From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineBrazil Steel: Tariffs Extended Amid Rising Plant Activity; Procurement Strategies Advised

Brazil’s steel market exhibits a positive outlook due to extended tariffs aimed at bolstering the domestic industry. The decision to extend the 25% tariff on steel imports, as reported in “Brazil extends 25pc tariffs on imported steel” and “Brazil extends 25% tariff on steel imports,” is likely influencing plant activity. Satellite-observed data indicates a positive trend in plant activity, though no direct causal relationship can be definitively established solely from these sources. Despite relative stability in freight rates as highlighted in “Freight rates roughly stable in April for Brazilian finished steel imports,” the tariff extension is expected to impact steel prices.

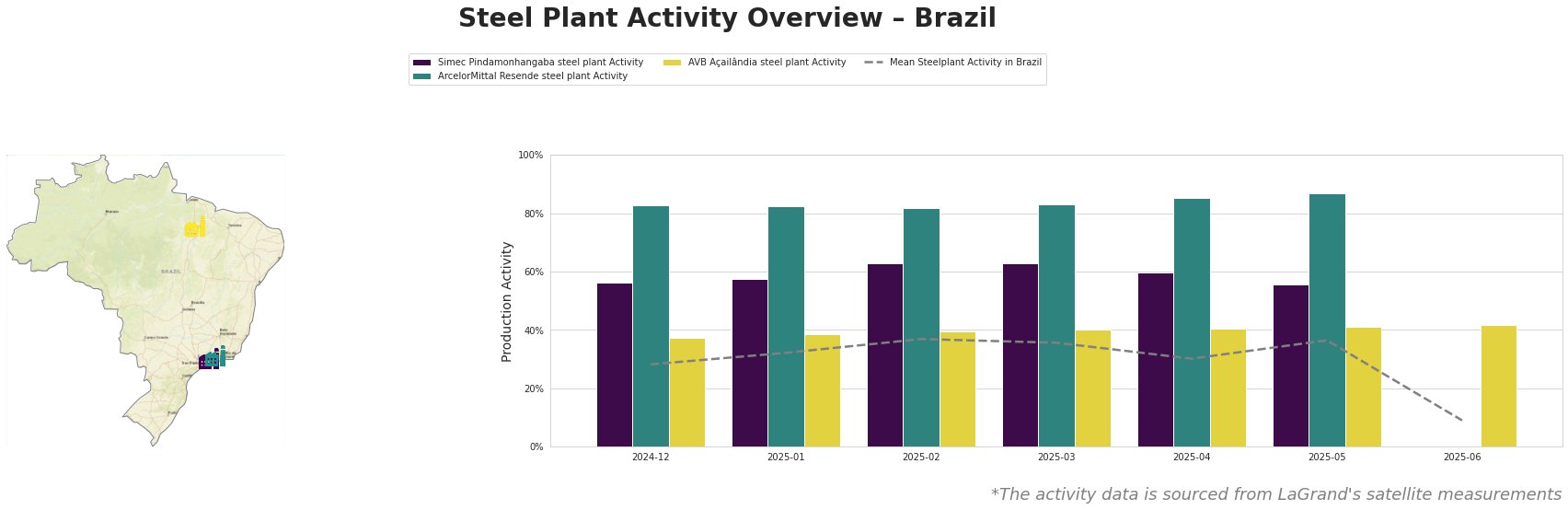

The mean steel plant activity in Brazil saw a generally increasing trend from December 2024 (28.0) to May 2025 (36.0), but decreased to 9.0 in June 2025. The ArcelorMittal Resende steel plant consistently demonstrated the highest activity levels, peaking at 87.0 in May 2025. Simec Pindamonhangaba steel plant activity remained consistently above the national mean, fluctuating between 56.0 and 63.0 until dropping to 56.0 in May. The AVB Açailândia steel plant consistently operated near or slightly above the national mean.

Simec Pindamonhangaba steel plant: Located in São Paulo, this plant has a crude steel capacity of 500 ttpa via EAF technology, producing finished rolled products like wire rod and rebar for the building and infrastructure sectors. While its activity was consistently above the national mean, there was a decrease from 63.0 in March 2025 to 56.0 in May 2025. This is potentially tied to the tariff changes, but not directly evident from the news articles or plant details.

ArcelorMittal Resende steel plant: Situated in Rio de Janeiro, this plant boasts a 1000 ttpa crude steel capacity using EAF technology. It produces rebar and wire rod for various sectors including building, energy, and transport. It consistently operated at the highest activity levels, reaching 87.0 in May 2025. This peak activity coincides with the period where the tariff extension was announced, potentially indicating increased production to capitalize on reduced import competition, as highlighted in “Brazil extends 25% tariff on steel imports“.

AVB Açailândia steel plant: Found in Maranhão, this integrated BF-BOF plant has a 600 ttpa crude steel capacity and 720 ttpa iron capacity. Its output includes semi-finished products like billets and finished products like rebar and wire rod, serving diverse sectors. Its activity has been steadily increasing, reaching 41.0 in May and 42.0 in June. While the tariff extension likely plays a role, no direct correlation can be firmly established based solely on the news articles and activity data.

Evaluated Market Implications:

The extension of tariffs, as reported in “Brazil extends 25pc tariffs on imported steel,” coupled with observed plant activity, suggests a potential for altered market dynamics.

- Potential Supply Disruptions: While overall plant activity shows a positive trend, the tariff extension may lead to reduced availability of specific imported steel products, particularly if domestic production cannot fully meet demand. This could be amplified if freight rates increase substantially, though “Freight rates roughly stable in April for Brazilian finished steel imports” indicates short-term stability. The drop of total steelplant activity to 9.0 in June requires additional observation.

- Recommended Procurement Actions: Steel buyers should proactively secure supply contracts with domestic producers, especially ArcelorMittal Resende and AVB Açailândia, to mitigate potential disruptions. Given the tariff on imported steel products, buyers should carefully evaluate the long-term contracts to make sure they don’t get locked into unfavorable conditions if the market conditions change. A focus on rebar and wire rod procurement is advised, aligning with the production focus of these plants. Furthermore, closely monitor freight rates and import volumes to anticipate potential price fluctuations as highlighted in the news articles.