From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineBrazil Steel Tariffs Extended: Monitor Simec Pindamonhangaba Output Amidst Import Restrictions

In South America, specifically Brazil, the domestic steel industry is poised for potential growth following the extension of import tariffs. This report analyzes the impact of Brazil’s protective measures, explicitly referencing “Brazil extends 25pc tariffs on imported steel” and “Brazil extends 25% tariff on steel imports,” on steel plant activity. While a direct realtionship to changes in activity cannot be explicitly established, the tariffs aim to shield domestic producers from import surges, potentially affecting local supply dynamics.

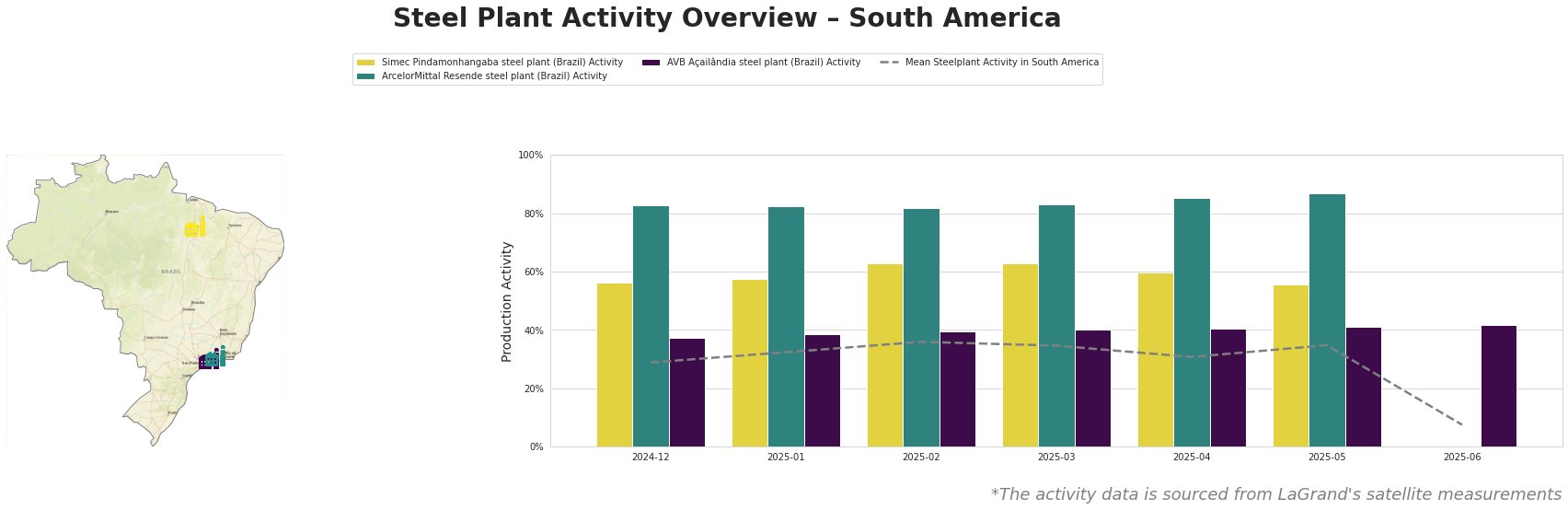

Here’s an overview of the monthly plant activities, focusing on notable trends:

Overall, the mean steel plant activity in South America shows a fluctuating trend, peaking in February 2025 at 36.0 and then decreasing significantly to 8.0 in June 2025. Simec Pindamonhangaba shows relatively high activity compared to the average, while ArcelorMittal Resende has consistently high activity. AVB Açailândia consistently shows below-average activity. It is important to note the data for Simec Pindamonhangaba and ArcelorMittal Resende is missing for June 2025, making it impossible to comment on their activity during that month.

Simec Pindamonhangaba steel plant: This EAF-based mill in São Paulo, with a 500 ttpa crude steel capacity, focuses on finished rolled products like wire rod and rebar for the building and infrastructure sectors. The plant’s activity decreased from 60.0 in April 2025 to 56.0 in May 2025. The company holds ResponsibleSteel Certification. While the decrease in May coincides with the extension of Brazilian tariffs, a definitive causal link cannot be established based solely on the provided data.

ArcelorMittal Resende steel plant: Located in Rio de Janeiro, this EAF-based mill has a 1000 ttpa crude steel capacity and is also ResponsibleSteel certified. The plant primarily produces rebar and wire rod for various sectors. Activity at ArcelorMittal Resende has been consistently high, reaching 87.0 in May 2025. There is no clear link between observed high activitiy and the extended tariffs, or the freight rates reported in “Freight rates roughly stable in April for Brazilian finished steel imports,” though the plant’s focus on rebar and wire rod aligns with products mentioned in the article.

AVB Açailândia steel plant: This integrated BF/BOF plant in Maranhão, with a 600 ttpa crude steel capacity, produces semi-finished and finished rolled products, including billets, rebar, and wire rod. This plant consistently exhibited below-average activity compared to the overall South American mean, reaching 41.0 in May 2025, and then 42.0 in June 2025, the highest it has been in the last 7 months. There is no immediate or obvious link between this elevated activity and any of the articles.

The extension of Brazil’s 25% tariff on imported steel, as highlighted in “Brazil extends 25pc tariffs on imported steel” and “Brazil extends 25% tariff on steel imports,” aims to protect domestic producers. While the provided data doesn’t establish a direct, causal relationship, the potential for reduced import competition could lead to increased demand for locally produced steel.

Evaluated Market Implications:

-

Potential Supply Disruptions: If the extended tariffs effectively curb imports, as intended, buyers should monitor the production capacity and output of domestic mills like Simec Pindamonhangaba, ArcelorMittal Resende and AVB Açailândia. The tariff extensions might allow them to gain market share, but a sudden surge in demand could strain their capacity.

-

Recommended Procurement Actions:

- For Steel Buyers: Given that “Brazil extends 25pc tariffs on imported steel” anticipates steel prices increasing due to protectionist measures, buyers should consider securing contracts with domestic suppliers like ArcelorMittal Resende and AVB Açailândia well in advance to mitigate potential price increases driven by import restrictions. Specifically, prioritize securing supply of rebar and wire rod.

- For Market Analysts: Closely monitor Simec Pindamonhangaba’s production levels in the coming months. The observed decrease in activity in May, combined with increased tariff protections for domestic mills, could indicate challenges in ramping up production to meet increased demand or could indicate other extraneous factors that may have been resolved. Track whether Simec Pindamonhangaba fully utilizes its EAF capacity and whether this decrease is simply a short term fluctuation or if it represents a more persistent downward trend that could affect availability.

- For Freight Analysts: The stability of freight rates reported in “Freight rates roughly stable in April for Brazilian finished steel imports” provides a short-term advantage. However, analysts should monitor these rates closely as the impact of the extended tariffs may alter import volumes and, consequently, freight costs in the coming months.