From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineBulgarian Steel Market Softens Amid Summer Slump: Turkish Imports Gain Traction

Bulgaria’s steel market faces headwinds as summer demand weakens, impacting domestic pricing. The situation is reflected in the news, with “Bulgarian domestic longs prices soften amid summer season” and “Prices for domestic long positions in Bulgaria are decreasing due to the summer season” directly attributing price decreases to this seasonal downturn. These articles highlight how Bulgarian buyers are increasingly considering cheaper Turkish imports due to the euro/dollar parity. No direct link can be established between these reports and observed plant activity.

Steel Plant Activity

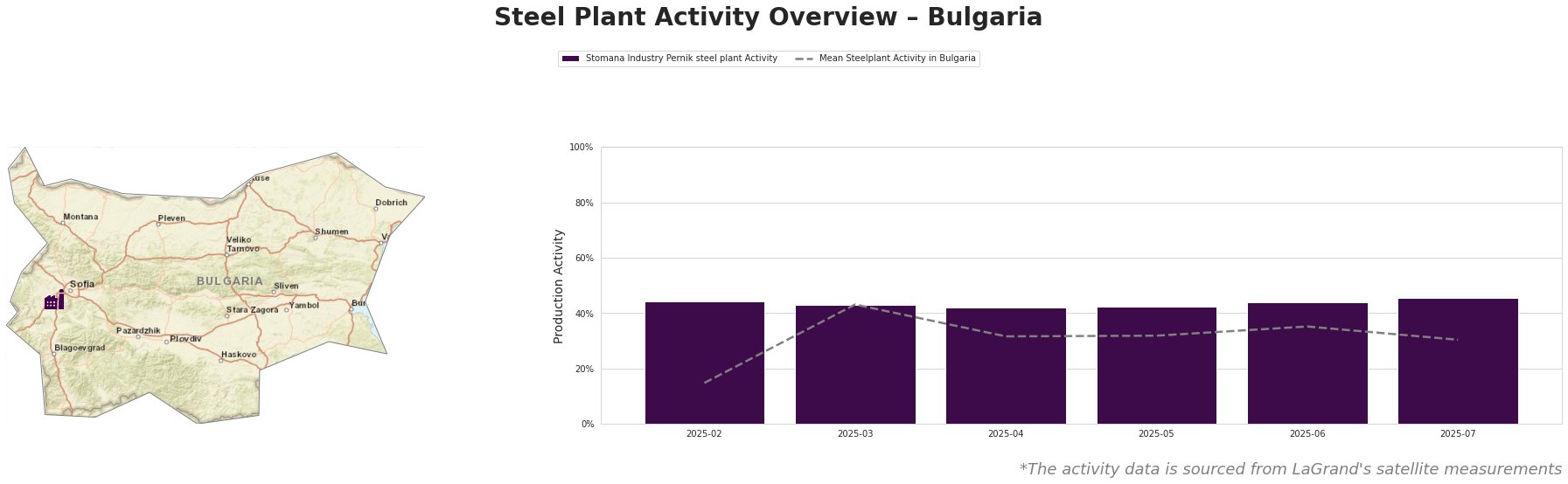

The mean steel plant activity in Bulgaria shows a decline from 35.0% in June to 30.0% in July, supporting the reported “sluggish demand”. The Stomana Industry Pernik steel plant, however, shows relatively stable activity levels, ranging between 42.0% and 46.0% since April, and ending at 46.0% in July, diverging from the overall downward trend. While the articles discuss decreased demand and price softening, a direct connection to the observed activity levels at Stomana cannot be explicitly confirmed.

Steel Plant Name: Stomana Industry Pernik steel plant

Stomana Industry Pernik is a Bulgarian steel plant located in Pernik, with a crude steel production capacity of 1.2 million tonnes per year, utilizing two Electric Arc Furnaces (EAF). They produce semi-finished and finished rolled products, including concrete reinforcing SD steel, hot-rolled steel plates, and merchant bars rounds, and holds a Responsible Steel Certification. Despite the general decrease in mean steel plant activity in Bulgaria, Stomana’s activity remained relatively stable, increasing slightly to 46.0% in July, even as the mean activity dropped to 30.0%. This contrasts with the news that “Bulgarian domestic longs prices soften amid summer season” due to weak demand, suggesting Stomana may be fulfilling existing orders or exporting. No direct link between this specific production and the news article “Romanian longs prices remain stable amid sluggish demand as market enters vacation mode” can be established.

Evaluated Market Implications

The Bulgarian steel market is currently experiencing a downturn, with decreasing domestic long steel prices driven by weak summer demand, while Stomana Industry Pernik’s activity remains relatively stable. The availability of cheaper Turkish imports, as highlighted in “Bulgarian domestic longs prices soften amid summer season” and “Prices for domestic long positions in Bulgaria are decreasing due to the summer season,” poses a competitive challenge to domestic producers.

- Recommended Procurement Actions: Steel buyers in Bulgaria should leverage the availability of cheaper Turkish rebar and wire rod, currently offered at $555-565/mt CFR and $565-575/mt CFR respectively, as mentioned in the news articles, to negotiate better prices with domestic suppliers like Stomana. Actively compare offers from Stomana with the imported Turkish prices, factoring in the $15-20/mt freight cost. While Romanian offers are perceived as too high, according to the news, they should still be considered in the negotiation mix.