From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineCanadian Steel Market Navigates Trade Tensions Amid Plant Activity Shifts

Canada’s steel market is facing a complex landscape due to recent trade developments and fluctuating plant activity. The observed changes in production levels at major steel plants do not appear to directly correlate with the news articles “Canada to exempt some steel and aluminum from the US and China from tariffs” and “Trump cancels trade talks with Canada” due to a lack of direct connection in article contents.

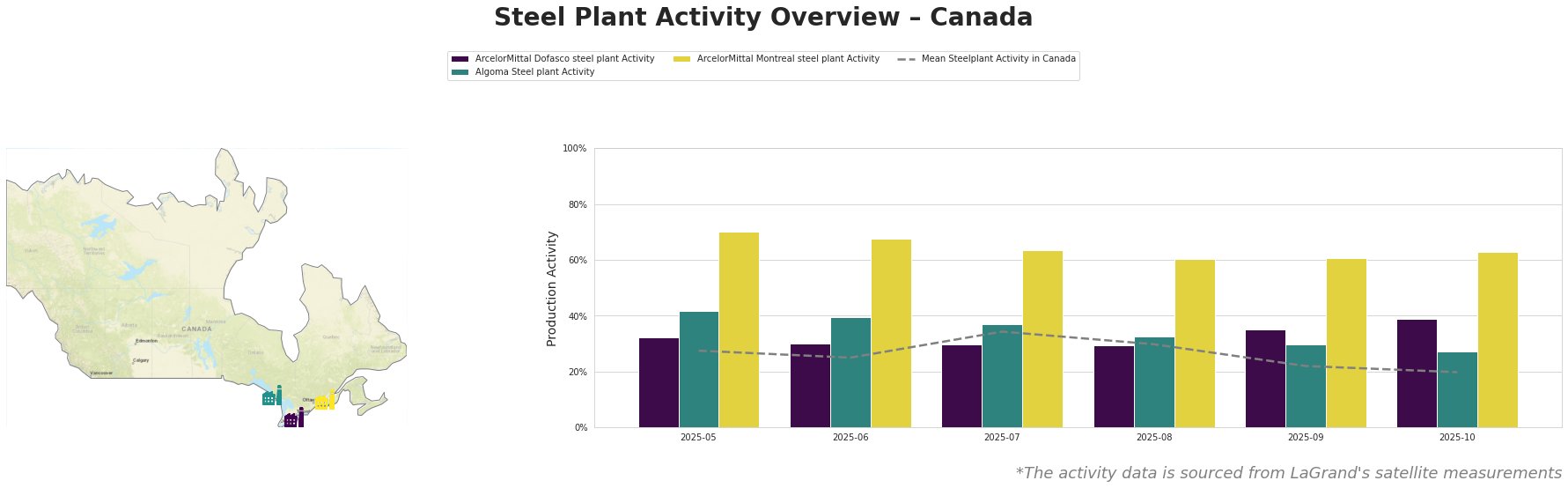

Monthly Steel Plant Activity in Canada

Overall, the mean steel plant activity in Canada shows a declining trend from May (28.0) to October (20.0). ArcelorMittal Dofasco’s activity shows a significant increase from September (35.0) to October (39.0). Algoma Steel plant shows a declining trend from May (42.0) to October (27.0). ArcelorMittal Montreal maintained a relatively high activity level compared to the others, although it decreased from May (70.0) to August (60.0), followed by an increase to 63.0 in October.

ArcelorMittal Dofasco steel plant

Located in Ontario, ArcelorMittal Dofasco operates as an integrated steel plant with a crude steel capacity of 4.05 million tonnes per annum (ttpa), utilizing both Basic Oxygen Furnace (BOF) and Electric Arc Furnace (EAF) technologies. It focuses on finished rolled products, serving the automotive, building, and energy sectors. The observed activity at ArcelorMittal Dofasco saw an increase from 35% in September to 39% in October. This rise in activity could not be directly linked to any of the provided news articles.

Algoma Steel plant

Also situated in Ontario, Algoma Steel has a crude steel capacity of 2.8 million ttpa and primarily uses BOF technology. It produces semi-finished and finished rolled products for the energy, infrastructure, and automotive industries. Algoma Steel’s activity level decreased from 30% in September to 27% in October. There is no direct connection to the mentioned news articles that could explain the activity decrease.

ArcelorMittal Montreal steel plant

ArcelorMittal Montreal, located in Quebec, operates with a crude steel capacity of 2.4 million ttpa, relying on DRI and EAF technologies. Their product portfolio includes special quality bars and reinforcing bars, primarily serving the automotive and construction sectors. The plant has consistently maintained a relatively high activity level compared to the others, despite a general decrease in overall activity from May to August (70% to 60%), recovering slightly in October (63%). No direct link could be established between this trend and the provided news articles.

Evaluated Market Implications

The “Trump cancels trade talks with Canada” news suggests heightened trade uncertainty between the US and Canada. Considering “Canada to exempt some steel and aluminum from the US and China from tariffs”, the Canadian steel industry is navigating complex trade dynamics, potentially impacting market access and pricing. The observed increase in activity at ArcelorMittal Dofasco from September to October, could be attributed to anticipation of increased demand resulting from the exemptions or potentially substituting for products affected by trade disputes.

Recommended Procurement Actions:

- Steel buyers should closely monitor market dynamics and inventory levels at ArcelorMittal Dofasco in anticipation of potential price adjustments due to increased activity.

- Diversify suppliers, consider domestic alternatives to mitigate risks associated with US tariffs and potential supply disruptions.

- Actively seek clarity on the specific steel and aluminum products exempted from tariffs to optimize sourcing strategies.

- Steel buyers should monitor the Algoma Steel plant. Should their downtrend continue, then alternative suppliers should be identified and qualified.