From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Exports Surge Amidst Global Demand: Plant Activity Analysis & Procurement Insights

China’s steel sector shows strong growth driven by increasing global demand, as indicated by the news articles “Global steel exports grew by 3.3% y/y in 2024” and “China’s steel exports further up in May, pace of growth in January-May accelerates to 8.9%“. These reports of rising exports may be related to observed activity levels at key steel plants, though no explicit operational connection can be established based on the provided data.

China’s finished steel exports reached 10.578 million metric tons in May, a 9.8% year-on-year increase, according to “China’s steel exports further up in May, pace of growth in January-May accelerates to 8.9%“, aligning with increased crude steel production and softer domestic demand. This trend is further supported by “Global steel exports reach 449 million tons: demand is growing“, which highlights a 3.3% global export increase in 2024, with China leading as the top exporter.

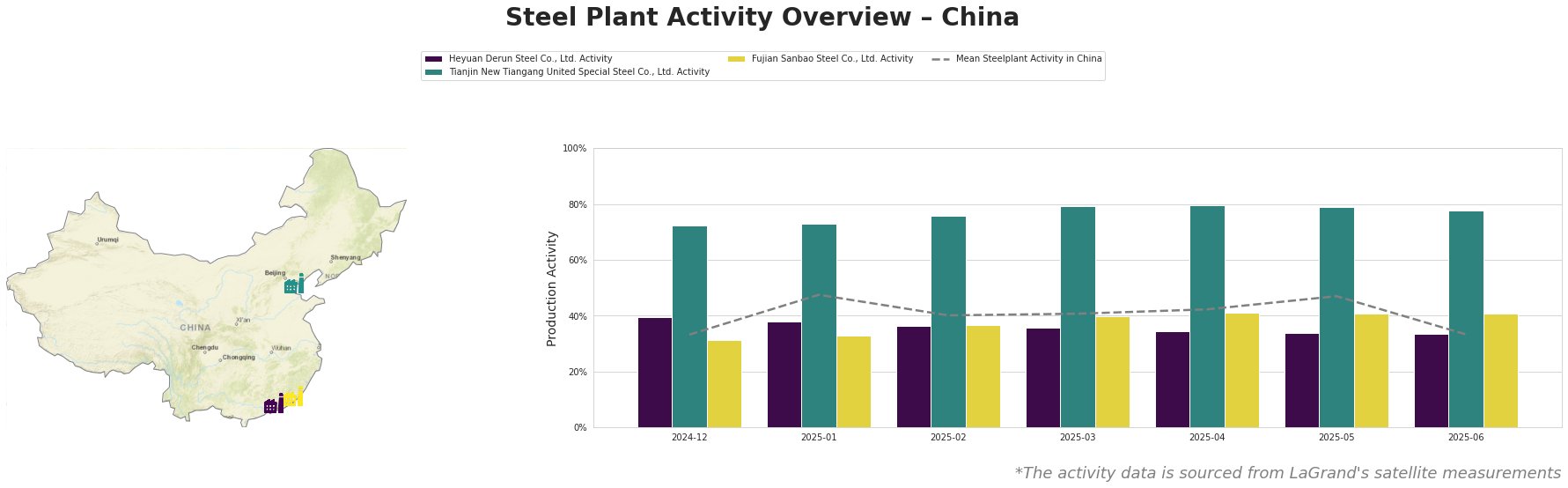

The mean steel plant activity in China saw a peak in January 2025 at 48.0%, declining to 33.0% by June 2025. In contrast, Tianjin New Tiangang United Special Steel Co., Ltd. consistently showed high activity, peaking at 80.0% in April 2025. Fujian Sanbao Steel Co., Ltd. exhibited a steady increase, reaching 41.0% in April and holding steady through June. Heyuan Derun Steel Co., Ltd. activity decreased over the observed time. No direct connection between these plant-specific activity levels and the news articles could be explicitly established.

Heyuan Derun Steel Co., Ltd., located in Guangdong, operates with an EAF-based production setup, boasting a crude steel capacity of 1200 ttpa. Specializing in finished rolled and semi-finished products like hot-rolled rebar and billet, the plant’s activity has decreased from 40% in December 2024 to 34% by June 2025. Given the focus on exports reported in “Global steel exports grew by 3.3% y/y in 2024” and “China’s steel exports further up in May, pace of growth in January-May accelerates to 8.9%“, this decline in activity at Heyuan Derun Steel Co., Ltd. is not directly linked to export growth based on the data provided.

Tianjin New Tiangang United Special Steel Co., Ltd., situated in Tianjin, is an integrated BF-BOF steel plant with a substantial crude steel capacity of 4500 ttpa. It produces angle steel and continuous casting billets. Activity levels at this plant remained high throughout the period, peaking at 80% in April 2025 and only slightly decreasing to 78% by June 2025. This high activity level is consistent with the increased export trend reported in “China’s steel exports further up in May, pace of growth in January-May accelerates to 8.9%“, although a direct operational connection is not explicitly established by the news report or provided plant details.

Fujian Sanbao Steel Co., Ltd., based in Fujian, also operates as an integrated BF-BOF steel plant with a crude steel capacity of 4620 ttpa. The company produces corrosion-resistant hot-rolled coils, billets, hot-rolled ribbed and round steel bars, high-strength fasteners, and steel strands. The plant’s activity has shown a steady increase from 31.0% in December 2024 to 41.0% from April through June 2025. This sustained increase could reflect the broader increase in exports described in “Global steel exports reach 449 million tons: demand is growing“, although a specific operational link cannot be definitively made with the data provided.

Based on the “China’s steel exports further up in May, pace of growth in January-May accelerates to 8.9%” and “Global steel exports reach 449 million tons: demand is growing“, the increasing global demand for steel, coupled with high activity at plants like Tianjin New Tiangang United Special Steel Co., Ltd. and Fujian Sanbao Steel Co., Ltd., suggests a generally stable supply situation.

Procurement Action: Buyers should consider the recent drop in average Chinese steel plant activity, and, more specifically, at Heyuan Derun Steel Co., Ltd. when negotiating contracts, although its implications for pricing and lead times is not clear from the present data. Further investigate the causes for decreased activity and proactively engage with suppliers to mitigate potential risks. Diversify supply chains in case of localized production disruptions in Guangdong, where Heyuan Derun Steel Co., Ltd. is located, as the decrease in activity at the plant has no clear linkages to increasing export figures.