From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market: Emission Spike Amid Production Declines Signals Procurement Caution

In China, steel sector emissions rose sharply in June despite a global production downturn. According to the news article, “Emissions in China’s steel sector rose by 17.3% y/y in June,” emissions from Chinese steel enterprises increased significantly year-over-year, even with a reduction in total energy consumption. This contrasts with the article, “Global steel production fell by 5.8% y/y in June,” which indicates a 9.2% drop in China’s steel production during the same period. The news article, “Global pig iron production fell to 115.3 million tons in June,” further underlines a decrease in global and Chinese pig iron production. Direct links between observed satellite activity at individual plants and these specific reports on emissions and pig iron production cannot be definitively established.

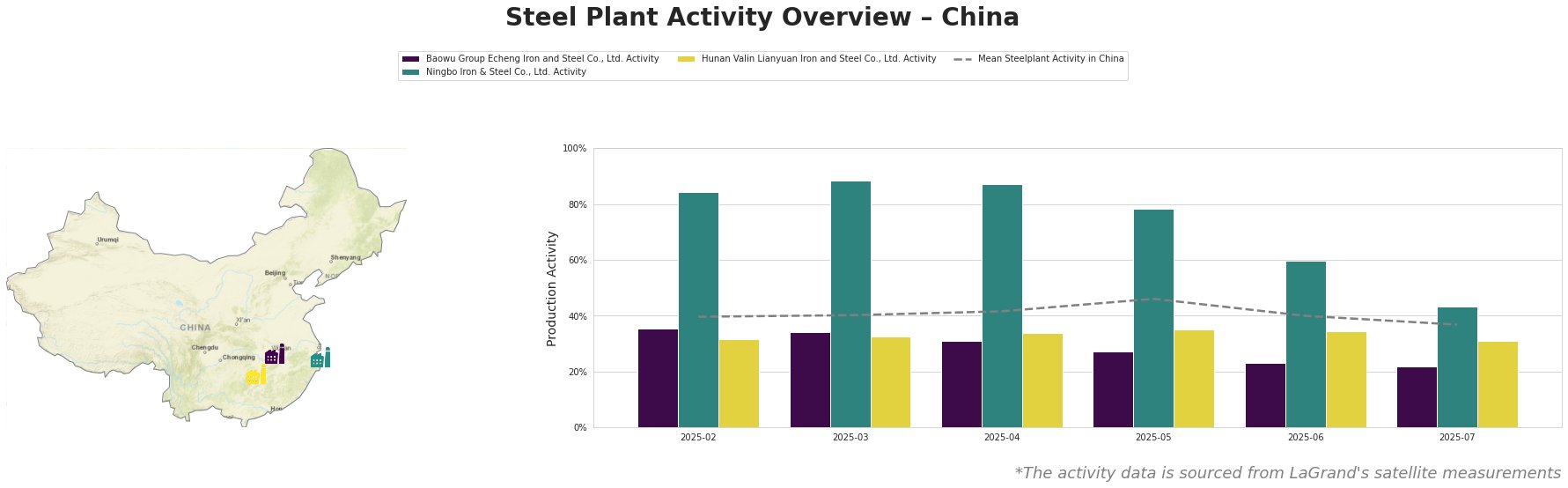

The mean steel plant activity in China shows a downward trend, dropping from 46% in May to 37% in July. Baowu Group Echeng Iron and Steel Co., Ltd. shows a significant decline from 35% in February to 22% in July, consistently underperforming the national average. Ningbo Iron & Steel Co., Ltd., after a peak of 88% in March, shows a sharp decrease to 43% in July, significantly impacting its contribution. Hunan Valin Lianyuan Iron and Steel Co., Ltd. shows relative stability, fluctuating slightly around 31-35%, consistently below the national average.

Baowu Group Echeng Iron and Steel Co., Ltd., located in Hubei, operates with a 4.4 million tonne crude steel capacity using integrated (BF) processes with BF and BOF equipment, producing finished rolled products like spring steel and high-strength ring chain steel. Its activity has consistently declined, dropping to 22% in July. No direct connection can be established between this decline and any specific news article.

Ningbo Iron & Steel Co., Ltd. in Zhejiang, with a 4.0 million tonne crude steel capacity, utilizes integrated BF processes, including three 180-tonne BOFs to produce carbon, low-alloy, and automotive structural steels. Its activity saw a sharp reduction, from 88% in March to 43% in July. While the decrease aligns with overall production declines reported in “Global steel production fell by 5.8% y/y in June,” no specific cause can be directly attributed to the news.

Hunan Valin Lianyuan Iron and Steel Co., Ltd., based in Hunan, possesses a larger 9.0 million tonne crude steel capacity, using integrated BF processes with BF and BOF equipment to manufacture products like electric steel and cold-rolled automotive steel. Its activity remained relatively stable, with a slight decrease to 31% in July. Despite general industry emission and production concerns highlighted in “Emissions in China’s steel sector rose by 17.3% y/y in June” and “Global steel production fell by 5.8% y/y in June“, no direct correlation can be made.

Despite the very positive market sentiment, the contradictory trends of rising emissions coupled with declining steel production and reduced plant activity, especially at Ningbo Iron & Steel, may indicate potential production inefficiencies and equipment downtime.

Procurement Action: Steel buyers should closely monitor Ningbo Iron & Steel’s output and explore diversifying suppliers to mitigate risks associated with potential shortfalls. Verify with Baowu Group Echeng Iron and Steel the reason for their ongoing production decline to avoid supply disruptions.