From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineCanadian Steel Market Reacts Positively to New Tariffs: Plant Activity Stabilizes

Canada’s steel industry is showing signs of stabilization following the introduction of new protective measures. Recent policy changes, as detailed in “Canada introduces new tariffs, investment plan to support steel industry,” “Canada announces new tariff measures on imported steel to protect domestic industry,” “Canada strengthens the system of tariff quotas for steel imports,” and “Canada announces new measures to protect steel industry,” are aimed at mitigating the impact of global market disruptions and supporting domestic producers. While a direct correlation between the implementation of these measures and observed activity changes cannot yet be definitively established, observed plant activity levels are showing signs of bottoming out.

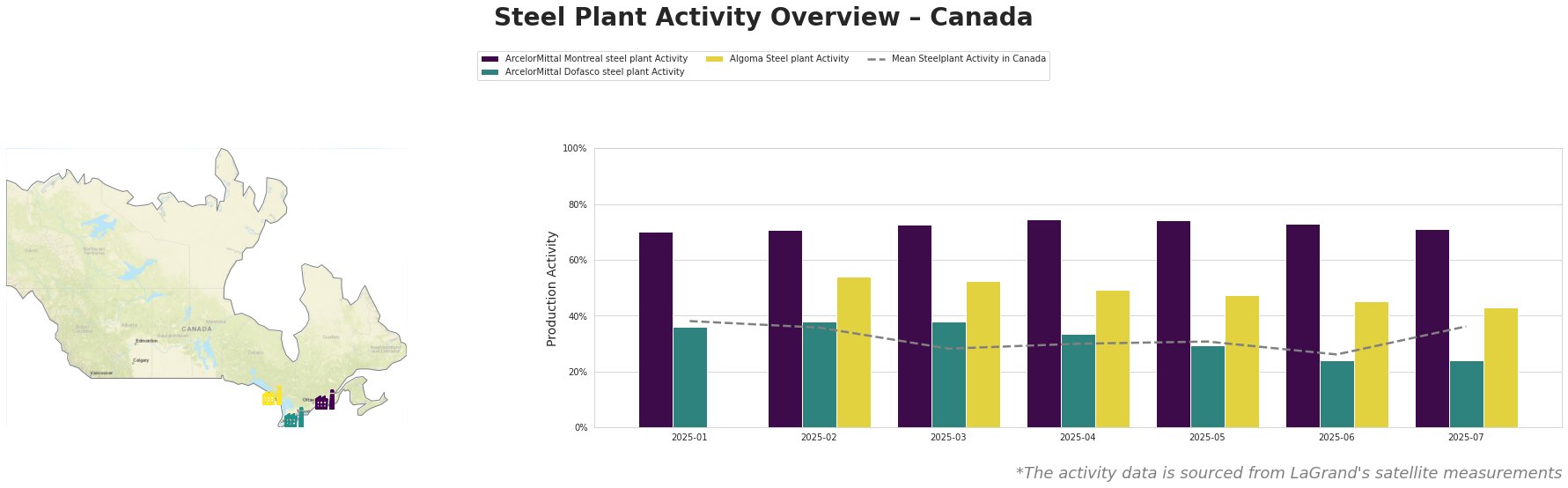

The mean steel plant activity in Canada decreased from 38% in January to a low of 26% in June, then rebounded to 36% in July. ArcelorMittal Montreal maintained a high and relatively stable activity level throughout the period, peaking at 74% in April and May and finishing the period at 71%. ArcelorMittal Dofasco’s activity declined significantly, dropping from 36% in January to 24% in both June and July. Algoma Steel’s activity also showed a declining trend from February to July, dropping from 54% to 43%.

ArcelorMittal Montreal steel plant

ArcelorMittal Montreal, located in Quebec, operates with a 2.4 MTPA capacity, primarily using DRI and EAF technologies to produce semi-finished and finished rolled products for the automotive and construction sectors. Its activity has remained consistently high, ranging between 70% and 74% during the observed period. This sustained activity, while not directly attributable to the recent tariff announcements, suggests a robust demand for its specialized bar and wire products.

ArcelorMittal Dofasco steel plant

ArcelorMittal Dofasco, situated in Ontario, is an integrated BF-BOF and EAF steel plant with a 4.05 MTPA crude steel capacity. Its products serve diverse sectors, including automotive, construction, and energy. The plant experienced a notable decline in activity from 36% in January to 24% in June and July. The drop cannot be definitively connected to the recent news articles.

Algoma Steel plant

Algoma Steel, based in Ontario, operates with a 2.8 MTPA capacity using BF-BOF technology. It produces hot-rolled and cold-rolled products for the energy, construction, and automotive industries. The plant saw a gradual decrease in activity from 54% in February to 43% in July. The decline cannot be definitively connected to the recent news articles.

Evaluated Market Implications

The recent implementation of tariffs and investment plans, as outlined in “Canada introduces new tariffs, investment plan to support steel industry,” “Canada announces new tariff measures on imported steel to protect domestic industry,” “Canada strengthens the system of tariff quotas for steel imports,” and “Canada announces new measures to protect steel industry,” creates a complex situation for steel buyers.

Given the consistent high activity at ArcelorMittal Montreal and potential supply uncertainties arising from the new tariffs, steel buyers reliant on specialized bar and wire products should:

1. Secure Contracts: Prioritize establishing long-term supply contracts with ArcelorMittal Montreal to ensure a stable supply of these products.

2. Assess Alternative Suppliers: Identify and evaluate alternative domestic suppliers of specialized steel bars and wire rod products to mitigate risks associated with potential disruptions to existing supply chains.

The decline in activity at ArcelorMittal Dofasco and Algoma Steel warrant a careful review. Buyers who have been relying on ArcelorMittal Dofasco and Algoma Steel for steel products should proactively engage with them to understand if and how it will affect current orders and if there might be delivery delays.