From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Positive Despite Mixed Signals: Baosteel Profit Surges, Ansteel Activity High, Iron Ore Price Volatility

China’s steel market presents a mixed but overall positive picture. “Baosteel more than doubled its net profit in the third quarter,” driven by strong domestic demand and exports, indicating underlying market strength. While “Asian Steel Market Faces Q4 Downturn as Regional Demand and Trade Barriers Intensify” suggests potential headwinds, observed plant activity at Ansteel remains robust, though a direct link between these articles and Ansteel’s activity cannot be established.

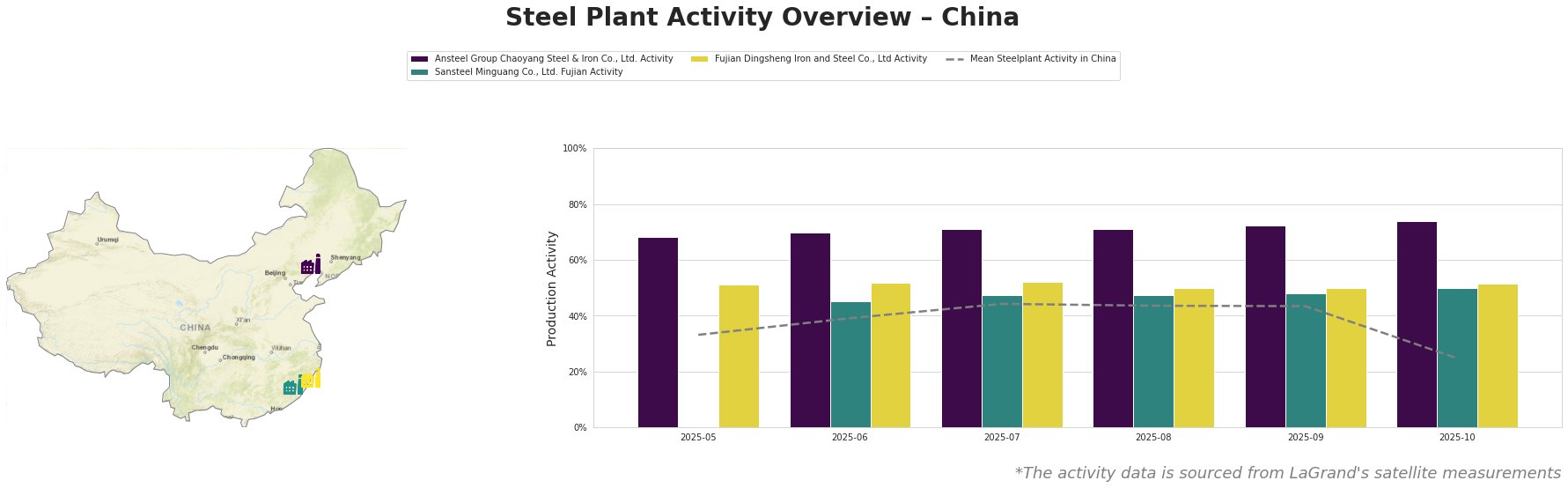

Here is the monthly activity table for the steel plants:

Mean steel plant activity in China decreased significantly to 25% in October after hovering around the 40% mark in the previous months.

Ansteel Group Chaoyang Steel & Iron Co., Ltd. has shown consistently high activity, increasing from 68% in May to 74% in October, significantly exceeding the mean. Sansteel Minguang Co., Ltd. Fujian activity has been relatively stable between 45% and 50%. Fujian Dingsheng Iron and Steel Co., Ltd Activity has remained consistent between 50% and 52%.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., located in Liaoning, is an integrated BF/BOF steel plant with a crude steel capacity of 2.1 million tonnes. The activity at Ansteel has been consistently high and increasing, reaching 74% in October, diverging significantly from the overall mean. This contrasts with the sentiment in “Iron Ore Declines as China’s Steel Production Drops and Inventories Rise, Impacting Asian Steel Value Chain,” which describes decreasing steel production. Despite the regional downturn and the challenges noted in “Asian Steel Market Faces Q4 Downturn as Regional Demand and Trade Barriers Intensify,” Ansteel’s increased output suggests resilience or a focus on specific high-demand sectors.

Sansteel Minguang Co., Ltd. Fujian, with a crude steel capacity of 6.8 million tonnes, is another integrated BF/BOF steel plant producing steel plates, round bars, and construction steel. Its activity fluctuated slightly between 45% and 50%. The relatively stable activity, slightly above the national mean in October, doesn’t directly reflect any specific news headlines, thus no concrete link to market trends could be explicitly established.

Fujian Dingsheng Iron and Steel Co., Ltd, operates an EAF-based steel plant with a crude steel capacity of 1.725 million tonnes. Specializing in high-quality steel, it maintained a steady activity level between 50% and 52% from May to October. This consistent performance, slightly above the mean, indicates stable demand for its specialized products; however, no direct connection to any of the news articles can be established.

Evaluated Market Implications

The significant drop in overall mean activity in October, as reflected in the table, combined with the news “Iron Ore Declines as China’s Steel Production Drops and Inventories Rise, Impacting Asian Steel Value Chain”, highlights a potential risk of supply disruption, despite Baosteel’s positive performance.

Given the stable iron ore prices noted in “Iron ore ended October in a narrow range amid mixed signals” as well as the expected increased prices as mentioned in “Goldman Sachs raises iron ore price forecast for 2026 to $93/t“, procurement professionals should:

- Prioritize securing supply contracts: Given the conflicting signals of decreased production and stable prices, secure contracts with suppliers like Ansteel, demonstrating consistently high output, to mitigate potential disruptions.

- Monitor inventory levels closely: “Iron Ore Declines as China’s Steel Production Drops and Inventories Rise, Impacting Asian Steel Value Chain” indicates rising steel inventories. Closely tracking inventory levels will be crucial to optimize purchase timing and avoid overstocking in a potentially softening market.

- Focus on high-quality steel procurement: China’s push towards “China will promote value-added steel production” suggests a long-term shift. Procurement strategies should be aligned to source higher-quality steel products, potentially from producers like Fujian Dingsheng Iron and Steel, to capitalize on this trend and meet evolving market demands.