From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Exports Surge Amid Production Shifts: Monitor Semis Supply

China’s steel market presents a mixed picture, with surging semi-finished steel exports juxtaposed against fluctuating domestic production. According to “Variations in China’s Steel Product Output from January to May 2025,” flat steel product output increased while long steel product output decreased, potentially reflecting shifting demand patterns. Simultaneously, “China’s iron ore output down 10.1 percent in January-May,” while seemingly contradictory at first glance, can be explained through high inventories. The activity levels of the steel plants are not fully aligned to these reports.

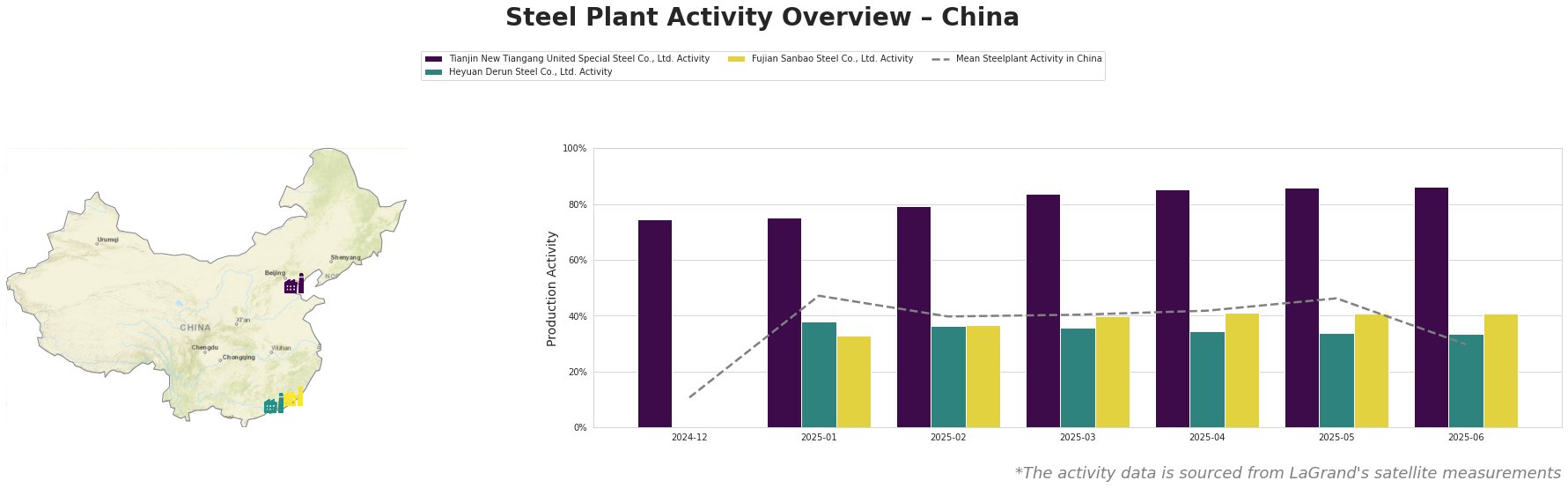

Measured Steel Plant Activity

The mean steel plant activity in China shows volatility throughout the observed period. It peaked in January 2025 at 47.0% and dropped to 30% in June 2025. This drop may be correlated to China reduced iron ore production by 10.1% y/y in January-May, even if it is not explicitly stated in the news article.

- Tianjin New Tiangang United Special Steel Co., Ltd. consistently operated at high activity levels, ranging from 75.0% to 86.0% throughout the observed period, significantly exceeding the mean activity level across all plants in China.

- Heyuan Derun Steel Co., Ltd. shows constant activity at 34-38% in the five months of the year.

- Fujian Sanbao Steel Co., Ltd. gradually increased from 33% to 41% in January-May, remaining stable in June.

Steel Plant Analysis

Tianjin New Tiangang United Special Steel Co., Ltd., located in Tianjin, is an integrated steel plant with a crude steel capacity of 4.5 million tons per year, utilizing BF and BOF technologies to produce finished rolled and semi-finished products like angle steel and continuous casting billets. Its consistent high activity, peaking at 86% in May-June 2025, suggests it is operating at near full capacity. There is no immediate link to the provided news articles.

Heyuan Derun Steel Co., Ltd., situated in Guangdong, operates an electric arc furnace (EAF) with a crude steel capacity of 1.2 million tons per year, focusing on hot-rolled rebar and billet production. Its relatively stable activity level around 34-38% from January to June does not show the volatility that the other plants show. There is no immediate link to the provided news articles.

Fujian Sanbao Steel Co., Ltd., based in Fujian, has a crude steel capacity of 4.62 million tons per year, employing both BF/BOF and EAF processes to manufacture corrosion-resistant hot-rolled coils, billets, and other products. The plant’s steady increase in activity from January to April, and then stabilization, does not have a direct link to any of the named news articles, although the increase may come from “Variations in China’s Steel Product Output from January to May 2025”.

Evaluated Market Implications

The news article titles “China’s semis exports up 75% in May from April, surge 306% in Jan-May, 2025“, “China quadrupled its exports of semi-finished steel products in January-May“, and “Exports of semi-finished products from China increased by 75% in May” clearly point to the fact that China is exporting record amounts of semi-finished steel. This rise, contrasted with the “Global steel production fell by 3.8% y/y in May” points to a global over-supply of steel, potentially affecting prices negatively.

- Potential Supply Disruptions: The combination of increased semi-finished steel exports and fluctuations in domestic steel production, as outlined in “Variations in China’s Steel Product Output from January to May 2025”, could lead to potential supply disruptions for specific steel products within China.

- Recommended Procurement Actions: Steel buyers should closely monitor price trends for semi-finished steel, given the significant export volumes. Consider diversifying suppliers and exploring opportunities to secure favorable contracts, especially for products where domestic production is declining and relying on integrated mills.