From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Exports Set to Surge in 2025 Amidst Shifting Domestic Demand

China’s steel market is poised for increased export activity, driven by stagnant domestic demand as reported in “IREPAS Meeting: 2025 set to be record year for China’s steel exports” and “Alexander Gordienko: 2025 set to be record year for China’s steel exports“. Concerns about protectionism squeezing the global steel industry, as highlighted in “Producers at IREPAS: Chinese exports and protectionism squeeze global steel industry”, could introduce volatility. This is happening as “Baosteel at IREPAS: Long-term demand outlook solid despite short-term disruptions” notes a shift in domestic demand from construction to manufacturing. While some plants maintained activity, satellite data shows a significant drop in mean steel plant activity in October, although no immediate connection can be established to any of the specific plants observed.

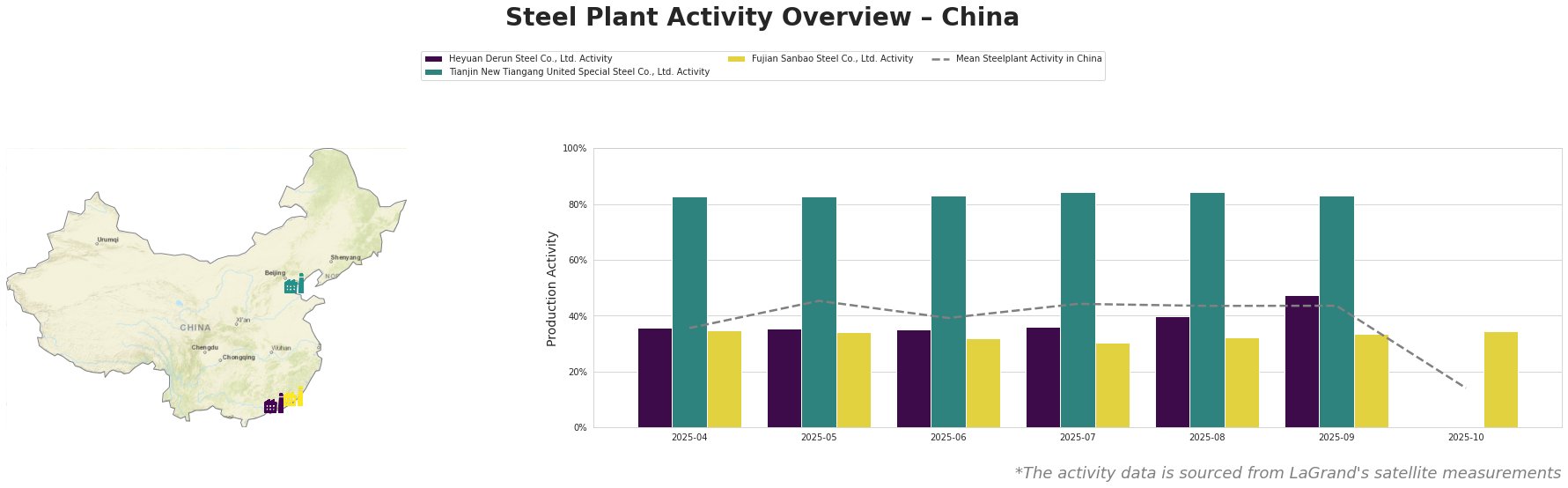

Monthly aggregated activities in % (0% = lowest ever measured, 100% = all time high):

The mean steel plant activity in China remained relatively stable from April to September 2025, fluctuating between 36% and 45%. There was then a sharp decrease to 14% in October.

Heyuan Derun Steel Co., Ltd., located in Guangdong and operating with electric arc furnaces (EAF) with a crude steel capacity of 1.2 million tonnes, showed fluctuating activity. Initially recorded at 36% in April 2025, it slightly decreased to 35% between May and June before gradually increasing to 48% by September. This increase could be linked to preparations for increased exports as foreshadowed in “IREPAS Meeting: 2025 set to be record year for China’s steel exports”, however no direct connection can be established. No data is available for October.

Tianjin New Tiangang United Special Steel Co., Ltd., an integrated BF-BOF plant in Tianjin with a 4.5 million tonne crude steel capacity, maintained a high and stable activity level between 83% and 84% from April to September. No data is available for October. This stability does not appear to directly reflect the export surge anticipated in “IREPAS Meeting: 2025 set to be record year for China’s steel exports”, suggesting the plant’s output is primarily focused on domestic consumption, however no direct connection can be established.

Fujian Sanbao Steel Co., Ltd., an integrated BF-BOF plant in Fujian with a 4.62 million tonne crude steel capacity producing a range of finished rolled and semi-finished products, showed decreasing activity levels between April (35%) and July (30%) before seeing a slight recovery to 34% until October. The plant’s decreased activity in July, when compared to other observed plants or the mean, does not appear to be directly linked to the news articles. The slight increase to 34% until October may reflect preparations for increased exports in line with “IREPAS Meeting: 2025 set to be record year for China’s steel exports”, however no direct connection can be established.

Given the anticipated surge in Chinese steel exports and potential disruptions from protectionist measures, steel buyers should consider the following:

- Monitor Export Prices: Closely track Chinese export prices for rebar, wire rod, and semi-finished steel, as highlighted in “IREPAS Meeting: 2025 set to be record year for China’s steel exports”. Be prepared for potential price increases due to increased demand or the imposition of trade barriers as mentioned in “Producers at IREPAS: Chinese exports and protectionism squeeze global steel industry”.

- Assess Alternative Supply Chains: Diversify supply chains to mitigate risks associated with potential trade tensions and protectionist measures, as suggested by “Producers at IREPAS: Chinese exports and protectionism squeeze global steel industry”. Consider suppliers in emerging Asian countries, which are experiencing strong growth.

- Factor in Product Mix Shift: Be aware of the shift in China’s steel product mix from long to flat products, as mentioned in “Baosteel at IREPAS: Long-term demand outlook solid despite short-term disruptions”. Ensure that your procurement strategy aligns with this changing product landscape.

- Evaluate Heyuan Derun Steel: Given the increase in activity level at Heyuan Derun Steel Co., Ltd., assess the possibility of negotiating forward supply contracts, to benefit from possible low prices.

- Long-term planning: It is advisable to make contracts for at least one year.