From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market: Rebar Output Declines Amidst Fluctuating Iron Ore Prices – Activity Shifts Observed

China’s steel sector faces fluctuating conditions as reflected in recent reports and plant activity. Rebar production is down, as highlighted in China’s rebar output down 1.6 percent in January-May, while iron ore production has also seen a decrease, according to China’s iron ore output down 10.1 percent in January-May and China reduced iron ore production by 10.1% y/y in January-May. These declines coincide with fluctuating iron ore prices, though a direct relationship between production cuts and specific plant activity observed via satellite cannot be definitively established at this time.

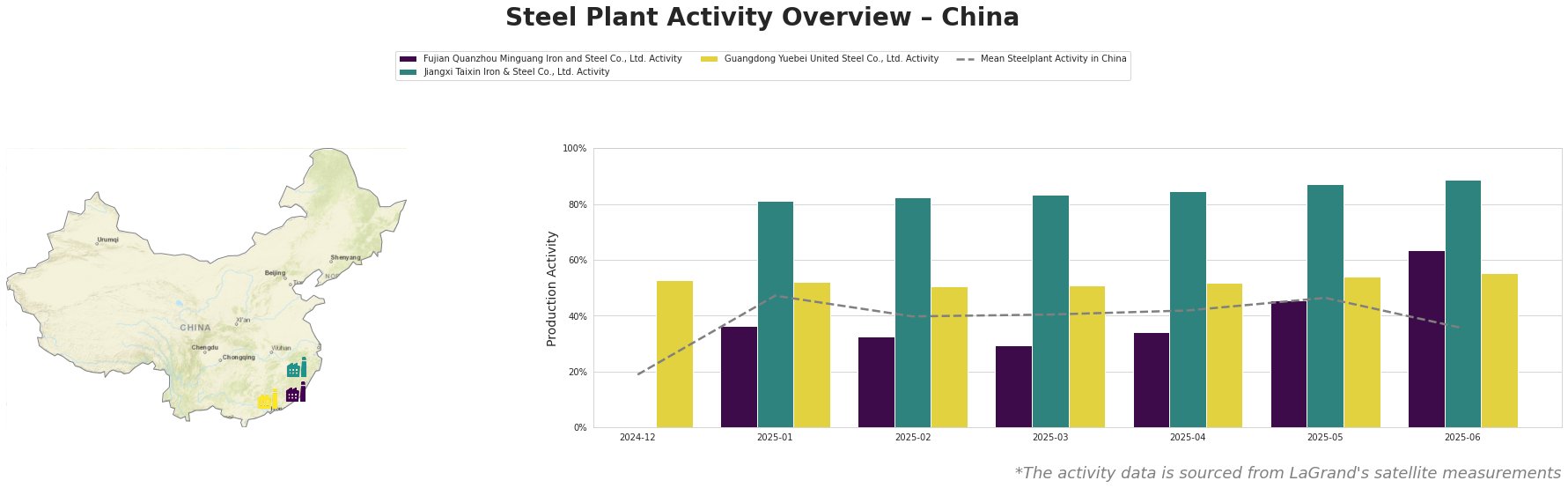

Here’s a summary of the observed monthly activity, presented as a percentage of all-time highs:

The mean steel plant activity in China shows a decline in June to 36% after relative stability from January-May.

Plant-Specific Activity:

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., an integrated BF/BOF steel plant with a crude steel capacity of 2.55 million tonnes, experienced a trough in activity in March 2025 (29%), before recovering to 64% in June, markedly above the national average. There is no immediately discernible connection between this observed increased activity and the news regarding national rebar and iron ore production declines.

Jiangxi Taixin Iron & Steel Co., Ltd., an electric arc furnace (EAF) steel plant with a 1 million tonne crude steel capacity focused on wire and rod production, consistently operated at high activity levels, ranging from 81% to 89% between January and June 2025, significantly exceeding the national average. As the China’s rebar output down 1.6 percent in January-May news report specifies a decline in rebar production, a product not primarily produced by Jiangxi Taixin Iron & Steel, the high activity level at this plant producing wire and rod does not necessarily contradict the report, although no direct connection can be explicitly established.

Guangdong Yuebei United Steel Co., Ltd., an integrated steel plant with both BF/BOF and EAF production routes and a 2 million tonne crude steel capacity, showed relatively stable activity levels between 51% and 55% from December 2024 through June 2025. Given its production of rebar, the news of “China’s rebar output down 1.6 percent in January-May” might suggest lower activity. However, the stable activity levels do not directly reflect this national trend, and no definitive link can be made.

Evaluated Market Implications:

The news articles “China’s rebar output down 1.6 percent in January-May” and “China reduced iron ore production by 10.1% y/y in January-May” suggest potential constraints on rebar availability.

Recommended Procurement Actions:

- For steel buyers focused on rebar: Closely monitor rebar pricing trends, particularly in regions supplied by plants showing decreased or stable activity. Consider diversifying suppliers or securing contracts to mitigate potential supply disruptions caused by the overall decline in rebar production reported nationally.

- For analysts: Pay close attention to regional steel inventory levels and price volatility, especially for rebar, given the reported production declines. Further investigation into regional discrepancies and plant-specific production strategies is warranted. Given the observed activity increases at Fujian Quanzhou Minguang Iron and Steel Co., Ltd., procurement professionals should further investigate this plant as a potential supply source.