From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market: Capacity Expansion & Activity Shifts Signal Automotive Sector Growth

China’s steel market shows a positive outlook with capacity expansions and varied plant activity. ANDRITZ’s involvement in multiple projects, as highlighted in “ANDRITZ receives final acceptance for cold rolling mill from Ansteel Group, China,” “ANDRITZ Delivers Cold Rolling Mill to Ansteel Group,” and “ArcelorMittal/China Oriental Group JV orders high-end silicon steel processing plant from ANDRITZ,” indicates a focus on advanced steel production. While no direct relationship to the news articles could be observed, the satellite data reveals activity shifts, necessitating a cautious approach to procurement strategies.

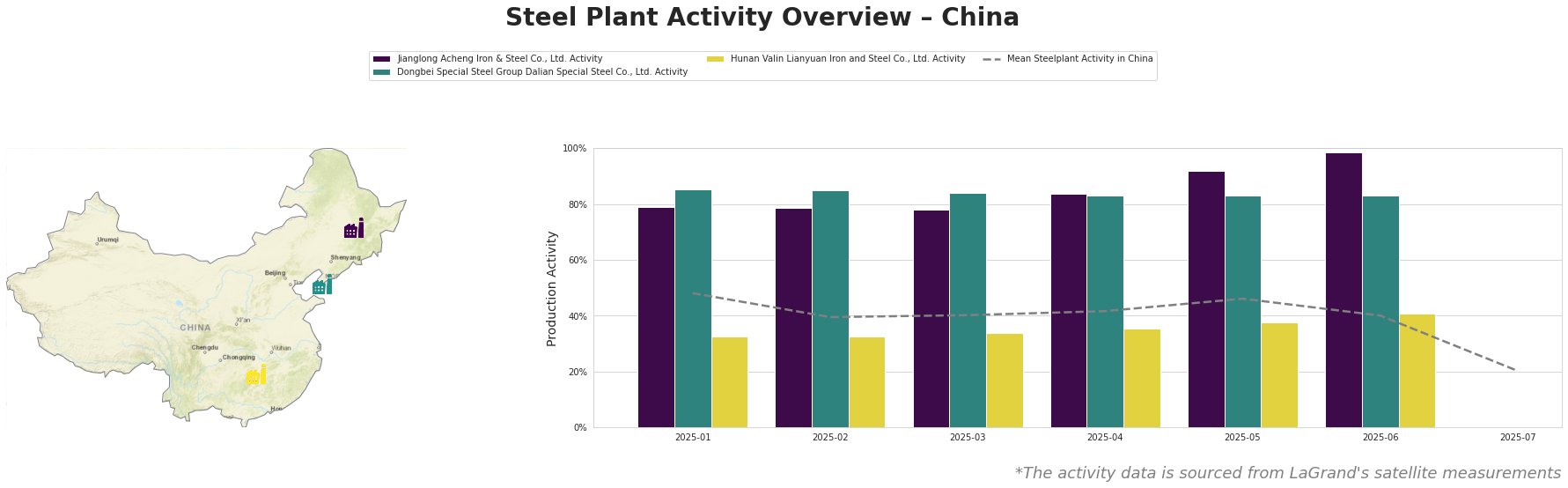

Measured Activity Overview

The mean steel plant activity in China fluctuated between 40% and 48% from January to June 2025, before dropping significantly to 20% in July, likely due to seasonal variations or unreported market shifts. Jianglong Acheng Iron & Steel Co., Ltd. consistently operated at high activity levels, peaking at 99% in June. Dongbei Special Steel Group Dalian Special Steel Co., Ltd. maintained a stable, high activity level around 83-85%. Hunan Valin Lianyuan Iron and Steel Co., Ltd. operated at significantly lower activity levels, ranging from 32% to 41%.

Jianglong Acheng Iron & Steel Co., Ltd., a Heilongjiang-based integrated steel plant with a crude steel capacity of 1.1 million tonnes per annum (mtpa), primarily produces hot-rolled and coated steel products for the automotive, energy, and machinery sectors. Its activity levels remained consistently high, reaching 99% in June before data became unavailable in July. No direct connection to the ANDRITZ news articles can be explicitly established for Jianglong Acheng, but continuous operation at near-peak levels suggests robust demand for its products.

Dongbei Special Steel Group Dalian Special Steel Co., Ltd., located in Liaoning, has a crude steel capacity of 1.54 mtpa and focuses on stainless steel bars and wires, as well as automotive steel. The plant’s consistent activity around 83-85% suggests stable production. No direct connection between the company and the ANDRITZ news can be drawn.

Hunan Valin Lianyuan Iron and Steel Co., Ltd., based in Hunan, is a major integrated steel producer with a capacity of 9 mtpa. It produces a diverse range of products, including electric steel, cold-rolled automotive steel, shipbuilding steel, and pipeline steel. The company operated at a lower activity level than the others, ranging between 32 and 41%, and also experienced a higher percentage increase than the other two plants. The start-up scheduled for the end of 2025 of the ArcelorMittal/China Oriental Group JV silicon steel processing plant, announced in “ArcelorMittal/China Oriental Group JV orders high-end silicon steel processing plant from ANDRITZ“, could impact production.

Evaluated Market Implications

The high activity at Jianglong Acheng Iron & Steel, coupled with ANDRITZ’s project completions and new orders, indicates increased demand, particularly for automotive-grade steel, throughout China. The observed drop in average production in July could create a temporary supply constraint.

Recommended Procurement Actions:

- Monitor Hunan Valin Lianyuan Iron and Steel: Due to the increased plant activity, analyze forward market trends and consider securing supply agreements in advance of the start-up of the ArcelorMittal/China Oriental Group JV silicon steel plant to mitigate against potential price fluctuations in the electric steel market.

- Evaluate alternative suppliers of automotive steel: The high activity at Jianglong Acheng might indicate tightness in the hot-rolled and coated steel market, but also a potential supply gap as production data becomes unavailable in July. Procurement professionals should consider diversifying their supply base to avoid potential disruptions.