From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Plummets Amid Chip Shortage and Trade Tensions

The Chinese steel market faces significant downward pressure. Steel plant activity has declined sharply, potentially influenced by the ongoing EU-China trade dispute over rare earths and semiconductors, as highlighted in “EU and China to hold talks to defuse trade dispute over rare earths.” This dispute coincides with plummeting activity levels observed via satellite data. While a direct causal link cannot be definitively established, the timing suggests a potential correlation.

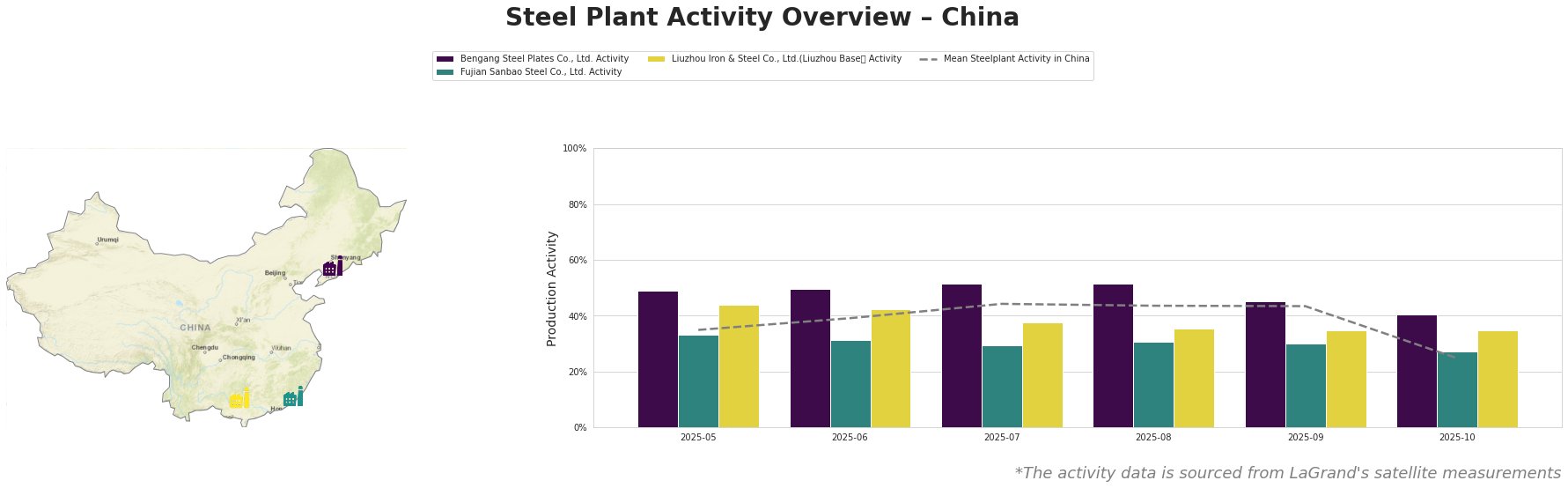

Observed steel plant activity levels are as follows:

The mean steel plant activity in China dropped dramatically in October, falling from 43% to just 25%.

Bengang Steel Plates Co., Ltd., a major integrated steel producer in Liaoning with a capacity of 12,800 TTPA of crude steel and specializing in automotive plates, experienced a decline in activity from 45% in September to 40% in October. The company’s output is geared towards automotive and other key industries. The drop coincides with the news of “Critical chip shortage worsens, production stoppages expected: ACEA“, as this plant produces plates for the automotive industry, this may be a direct effect of chip shortages.

Fujian Sanbao Steel Co., Ltd., a smaller integrated steel producer in Fujian with a 4,620 TTPA crude steel capacity, mainly producing hot-rolled coils and steel bars for construction and automotive sectors, saw its activity decrease slightly from 30% in September to 27% in October. While no direct link can be established, the general market downturn might be affecting this plant.

Liuzhou Iron & Steel Co., Ltd.(Liuzhou Base), an integrated steel plant in Guangxi with a 12,500 TTPA crude steel capacity, primarily producing plate and wire rod, maintained a stable activity level at 35% in October, consistent with the previous month. This plant’s stability contrasts with the overall market decline; however, no explicit connection to the provided news articles can be established.

The potential easing of the Nexperia semiconductor export ban, as indicated in “China signals easing of Nexperia Semiconductor Export Ban“, may offer some relief; however, uncertainty remains regarding the details of the exemptions and their impact on steel demand. The urgency with which “German auto parts sector rushes to get China exemptions for Nexperia chip exports” underscores the severity of the situation.

Evaluated Market Implications:

The sharp decline in overall steel plant activity in China, coupled with the semiconductor shortage impacting automotive production as evidenced by the news articles, suggests a significant near-term risk of reduced steel demand, particularly for automotive-grade steel. Bengang Steel Plates Co., Ltd. clearly shows this effect in reduced activity.

Recommended Procurement Actions:

- Steel Buyers: Delay any large-volume spot purchases of steel, particularly automotive-grade plates. The market is likely to soften further.

- Market Analysts: Closely monitor the implementation details of the Nexperia export ban exemptions. Any delays or limitations will exacerbate the negative impact on steel demand. Pay close attention to Bengang Steel Plates Co., Ltd. Activity, as any increase in production will signal easing of the automotive industry chip shortage.