From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Reacts Positively to US Tariff Deal: Plant Activity Shows Mixed Response

China’s steel market shows a potentially positive outlook following the announced trade agreement with the US. Recent news of tariff reductions, as indicated in “Zolleinigung zwischen China und den USA: Tag der Entspannung,” “USA präsentieren Deal mit China im Zollstreit,” and “China und USA erzielen Einigung im Handelskrieg,” suggest improved trade conditions. However, a direct link between these developments and recent satellite-observed changes in activity at specific steel plants is not immediately evident from the data provided.

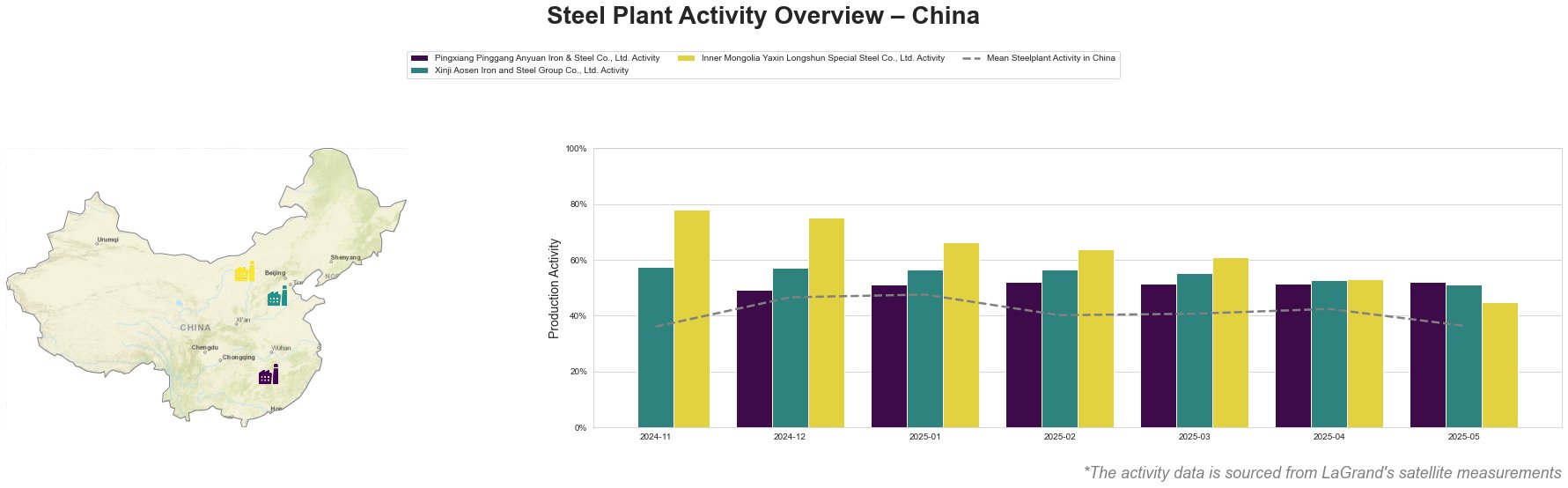

The mean steel plant activity in China experienced a peak in January 2025 at 48%, followed by a decrease to 36% in May 2025. Pingxiang Pinggang Anyuan Iron & Steel Co., Ltd. activity remained relatively stable between 49% and 52% throughout the observed period, peaking at 52% in February, March and again in May 2025. Xinji Aosen Iron and Steel Group Co., Ltd. showed consistent activity at 57% from November 2024 to January 2025, then experienced a gradual decline to 51% by May 2025. Inner Mongolia Yaxin Longshun Special Steel Co., Ltd. exhibited the highest activity levels, starting at 78% in November 2024 and decreasing to 45% by May 2025.

Pingxiang Pinggang Anyuan Iron & Steel Co., Ltd., based in Jiangxi, operates as an integrated BF-BOF steel plant with a crude steel capacity of 2.65 million tonnes. The company is certified by ResponsibleSteelCertification and primarily produces finished rolled products like steel bars and high-speed wire rods, catering to the building and infrastructure sectors. Despite the positive news surrounding the US-China trade agreement, the plant’s activity remained relatively consistent, fluctuating between 49% and 52%. No direct connection can be established between the plant’s activity level and the news articles provided.

Xinji Aosen Iron and Steel Group Co., Ltd., located in Hebei, also uses an integrated BF-BOF process, boasting a crude steel capacity of 3.6 million tonnes. Certified by ResponsibleSteelCertification, its main products include billets, slabs, and high-speed wire rods. The plant’s activity decreased gradually from 57% to 51% over the observed months. While the trade agreement suggests a positive market outlook, no explicit link can be established between these broader economic factors and the observed decrease in plant activity.

Inner Mongolia Yaxin Longshun Special Steel Co., Ltd., an integrated BF-BOF steel plant in Inner Mongolia with a 2 million tonne crude steel capacity, focuses on high-strength anti-vibration rebar. The plant’s activity experienced a notable decrease from 78% in November 2024 to 45% in May 2025. Although the company is ISO14001 certified and is certified by ResponsibleSteelCertification, no direct connection can be established between the observed decrease in plant activity and the news articles concerning the trade agreement.

Given the recent trade agreement between the US and China, as reported in “USA präsentieren Deal mit China im Zollstreit,” steel buyers should anticipate a potential increase in demand for steel products in the coming months due to reduced tariffs. However, as plant activity data shows no immediate reaction, buyers should closely monitor production levels and lead times, particularly for products supplied by Inner Mongolia Yaxin Longshun Special Steel Co., Ltd., which experienced a notable activity decline. Specifically, monitor prices for high-strength anti-vibration rebar, given this plant’s decreased output. Diversification of suppliers should be considered to mitigate potential disruptions, particularly for those relying solely on Inner Mongolia Yaxin Longshun Special Steel Co., Ltd. for their supply of niche products.