From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineBrazil Steel Market: Tariffs Extended Amid Stable Plant Activity

Brazil’s steel market is seeing continued tariff protection as highlighted by the news articles “Brazil may replace quotas on low-taxed steel imports with high import tariffs“, “Brazil extends 25pc tariffs on imported steel“, “Brazil renews and expands safeguard measures on steel imports“, and “Brazil extends 25% tariff on steel imports“. While these measures aim to protect domestic producers, satellite-observed activity at key steel plants indicates a relatively stable production output, showing no direct relationship.

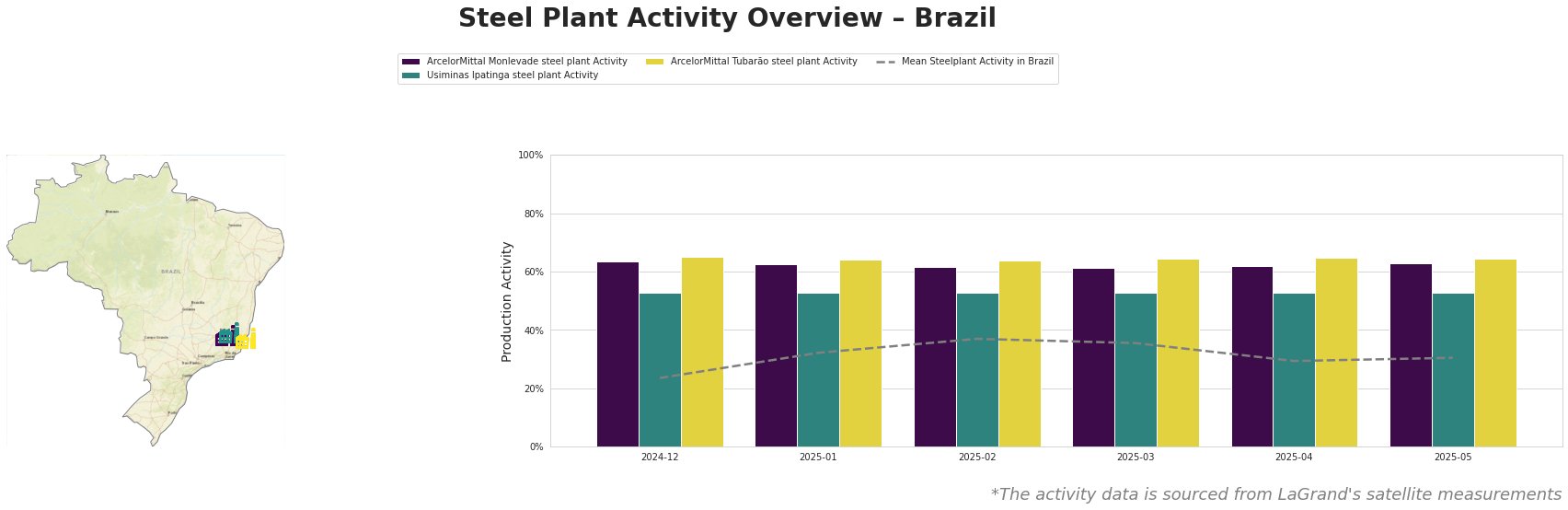

Recent monthly activity trends across selected Brazilian steel plants are summarized below:

The mean steel plant activity in Brazil fluctuated between 24% and 37% over the observed period. ArcelorMittal Monlevade consistently operated well above the mean, with activity levels ranging from 61% to 64%. Usiminas Ipatinga showed stable activity at 53% throughout the period. ArcelorMittal Tubarão maintained activity levels between 64% and 65%, also remaining above the national average. There is no clear link between these observed trends and the news articles on tariffs.

ArcelorMittal Monlevade, located in Minas Gerais, is an integrated BF steel plant with a crude steel capacity of 1.2 mtpa, specializing in finished rolled products for the automotive sector, specifically wire rod and steel cord. Activity at ArcelorMittal Monlevade remained consistently high, above 60%, with minor fluctuations, suggesting robust production levels. No direct connection to the cited news articles regarding tariff changes can be established.

Usiminas Ipatinga, also in Minas Gerais, is an integrated BF steel plant boasting a 5 mtpa crude steel capacity, producing semi-finished and finished rolled products, including slabs, plates, and sheets, catering to diverse sectors like automotive and construction. Activity at Usiminas Ipatinga remained stable at 53%. This stable activity doesn’t directly reflect immediate impacts from the tariff extensions discussed in the news articles.

ArcelorMittal Tubarão, situated in Espírito Santo, is another major integrated BF steel plant with a 7.5 mtpa crude steel capacity. It focuses on semi-finished and finished rolled products such as slabs and hot-rolled coils, serving sectors including automotive and infrastructure. Activity at ArcelorMittal Tubarão has remained consistent around 64-65%. As with the other plants, no explicit link between the extended tariffs and production activity can be established from the provided data.

The extension of tariffs, as detailed in “Brazil extends 25pc tariffs on imported steel“, “Brazil renews and expands safeguard measures on steel imports“, and “Brazil extends 25% tariff on steel imports“, aims to protect domestic steel producers. Given the stable production at plants like Usiminas Ipatinga, steel buyers should anticipate potentially increasing domestic steel prices.

Procurement Actions:

* Monitor Domestic Pricing Trends: Closely track price movements of hot-rolled and cold-rolled sheets and coils, especially from Usiminas Ipatinga and ArcelorMittal Tubarão, given the tariff extensions and their impact on domestic supply costs.

* Evaluate Inventory Levels: Given the continued tariff protection, steel buyers should evaluate their inventory levels and consider strategic stock adjustments to mitigate potential price increases.

* Assess Alternative Sourcing Options: While tariffs limit import options, explore alternative sourcing strategies within permitted trade agreements to manage costs.