From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market: Production Dips Amidst Stable Demand, Signals Procurement Opportunities

China’s steel market is showing signs of stabilization following recent production adjustments. According to the news articles “China reduced steel production by 7% m/m in April” and “China has reduced steel production“, April saw a 7% month-on-month decrease in steel production, totaling 86.02 million tons. This aligns with the article “China’s crude steel production fell 7% in April, m-o-m“. While the articles indicate decreased production, the impact on supply chains could be moderated by stable domestic demand and strong exports as highlighted in “China reduced steel production by 7% m/m in April“. We can observe a correlation between these news articles and decreasing plant activity by end of May in our satellite data.

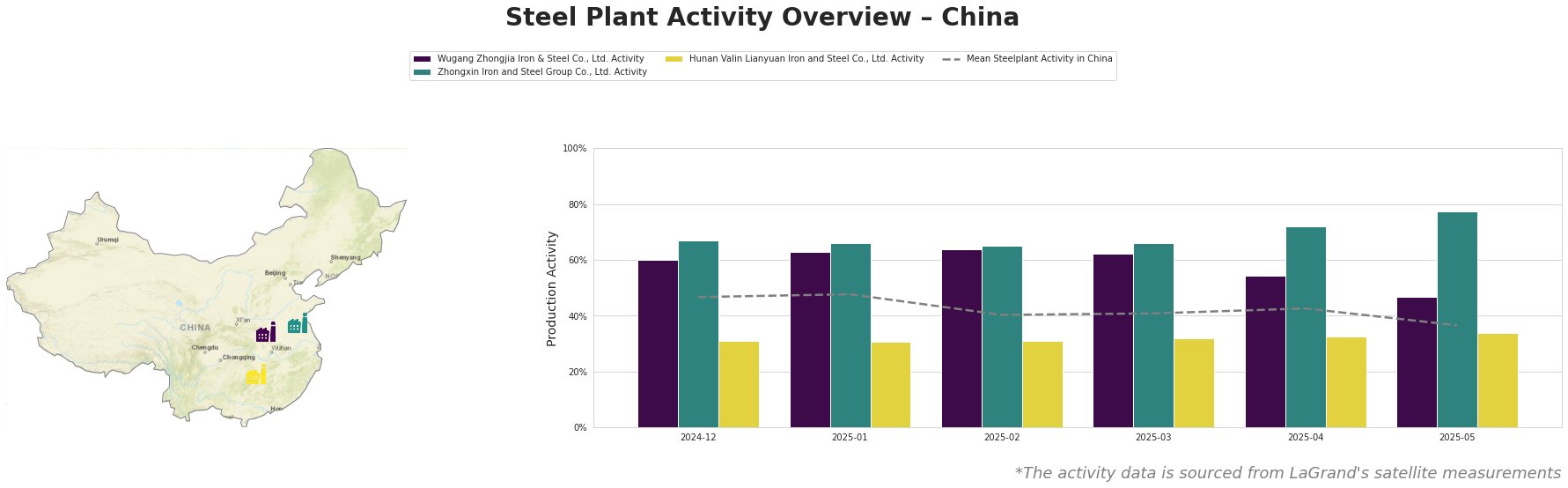

The mean steel plant activity in China has fluctuated over the past months, with a general downward trend observed from January (48.0%) to May (37.0%). Wugang Zhongjia Iron & Steel Co., Ltd. started with a high activity level of 60.0% in December, peaking at 64.0% in February, but experiencing a significant drop to 47.0% by May, mirroring the overall trend. Zhongxin Iron and Steel Group Co., Ltd. has shown a consistently high activity level, increasing from 67.0% in December to 77.0% in May, defying the overall downward trend. Hunan Valin Lianyuan Iron and Steel Co., Ltd. has maintained a relatively stable, low activity level, hovering around 31.0-34.0% throughout the observed period. The activity of Zhongxin Iron and Steel Group is remarkable as it is the only of the observed plants that is significantly overperforming the Chinese Mean steel plant activity.

Wugang Zhongjia Iron & Steel Co., Ltd., located in Henan, primarily focuses on ironmaking using blast furnaces (BF) with a capacity of 1220 ttpa. Observed activity decreased by 17% in May, from 64% (Feb.) to 47%, a significant reduction that correlates with the overall decrease in steel production reported in “China reduced steel production by 7% m/m in April“. This suggests that Wugang Zhongjia may have scaled back production in response to the broader market adjustments.

Zhongxin Iron and Steel Group Co., Ltd., situated in Jiangsu, is an integrated steel plant with a crude steel capacity of 5700 ttpa, utilizing both BF and BOF processes to produce semi-finished and finished rolled products. Contrary to the general trend, Zhongxin Iron and Steel Group Co., Ltd. activity levels have increased from 67.0% in December to 77.0% in May, a significant increase. This could be due to the plant capitalizing on stable domestic demand and strong exports, as indicated in “China reduced steel production by 7% m/m in April,” driving increased profitability and production.

Hunan Valin Lianyuan Iron and Steel Co., Ltd., based in Hunan, is another integrated steel plant with a crude steel capacity of 9000 ttpa. Its activity level has remained relatively stable at around 31-34% since December 2024. While there is a slight increase, the activity level remains relatively low compared to its production capacity. No direct link to the cited news articles can be established.

The 7% month-on-month decrease in China’s steel production may create selective supply disruptions, particularly affecting regions where plants such as Wugang Zhongjia Iron & Steel Co., Ltd. have significantly reduced activity, as seen in Henan. Steel buyers should proactively engage with suppliers, especially those relying on plants potentially affected by production cuts. Given Zhongxin Iron and Steel Group Co., Ltd.’s increased activity, buyers should explore opportunities to secure supply from this source to mitigate potential disruptions. The decrease of iron ore production by 12% y/y, as stated in “China reduced iron ore production by 12% y/y in January-April” may compound supply issues. Procurement strategies should consider these trends to ensure supply chain resilience.