From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineBrazil Steel Market Strengthens Amid EU Climate Policy Shifts and Stable Production

Brazil’s steel market shows signs of stability, coinciding with evolving EU climate policies. The upcoming UN climate conference in Belém, Brazil, is a key focus. While “EU-Staaten beschließen Klimaziel für 2040” and “EU-Staaten verschieben Start des Emissionshandels um ein Jahr” highlight the broader context of climate policy impacting global steel markets, no direct correlation to specific observed steel plant activity changes in Brazil can be established based on the provided information. However, the anticipation of the EU’s 2040 GHG target, as suggested by “EU to formalise 2040 GHG target soon: Green MEP“, could indirectly influence long-term investment strategies and production decisions in Brazil’s steel sector.

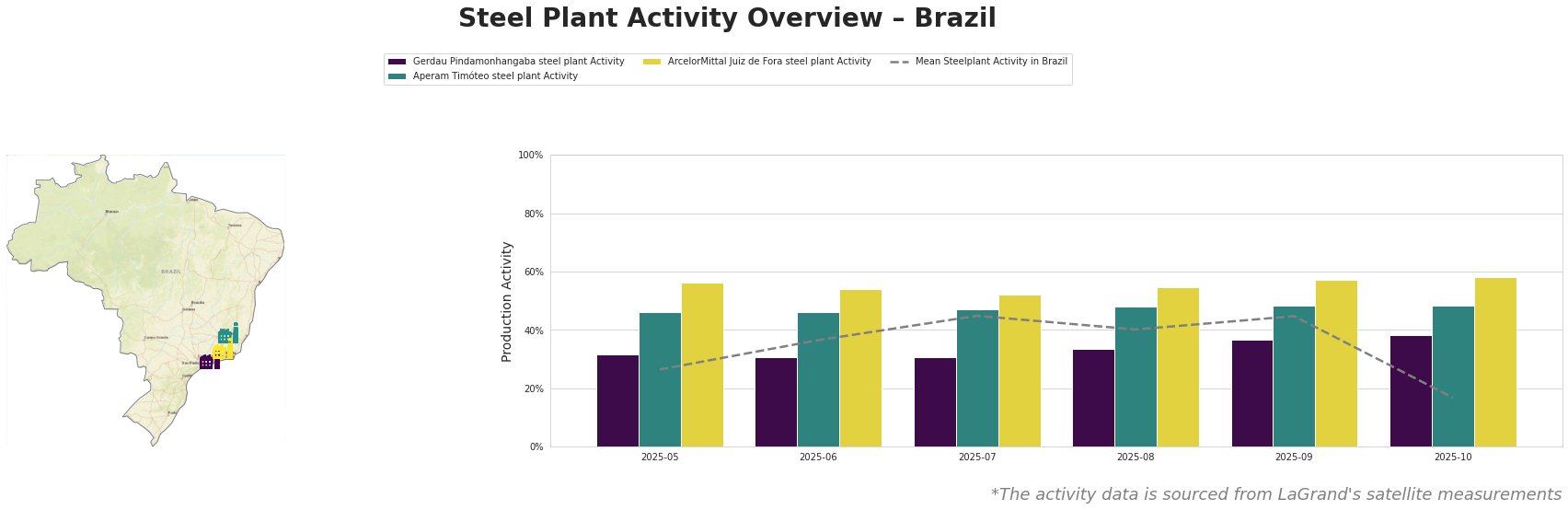

Across all observed plants, the mean activity in Brazil fluctuated between 26% and 45% from May to September 2025, before dropping significantly to 17% in October.

Gerdau Pindamonhangaba steel plant: This plant in São Paulo, with a 620 ttpa EAF-based crude steel capacity, produces finished rolled products, including bars and wire rods, primarily for the building, infrastructure, and energy sectors. The plant’s activity saw a notable increase to 38% in October, contrasting the mean decreasing trend across the country. No direct connection between this upward trend and the named news articles can be established.

Aperam Timóteo steel plant: Located in Minas Gerais, Aperam Timóteo is an integrated steel plant with both BF and EAF operations, boasting a crude steel capacity of 900 ttpa. Its product portfolio includes stainless steel and electrical steel for the automotive, energy, and transport industries. Activity at this plant remained consistently high, fluctuating narrowly between 46% and 48% from May to October, consistently above the Brazilian mean. There is no indication that the EU climate policy discussions outlined in the news articles have directly affected Aperam Timóteo’s production levels.

ArcelorMittal Juiz de Fora steel plant: Also situated in Minas Gerais, ArcelorMittal Juiz de Fora has a crude steel capacity of 1100 ttpa, utilizing both BF and EAF processes. The plant focuses on rebar and wire rod for the building and infrastructure sectors. This plant showed the highest activity level, constantly above the average and reaching 58% in October. While no direct link can be established, the stability in activity at ArcelorMittal Juiz de Fora and Aperam Timóteo, combined with the overall positive sentiment in the steel market, suggests sustained demand for their respective products.

The significant drop in the mean activity level in October, while some individual plant activities increased, might be a starting trend to consider with caution, without any immediately obvious connection to the named news articles.

Evaluated Market Implications:

Given the stability in activity at Aperam Timóteo and ArcelorMittal Juiz de Fora, steel buyers reliant on these plants should anticipate continued supply. However, the considerable dip in overall activity in Brazil during October warrants a review of alternative suppliers and careful monitoring of inventory levels.