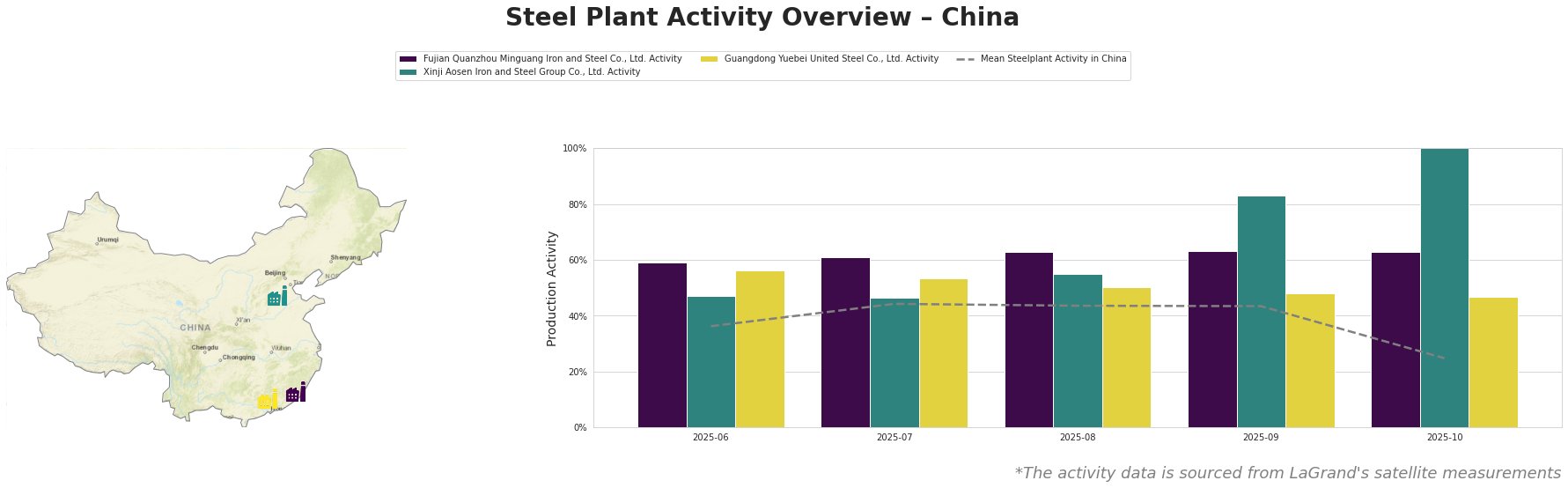

The mean steel plant activity in China experienced fluctuations, with a notable drop to 25% in October 2025, while the individual steel plants experienced different trends during the same period.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., an integrated BF steel plant with a crude steel capacity of 2,550 ttpa, maintained a consistently high activity level, hovering around 60% throughout the observed period and peaking at 63% in August, September and October 2025. This stable operation, specializing in finished rolled products like rebar, high-speed bar, and wire rod, does not directly correlate with the iron ore price volatility described in “Iron ore prices hit four-month lows in November“. No direct relationship between plant activity and the provided news articles can be established.

Xinji Aosen Iron and Steel Group Co., Ltd., a large integrated BF steel plant in Hebei with a 3,600 ttpa crude steel capacity, showed a significant activity increase, peaking at 100% in October 2025 after a steep rise from 47% in July 2025. This contrasts with the general trend of a declining national average steel plant activity in October. The plant’s focus on semi-finished and finished rolled products, including hot-rolled strip products, indicates responsiveness to the demand reflected in “MOC: Average rebar price in China up 0.4 percent in November 24-30” and “NBS: Local Chinese rebar prices up 0.9 percent in late November 2025“, but no direct causal link can be established.

Guangdong Yuebei United Steel Co., Ltd., an integrated BF steel plant in Guangdong with 2,000 ttpa crude steel capacity, maintained a relatively stable activity level around 50% throughout the observed months. While specializing in rebar, the activity level does not appear to be directly influenced by the rebar price increases reported in “MOC: Average rebar price in China up 0.4 percent in November 24-30” and “NBS: Local Chinese rebar prices up 0.9 percent in late November 2025“. No direct relationship between plant activity and the provided news articles can be established.

Despite iron ore price volatility and a dip in mean steel plant activity in October, the increase in rebar prices signals strong end-user demand, particularly in building and infrastructure. The high activity level at Xinji Aosen, despite the falling average activity, could suggest the steel plant benefited from local advantages in Heibei.

- Procurement Action: Steel buyers should consider securing rebar supply from producers in Hebei and prioritize those with high activity levels, like Xinji Aosen, to mitigate potential price increases. Despite the stability and high activity observed at Fujian Quanzhou Minguang Iron and Steel, its apparent lack of responsiveness to price movements could mean less flexibility in contract negotiations.

- Analyst Action: Closely monitor the sustainability of Xinji Aosen’s high activity level, especially in relation to local government policies and environmental regulations in Hebei, as potential production restrictions could impact supply. Track Guangdong Yuebei United Steel’s responsiveness to market signals in upcoming periods, as consistent production may not always align with demand fluctuations, making it a less agile supplier.