From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineCBAM Fuels European Steel Price Surge: Production Trends and Procurement Strategies

Europe’s steel market is bracing for significant price increases driven by the impending Carbon Border Adjustment Mechanism (CBAM). The news articles “CBAM effect pushes up prices, demand in Europe’s heavy steel plate market,” “All Steels: EU and UK steel prices set to surge as new tariffs and CBAM framework take effect,” “All types of steel: steel prices in the EU and the UK will rise as new tariffs and the CBAM framework come into force.” and “New tariffs and CBAM will push up steel prices in the EU and the UK – forecast” all point to the transformative impact of CBAM and revised import quotas on European steel prices. No direct relationship can be established between these news articles and observed plant activity levels.

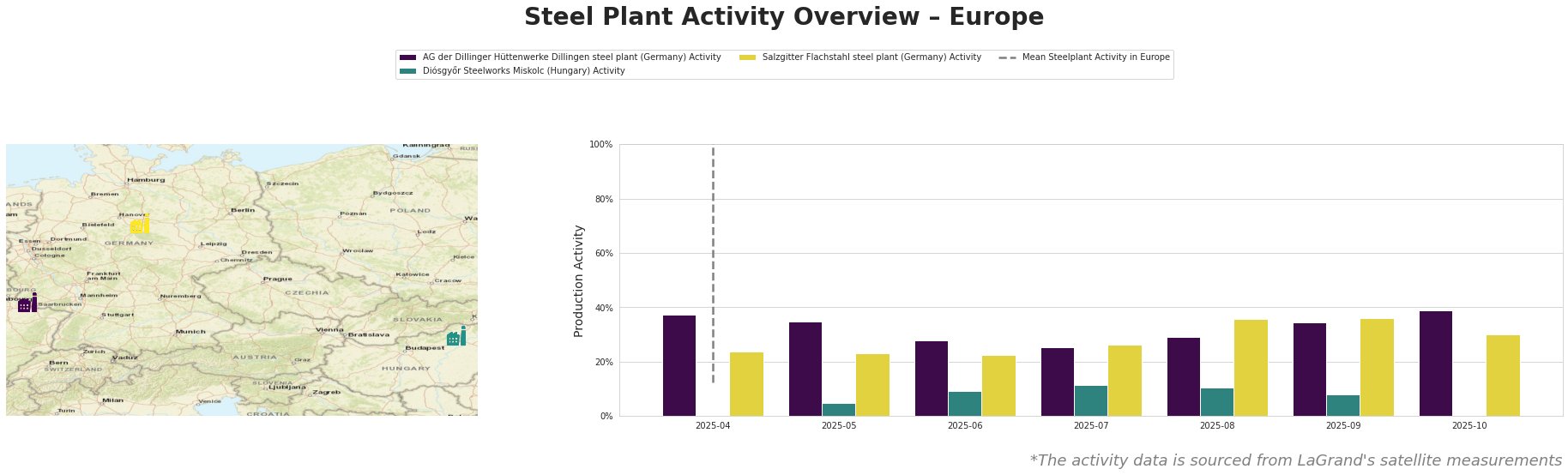

The data indicates fluctuating activity levels across European steel plants. The mean steel plant activity shows considerable variance month-to-month, starting with a low of 12.0 in April, jumping significantly in May, and then fluctuating through October. AG der Dillinger Hüttenwerke’s activity started at 37.0 in April, dipped to 25.0 in July, and rose to 39.0 in October, consistently above the European mean for months with available data. Salzgitter Flachstahl shows a similar trend, with a low of 22.0 in June and peaks at 36.0 in August and September. Diósgyőr Steelworks only shows data for certain months and displays the lowest activity values among the listed plants. There are no immediate discernible trends related to the news articles regarding CBAM and its effects on these plants specifically.

AG der Dillinger Hüttenwerke Dillingen steel plant in Saarland, Germany, is an integrated BF-BOF producer with a crude steel capacity of 2.76 million tonnes per annum. The plant specializes in heavy-plate products, including high-strength and offshore steels. Satellite data shows activity rising to 39.0 in October from 25.0 in July. This rise does not have any established connection to the provided news articles.

Diósgyőr Steelworks Miskolc in Hungary operates an EAF with a capacity of 550,000 tonnes per annum, producing construction and microalloyed steels. Activity data is intermittent, showing limited activity between May and September. There is no clear trend, and no established connection to the provided news articles.

Salzgitter Flachstahl steel plant in Lower Saxony, Germany, is also an integrated BF-BOF producer, with a crude steel capacity of 5.2 million tonnes per annum. The plant is transitioning to hydrogen-based steel production. The plant’s activity increased from 22.0 in June to 36.0 in August and September, before dropping to 30.0 in October. There is no established connection to the provided news articles.

The impending implementation of CBAM, as highlighted in “CBAM effect pushes up prices, demand in Europe’s heavy steel plate market” and “New tariffs and CBAM will push up steel prices in the EU and the UK – forecast“, suggests that European steel buyers should expect rising prices. The news articles forecast potential price increases of £80 per ton in the short term, potentially exceeding £200 per ton in 2026. Given AG der Dillinger Hüttenwerke’s focus on heavy plate and its increased activity in October, buyers requiring these products should secure contracts promptly to mitigate the impact of anticipated price hikes. While overall EU production capacity may be sufficient, the shift to local sourcing, as discussed in the news articles, may create temporary supply bottlenecks and affect prices for specific product categories, such as those produced by AG der Dillinger Hüttenwerke.