From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Holds Steady Amidst Iron Ore Price Pressures: Activity Analysis & Procurement Strategies

China’s steel market demonstrates resilience despite projected iron ore price stability due to low demand and high supply, as reported in “Moody’s expects iron ore prices to remain stable at $80-100/t in the coming years“. This stability contrasts with fluctuating activity levels observed at specific steel plants. While the article does not directly relate to specific activity levels of the steel plants, it paints a wider picture of China’s iron and steel sector. Moreover, Rio Tinto and BHP anticipate sustained demand from China despite global economic uncertainties, according to “Iron ore as a pillar: industry giants rely on Chinese steel production“, bolstering a positive outlook for the market.

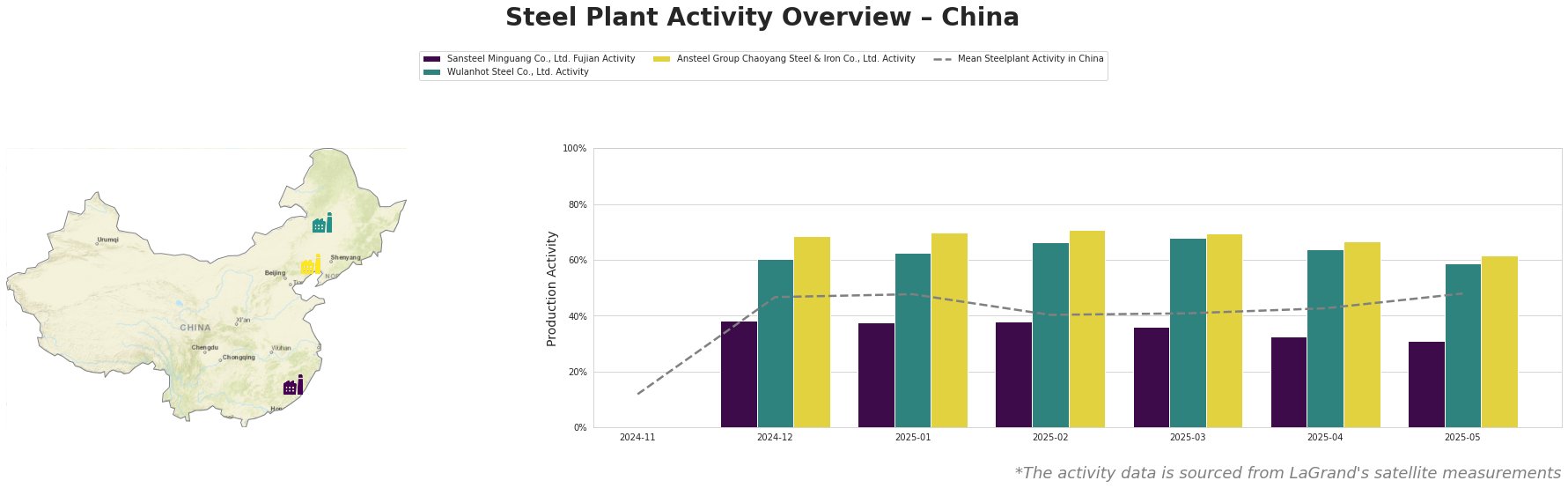

The satellite-observed activity levels reveal the following trends:

The mean steel plant activity in China increased significantly from November (12%) to December (47%) of 2024 and has been fluctuating since then, with a slight dip in February and March 2025 before recovering to 48% in May 2025. Sansteel Minguang Co., Ltd. Fujian consistently operated below the national average. In contrast, Wulanhot Steel Co., Ltd. and Ansteel Group Chaoyang Steel & Iron Co., Ltd. have shown consistently higher activity levels than the national mean. It is worth noting that all three steel plants have decreased production in May 2025.

Sansteel Minguang Co., Ltd. Fujian, an integrated BF-BOF steel plant in Fujian with a crude steel capacity of 6.8 million tonnes, primarily produces finished rolled products, including steel plates, round bars, and construction steel. The observed activity levels remained consistently below the national average, declining further from 38% between December 2024 and February 2025 to 31% in May 2025. This could indicate localized production adjustments, but no direct connection can be established with the provided news articles.

Wulanhot Steel Co., Ltd., located in Inner Mongolia, is an integrated BF-BOF steel plant with a much smaller crude steel capacity of 1.05 million tonnes. Its activity levels consistently exceeded the national average, peaking at 68% in March 2025 before dropping to 59% in May 2025. Wulanhot Steel´s production involves bars, steel slag cement, and cast iron for building and infrastructure. It is difficult to directly link the article “Moody’s expects iron ore prices to remain stable at $80-100/t in the coming years” to the observed activity due to the lack of regional economic data and the relatively low production capacity.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., based in Liaoning, also operates as an integrated BF-BOF steel plant. Its activity levels have been consistently high, reaching 71% in February 2025, before decreasing to 62% in May 2025. Ansteel Group Chaoyang´s products are steel plate and steel pipe. The high activity aligns with the news reported in “Iron ore as a pillar: industry giants rely on Chinese steel production,” stating that Rio Tinto and BHP anticipate sustained demand from China despite global economic uncertainties.

Despite overall positive sentiment, the decrease of plant activity in May requires close monitoring. The article “Moody’s expects iron ore prices to remain stable at $80-100/t in the coming years” underscores stable iron ore prices amidst weak demand.

- Procurement Action: Steel buyers focused on construction steel (Sansteel Minguang) should monitor local Fujian market conditions closely for potential supply constraints stemming from observed production decreases, and diversify sourcing to mitigate this.

- Procurement Action: Buyers sourcing from Ansteel Group Chaoyang can expect continued reliability given its consistently high activity levels and should focus on negotiating favorable long-term contracts, leveraging the stable outlook reported by Rio Tinto and BHP.

- Market Analysis Action: Analysts should investigate localized factors impacting Sansteel Minguang’s production in Fujian to assess potential regional demand shifts. Consider also that Rio Tinto plans its first shipment from the Simandou project in November, per the article “Iron ore as a pillar: industry giants rely on Chinese steel production,”. This increased supply could further influence pricing strategies.