From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineBrazil’s Steel Revival: Positive Market Trends Amid Expanding Exports

In Brazil, positive trends in the steel market are observed, particularly with rising prices for products like pig iron and significant increases in steel exports to Europe. The articles titled “Prices for Brazilian pig iron rose to $408 per ton in December“ and “Brazil’s steel exports to Europe double in 2025“ highlight the connection between price movements and plant activity as observed through satellite data.

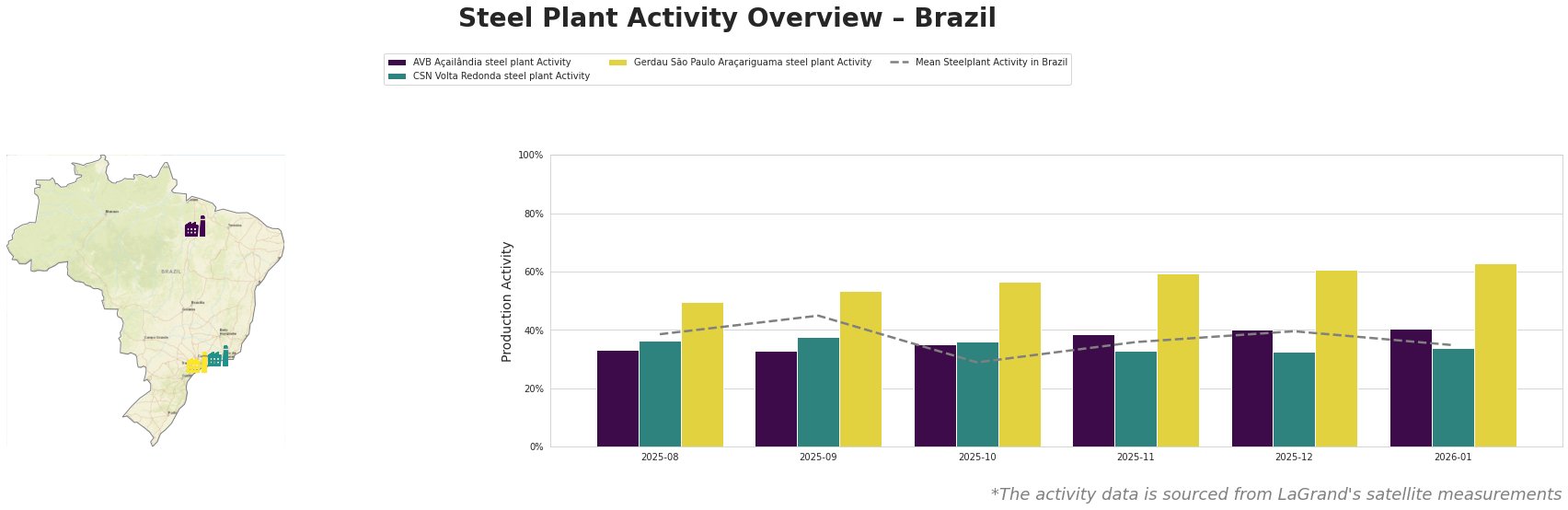

The satellite data indicates a fluctuating yet general upward trend in AVB Açailândia and Gerdau São Paulo Araçariguama steel plant activity, with AVB soaring to 41% in January 2026. This rise aligns with the reported demand increases noted in the article “Prices for Brazilian pig iron rose to $408 per ton in December.” In contrast, CSN Volta Redonda experienced a dip, maintaining lower activity levels despite overall positive trends in the market.

AVB Açailândia, employing integrated processes, has shown resilience with activity rising from 33% to 41% between December 2025 and January 2026. However, no direct correlation can be established with the recent market articles. Meanwhile, Gerdau São Paulo Araçariguama, which focuses on electric arc furnace (EAF) processes, also evident in its growth in activity from 57% to 63%, reflects the ongoing alignment with burgeoning steel exports as reported.

Increased activities of AVB and Gerdau may provide a buffer against anticipated supply disruptions resulting from the significant decline in pig iron shipments to the US, as noted in the “Prices for Brazilian pig iron rose to $408 per ton in December.” Steel buyers are advised to monitor pricing strategies in connection with both rising European demands and local market fluctuations.

In response to expanding European opportunities, buyers should consider shifting procurement strategies towards Brazilian suppliers that demonstrate increased productivity and monitor price shifts in light of escalating European tariffs and shifting trade dynamics revealed in “Brazil’s steel exports to Europe double in 2025.”

Strategically, securing long-term agreements with plants like AVB and Gerdau could mitigate risks associated with fluctuating market conditions and ensure stable supply in a positive, rising market environment.