From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market: Output Dips in April Amidst Production Control Plans, Select Plants Ramp Up Activity

China’s steel market saw a production dip in April amidst fluctuating iron ore prices and looming production control measures. According to the news articles “China’s crude steel production fell 7% in April, m-o-m,” “China reduced steel production by 7% m/m in April” and “China has reduced steel production,” crude steel output decreased by 7% month-over-month. While these articles highlight a decrease in overall production, satellite-observed activity data indicates divergent trends among individual steel plants, suggesting a complex interplay of factors beyond broad production cuts. However, no direct link can be established, as the satellite data reflects activities beyond crude steel production volumes.

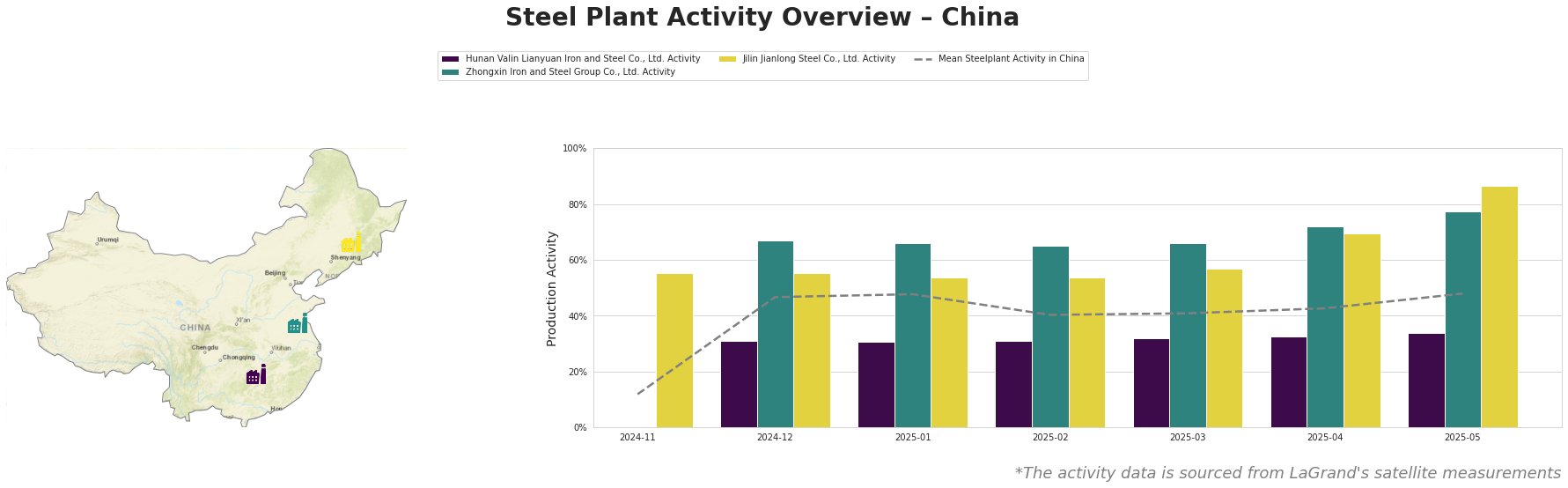

The mean steel plant activity in China, as observed via satellite, fluctuated between 40% and 48% from February to May 2025, suggesting a moderate level of operational intensity. Hunan Valin Lianyuan Iron and Steel Co., Ltd. shows consistently low activity levels, ranging from 31% to 34%, while Zhongxin Iron and Steel Group Co., Ltd. demonstrates significantly higher activity, rising from 67% in December 2024 to 77% in May 2025. Jilin Jianlong Steel Co., Ltd. experienced the most substantial increase, surging from 55% in December 2024 to 86% in May 2025.

Hunan Valin Lianyuan Iron and Steel Co., Ltd., an integrated BF-BOF steel plant in Hunan with a crude steel capacity of 9 million tons, has shown consistently low activity levels between 31% and 34% since December 2024. This relatively stable but low activity does not directly correlate with the production decreases mentioned in “China’s crude steel production fell 7% in April, m-o-m,” “China reduced steel production by 7% m/m in April” and “China has reduced steel production” as these articles refer to broader national trends. The company’s focus on high-end products like automotive and pipeline steel might explain a more selective production strategy.

Zhongxin Iron and Steel Group Co., Ltd., a Jiangsu-based integrated BF-BOF steel plant with a crude steel capacity of 5.7 million tons, has exhibited consistently high activity levels, climbing to 77% by May 2025. This contrasts with the overall production decline reported in “China’s crude steel production fell 7% in April, m-o-m,” “China reduced steel production by 7% m/m in April” and “China has reduced steel production,” suggesting the plant may be operating at a higher capacity utilization rate than the national average, potentially driven by robust regional demand for its products, including steel billets and hot-rolled steel.

Jilin Jianlong Steel Co., Ltd., an integrated BF-BOF steel plant in Jilin with a crude steel capacity of 3 million tons, has shown a significant increase in activity, reaching 86% in May 2025. This increase does not directly correspond with the overall production decreases indicated in “China’s crude steel production fell 7% in April, m-o-m,” “China reduced steel production by 7% m/m in April” and “China has reduced steel production,” but it may be linked to the expectation of increasing production in the coming months to recover from recent losses, as mentioned in “China has reduced steel production.” The plant’s focus on automotive and pipeline steel may also be contributing to the increased activity.

The decrease in overall Chinese steel production, as indicated by “China’s crude steel production fell 7% in April, m-o-m,” “China reduced steel production by 7% m/m in April” and “China has reduced steel production,” coupled with the 12.2% year-on-year decrease in domestic iron ore production reported in “China reduced iron ore production by 12% y/y in January-April” and “China’s iron ore output down 12.2 percent in Jan-Apr” , suggests a potential tightening of supply in the near term.

Evaluated Market Implications:

Given the conflicting signals of overall production cuts versus increased activity at specific plants, steel buyers should:

- Prioritize securing supply contracts with producers demonstrating consistently high activity levels, such as Zhongxin Iron and Steel Group Co., Ltd. and Jilin Jianlong Steel Co., Ltd., to mitigate potential supply disruptions stemming from broader production cuts.

- Closely monitor the implementation details of the announced production control measures, mentioned in “China has reduced steel production,” as the timing and specifics will significantly impact market dynamics in the second half of the year.

- Factor in the reduced domestic iron ore production highlighted in “China reduced iron ore production by 12% y/y in January-April” and “China’s iron ore output down 12.2 percent in Jan-Apr” , potentially leading to increased reliance on imports and price volatility, when negotiating steel prices.

- Diversify sourcing strategies to include regions less affected by the production cuts if possible.