From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineBrazil Steel Market Update: Optimism Amid Rising Activity Levels and Strategic Adjustments

Brazilian steel production is poised for robust growth, driven by increased activity at key facilities, despite some anticipated disruptions from external factors. Recent developments, including Viewpoint: Brazil likely to delay biodiesel blend hike and Viewpoint: Brazil freight rates rise on record soy crop, highlight strategic shifts that strengthen the outlook for steel suppliers.

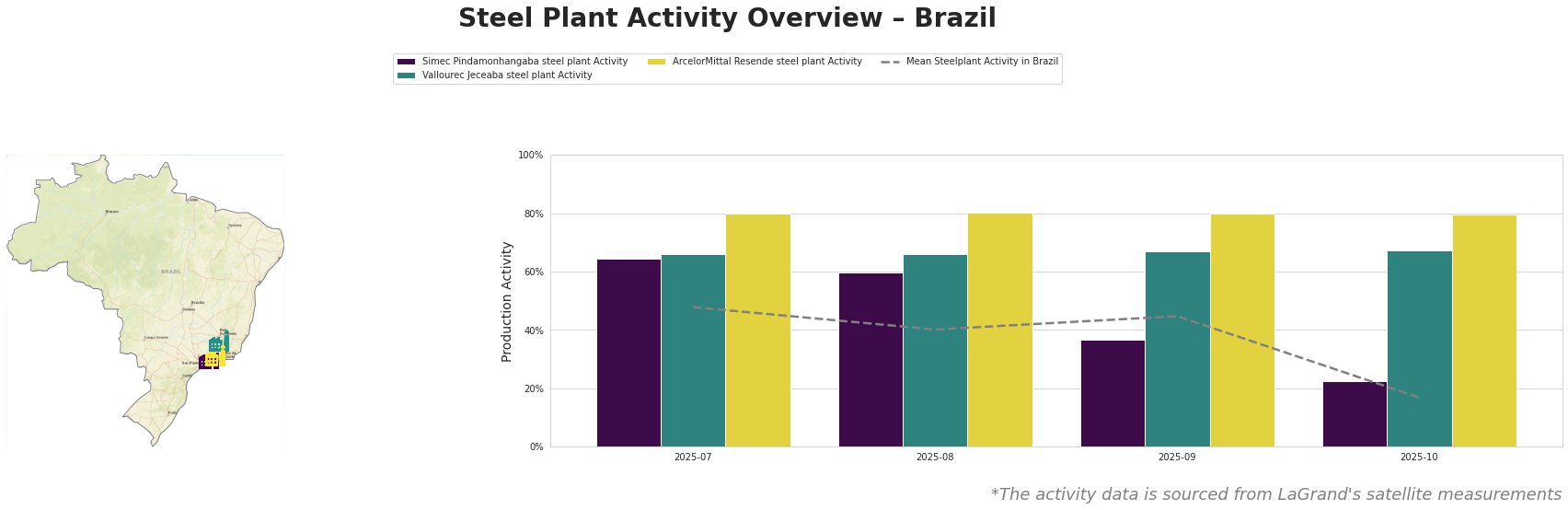

Steel plant activity data shows significant variability across the sector. The mean steel plant activity stands at 45.0% in September, dipping to 17.0% by October. The Simec Pindamonhangaba plant demonstrated notable fluctuations, dropping from 65.0% to 23.0%, while Vallourec Jeceaba maintained strong performance at 67.0%, and ArcelorMittal Resende sustained high levels at 80.0% throughout the observed months. This disparity suggests potential inconsistencies in production capabilities, warranting closer monitoring.

Simec Pindamonhangaba, focused on electric arc furnace methods, experienced a significant reduction in activity from 65.0% to 23.0% between July and October. While recent news does not directly correlate this decline with any cited events, the broader scrutiny of feedstock purchasing aligns with the biodiesel blend uncertainty, potentially affecting the steel market.

At Vallourec Jeceaba, the facility remained stable around 67.0%, indicating resilience amid market fluctuations. Its capacity to produce seamless steel pipes serves the energy sector, which may benefit from increased governmental infrastructure investments hinted at in the asphalt demand forecast.

ArcelorMittal Resende continued to operate effectively at 80.0%, contained by its strategic alliances and technology. The continuation of established capacity could mitigate supply concerns linked to freight cost surges as indicated in Viewpoint: Brazil freight rates rise on record soy crop, affecting the logistics of steel products.

Market analysts should remain vigilant regarding potential supply disruptions stemming from:

1. Fluctuating demand in the asphalt and biodiesel sectors, affecting production strategies.

2. Rising freight costs complicating procurement routes.

Given the activity insights and news developments, steel procurement professionals are advised to solidify contracts with reliable suppliers, particularly those with stable production levels like Vallourec Jeceaba and ArcelorMittal Resende. Ensuring diversification in steel sourcing may also mitigate impacts from regional disruptions and stabilize supply chains, particularly as external agricultural demands grow.