From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Reacts Positively to US Trade Deal: Plant Activity Trends Upward

China’s steel market shows a positive outlook driven by easing trade tensions with the U.S. Recent satellite observations indicate increasing steel plant activity, potentially linked to the trade agreement discussed in “Zollstreit: „Differenzen nicht so groß wie gedacht“ – USA und China verkünden Einigung im Handelskonflikt” and “USA präsentieren Deal mit China im Zollstreit.” The latter article directly mentions tariff reductions beginning May 14th, potentially influencing observed activity at the end of the month.

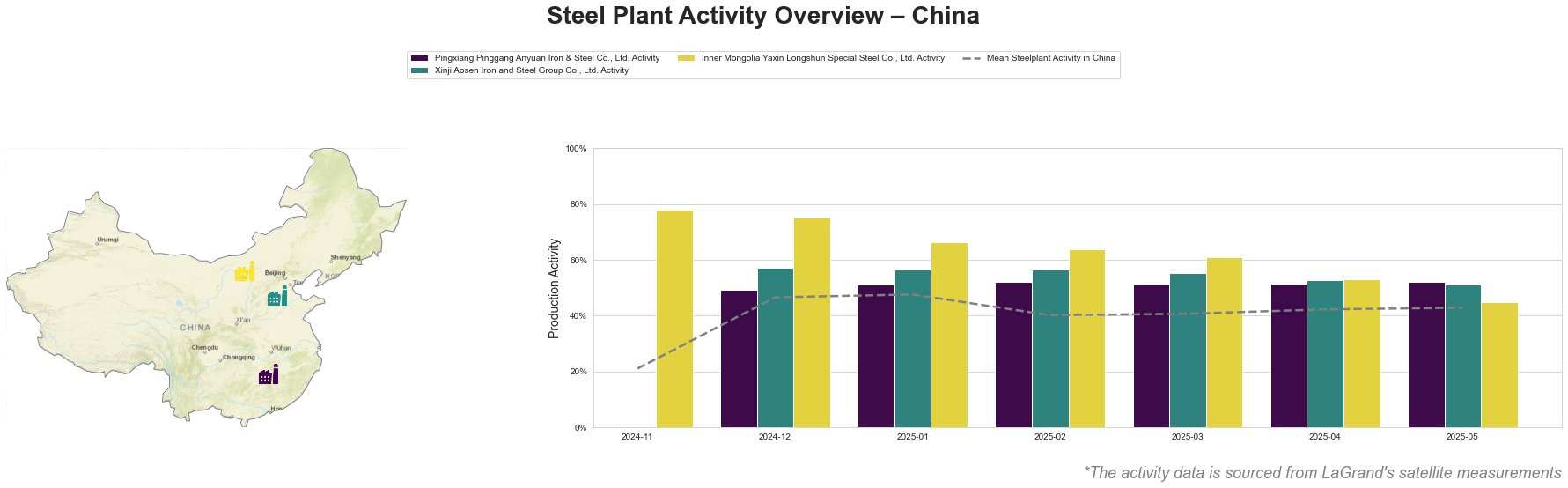

Mean steel plant activity in China has shown a steady, albeit modest, increase from 21.0% in November 2024 to 43.0% in May 2025. Pingxiang Pinggang Anyuan Iron & Steel Co., Ltd.’s activity remained relatively stable between 49.0% and 52.0% from December 2024 to May 2025, consistently above the national average. Xinji Aosen Iron and Steel Group Co., Ltd. shows a slight decline, from 57.0% in December 2024 to 51.0% in May 2025, also remaining above the national average for most of the period. Inner Mongolia Yaxin Longshun Special Steel Co., Ltd. experienced a more significant decrease, from a high of 78.0% in November 2024 to 45.0% in May 2025, falling below the national average in the last month.

Pingxiang Pinggang Anyuan Iron & Steel Co., Ltd., located in Jiangxi, is an integrated steel plant with a crude steel capacity of 2.65 million tonnes per annum (ttpa) using BF/BOF technology, producing finished rolled products such as steel bars and medium-thick plates for the building and transport sectors. Its activity has remained relatively stable, at about 50%, suggesting consistent production, and outperforming the national average. No direct connection between the plant’s activity and the recent news could be established.

Xinji Aosen Iron and Steel Group Co., Ltd., based in Hebei, also operates as an integrated BF/BOF steel plant with a larger crude steel capacity of 3.6 million ttpa, producing semi-finished and finished rolled products like billets and high-speed wire rods. Its activity saw a small, gradual decline to 51.0% in May, which remains high. Given its production of semi-finished products, its activity could be impacted by downstream demand changes potentially influenced by the trade deal; however, no direct connection between the plant’s activity and the recent news could be established.

Inner Mongolia Yaxin Longshun Special Steel Co., Ltd., situated in Inner Mongolia, has a crude steel capacity of 2 million ttpa using BF/BOF technology, specializing in high-strength anti-vibration rebar. Its activity decreased to 45.0% in May. The decline might suggest adjustments in production strategy, shifting away from rebar, however, no direct connection between the plant’s activity and the recent news could be established.

The easing of trade tensions, as highlighted in “Zolleinigung zwischen China und den USA: Tag der Entspannung” and “Trump’s trade agreement with China is another big win for investors,” suggests potential for increased demand, but given the diversity in observed plant behavior a correlation is difficult to explicitly establish.

Evaluated Market Implications:

The potential reduction in tariffs described in “USA präsentieren Deal mit China im Zollstreit” from May 14th onwards could lead to increased demand, specifically for finished rolled steel products destined for the US market. The article “China und USA erzielen Einigung im Handelskrieg” supports this, reporting that tariffs have been suspended. This may also lead to an increased influx of shipping containers from China as trading normalizes.

Recommended Procurement Actions:

- Steel Buyers: Given the potential for increased demand driven by the trade agreement, especially for finished rolled products, consider securing contracts for steel bars and high-speed wire rods now, as plants like Pingxiang Pinggang Anyuan are running above the national average.

- Market Analysts: Monitor prices of finished rolled steel products closely, particularly those used in building and infrastructure, as demand from the US market may increase. It is critical to understand that these recommendations are explicitly driven by observations and specific news events. Further monitoring of plant-level activity is crucial to validating these trends.