From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineCBAM Uncertainty Drives Asian Steel Price Fluctuations: Plant Activity Signals Market Volatility

Asia’s steel market faces volatility due to the Carbon Border Adjustment Mechanism (CBAM) and shifting global demand. Leaked CBAM benchmark values are causing price drops for Indian steel in the EU, as evidenced by the news articles “India-EU coil prices drop amid CBAM benchmark leaks” and “India and EU roll Prices fall due to CBAM Benchmark leaks“. However, no direct impact on the satellite-observed plant activity in Asia could be directly established through the provided news data.

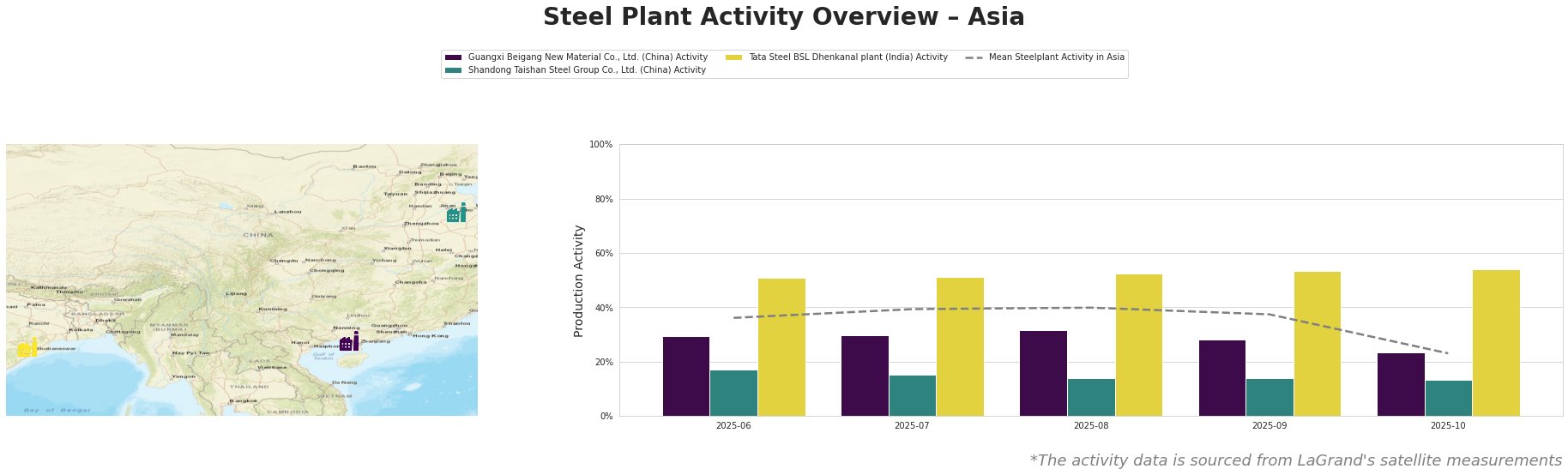

The mean steel plant activity in Asia saw a significant drop in October 2025, falling to 23% from 37% in September. Guangxi Beigang New Material Co., Ltd.’s activity mirrors this trend, dropping from 28% to 23% in the same period. Shandong Taishan Steel Group Co., Ltd. shows a consistently low activity level, fluctuating between 17% and 13% over the observed months. Conversely, Tata Steel BSL Dhenkanal plant demonstrates a stable upward trend, increasing from 51% in June to 54% in October, significantly exceeding the Asian mean activity levels.

Guangxi Beigang New Material Co., Ltd., an integrated BF and EAF-based steel plant in Guangxi, China, with a 3.4 million tonne crude steel capacity is experiencing fluctuating activity levels. The plant’s activity dropped from 32% in August to 23% in October, mirroring the overall decline in Asian activity. Given their production of HRC and CRC, this might be partly attributable to weaker regional demand impacting HRC/CRC offers as referenced in “India-EU coil prices drop amid CBAM benchmark leaks“.

Shandong Taishan Steel Group Co., Ltd., another integrated BF and BOF/EAF producer in Shandong, China, with a 5 million tonne capacity, consistently shows the lowest activity among the observed plants, remaining around 13-17%. Its production includes HRC and CRC, and this level is below the mean Asian level. No direct causal link between the plant activity and provided news could be established.

Tata Steel BSL Dhenkanal plant in Odisha, India, an integrated BF/DRI-based plant with a 5.6 million tonne crude steel capacity, shows a steady increase in activity, reaching 54% in October. This suggests resilience despite the CBAM-related price pressures affecting Indian exports as detailed in “India-EU coil prices drop amid CBAM benchmark leaks” and “India and EU roll Prices fall due to CBAM Benchmark leaks“. The plant’s production is focused on semi-finished and finished rolled products.

Market Implications and Recommended Procurement Actions:

The drop in mean Asian steel plant activity, particularly in China, coupled with CBAM-related price pressures on Indian exports, may lead to short-term supply constraints, especially for flat steel products. The article “The EU reduced imports of flat steel products by 4% y/y in January-August – EUROFER” reinforces this trend in Europe.

-

Steel Buyers: Given the potential for price volatility and supply chain disruptions, particularly in HRC and CRC, buyers should:

- Diversify sourcing: Explore alternative suppliers, particularly those less affected by CBAM, to mitigate risks. As “Chinese steel will lose its price advantage in Europe with the introduction of CBAM – forecast” highlights, Turkish steel may become more competitive than Chinese steel in the EU market.

- Monitor Tata Steel BSL’s output: The increasing activity at Tata Steel BSL Dhenkanal plant indicates a potentially reliable supply source. Buyers should actively engage with Tata Steel to secure contracts.

- Short-term contracts: Negotiate shorter-term contracts to retain flexibility and capitalize on potential price dips as the CBAM situation evolves.

- Hedging strategies: Implement hedging strategies to protect against potential price increases, especially if relying on Chinese steel, given the forecasted impact of CBAM.

-

Market Analysts: Focus on tracking the impact of CBAM on Chinese and Indian steel exports to the EU. Monitor plant activity data, especially at facilities like Guangxi Beigang and Shandong Taishan, to anticipate production cuts or shifts in product focus. Analyze trade flows to identify emerging supply patterns and alternative sourcing options.