From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Plunge: Production Cuts Hit Four-Year Low Amid Weak Demand – Procurement Alert

China’s steel market faces significant headwinds as production hits multi-year lows. According to “China cut steel production to a four-year low in October“, production fell to 72 million tons in October, a 12% year-on-year decline. This production cut, detailed in “China reduced steel production by 12.1%“, is occurring amidst broader Asian market pressures, as highlighted by “Asian steel market to remain under pressure in Q4 – S&P Global“, which cites weak Chinese demand and restructuring efforts. While the news articles point to reduced production, no direct connection between these broad market forces and specific plant activity changes could be definitively established using the provided satellite-observed activity data.

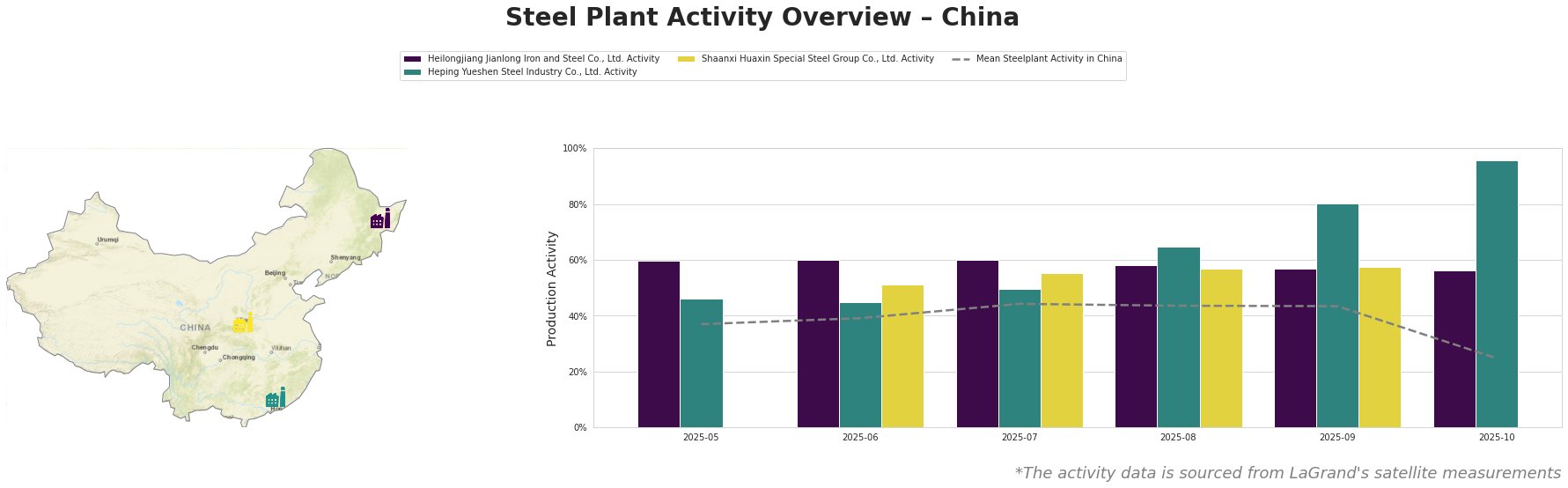

The mean steel plant activity in China exhibited a significant drop in October, falling to 25% after remaining relatively stable in the low 40s from July to September. Heilongjiang Jianlong Iron and Steel Co., Ltd. saw a slight decrease, remaining above average. In contrast, Heping Yueshen Steel Industry Co., Ltd. experienced a surge in activity, reaching 96% in October, significantly above the average.

Heilongjiang Jianlong Iron and Steel Co., Ltd., an integrated BF/BOF steel plant with a 2000ktpa crude steel capacity, primarily produces finished rolled products like hot rolled ribbed steel bars and rebar. While its activity has seen a slight decline from 60% to 56% between May and October, it has remained consistently above the national average. This suggests a more resilient operation despite the overall market downturn as reported in “China cut steel production to a four-year low in October”, but no direct causal link can be asserted.

Heping Yueshen Steel Industry Co., Ltd., an EAF-based plant in Guangdong with a 1400ktpa crude steel capacity, focuses on hot rolled rebar production. Its activity sharply increased, reaching 96% in October, in contrast to the overall market decline, which, according to the news “Asian steel market to remain under pressure in Q4 – S&P Global”, is driven by weak Chinese demand. The activity data does not directly reflect this negative market sentiment, and no direct link to provided news articles can be firmly established.

Shaanxi Huaxin Special Steel Group Co., Ltd., an EAF-based plant in Shaanxi with a 1200ktpa crude steel capacity, produces rolled round steel plate and rebar. Activity data is only partially available.

The substantial drop in mean steel plant activity in China, coupled with the news of production cuts (“China cut steel production to a four-year low in October”), raises concerns about potential supply disruptions. The “Asian steel market to remain under pressure in Q4 – S&P Global” article indicates that China’s steel exports are crucial to easing inventory pressure. Steel buyers should immediately:

- Scrutinize Contracts: Carefully review existing contracts with Chinese steel suppliers, paying close attention to clauses regarding force majeure, delivery timelines, and pricing adjustments.

- Diversify Sourcing: Actively explore alternative steel sources outside of China, especially for products where Heilongjiang Jianlong Iron and Steel Co., Ltd. is a key supplier (rebar). Given their relative stability above the mean, disruptions from this supplier may be less pronounced, but contingency plans are warranted.

- Monitor Heping Yueshen: Closely monitor the output and pricing from Heping Yueshen Steel Industry Co., Ltd. Given their increased activity, their pricing may offer short-term advantages, but sustainability in the face of broader market downturn needs verification.

- Assess Regional Impact: Acknowledge that these specific steel plants might not fully represent the broader Chinese market dynamics, and that additional research might be required to get a clear picture.