From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Exports Surge Amid Inventory Shifts: Asia Market Report (August 2025)

Asia’s steel market shows a positive sentiment driven by increased Chinese exports and shifting inventory dynamics. China’s steel exports increased as reported in “China increased steel exports by 1.6% m/m in July” and “China’s steel exports strong in July and up 11.4% in Jan-July as sellers change geography“. While these articles point to robust export activity, “Stocks of main finished steel products in China up 1.3 percent in late July 2025” indicates a domestic inventory increase, potentially impacting regional supply and pricing. No direct relationships could be established between these articles and the observed satellite activity changes.

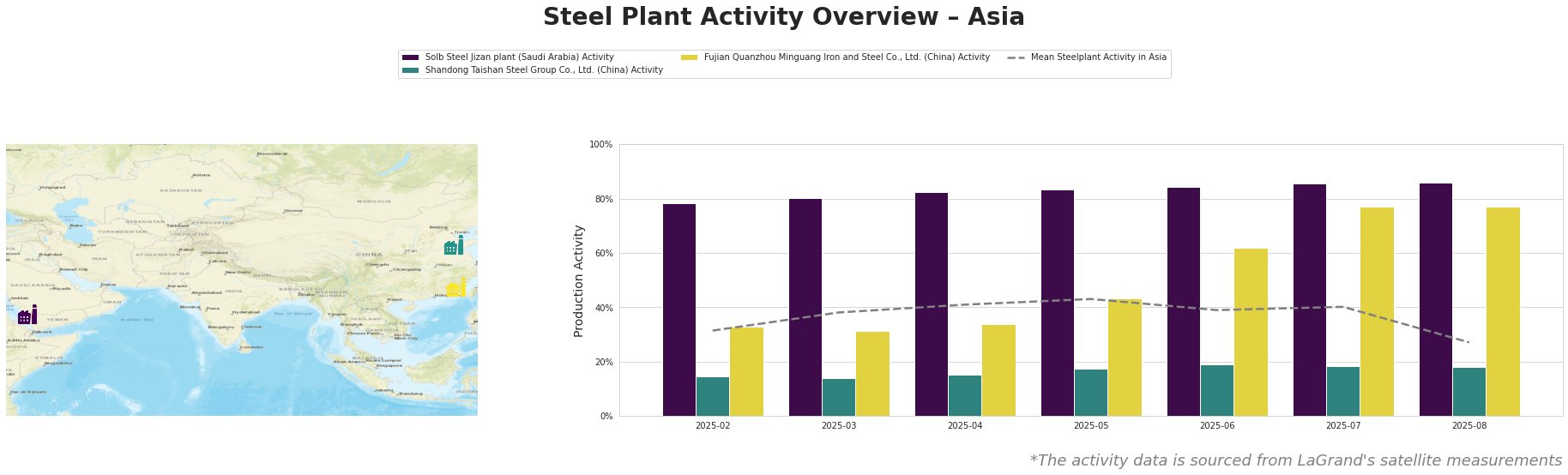

The mean steel plant activity in Asia shows a decline to 27.0% in August, following a relatively stable period between March and July. Solb Steel Jizan plant consistently operates well above the Asian average, reaching 86.0% in August, indicating strong and stable production. Shandong Taishan Steel Group Co., Ltd. consistently shows low activity levels (14-19%) relative to the regional mean. Fujian Quanzhou Minguang Iron and Steel Co., Ltd. experienced a significant increase in activity from February (33.0%) to July (77.0%), remaining stable in August, well above the Asian average.

Solb Steel Jizan plant, a Saudi Arabian facility with a 1.2 million tonne EAF-based capacity focusing on semi-finished and finished rolled products like rebar, has consistently demonstrated high activity levels, reaching 86.0% in August. This stable output contrasts with the fluctuating regional average, suggesting reliable supply from this source. No direct link to the provided news articles can be established.

Shandong Taishan Steel Group Co., Ltd., an integrated BF-based Chinese producer with a 5 million tonne capacity manufacturing hot-rolled coil and cold-rolled coil, exhibits consistently low activity levels, ranging from 14% to 19%. This subdued activity might correlate with the inventory increases reported in “Stocks of main finished steel products in China up 1.3 percent in late July 2025“, but no explicit connection can be established.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., a BF/BOF-based Chinese producer with a 2.55 million tonne capacity focusing on long products like rebar and wire rod, shows a significant activity increase to 77.0% by July, where it remains stable in August. This contrasts with the previously named article “Stocks of main finished steel products in China up 1.3 percent in late July 2025“, suggesting that its production is being directed towards exports, potentially aligning with the trends reported in “China increased steel exports by 1.6% m/m in July“.

Given the increased Chinese steel exports reported in “China increased steel exports by 1.6% m/m in July” and “China’s steel exports strong in July and up 11.4% in Jan-July as sellers change geography“, coupled with the domestic inventory increase highlighted in “Stocks of main finished steel products in China up 1.3 percent in late July 2025“, steel buyers should:

- Negotiate strategically with Chinese suppliers: Leverage the inventory increase and strong export figures from “China increased steel exports by 1.6% m/m in July” to potentially secure more favorable pricing, especially for products where inventories are rising.

- Diversify procurement: Consider increasing procurement from Solb Steel Jizan plant due to its consistently high activity levels, ensuring a stable supply source independent of Chinese market fluctuations. This is particularly important if the overall Mean Steelplant Activity in Asia remains on the low side as measured in August.