From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineBrazil Steel Market Reels as Trump Tariffs Threaten Supply, Trigger Retaliation Fears

The Brazilian steel market faces significant disruption due to newly imposed tariffs by the U.S., as evidenced by recent plant activity declines. The impact of these tariffs, detailed in news articles like “Trump imposes 50% tariff on imports from Brazil” and “Trump threatens 50pc Brazil tariff,” directly correlates with a sharp drop in observed steel plant activity in July. These tariffs, driven by political motives according to “Donald Trumps Zölle gegen Brasilien: Eine Lehre für Europa,” are prompting Brazil to consider retaliatory measures, as reported in “Brazil eyes retaliatory tariffs on US,” potentially escalating trade tensions further.

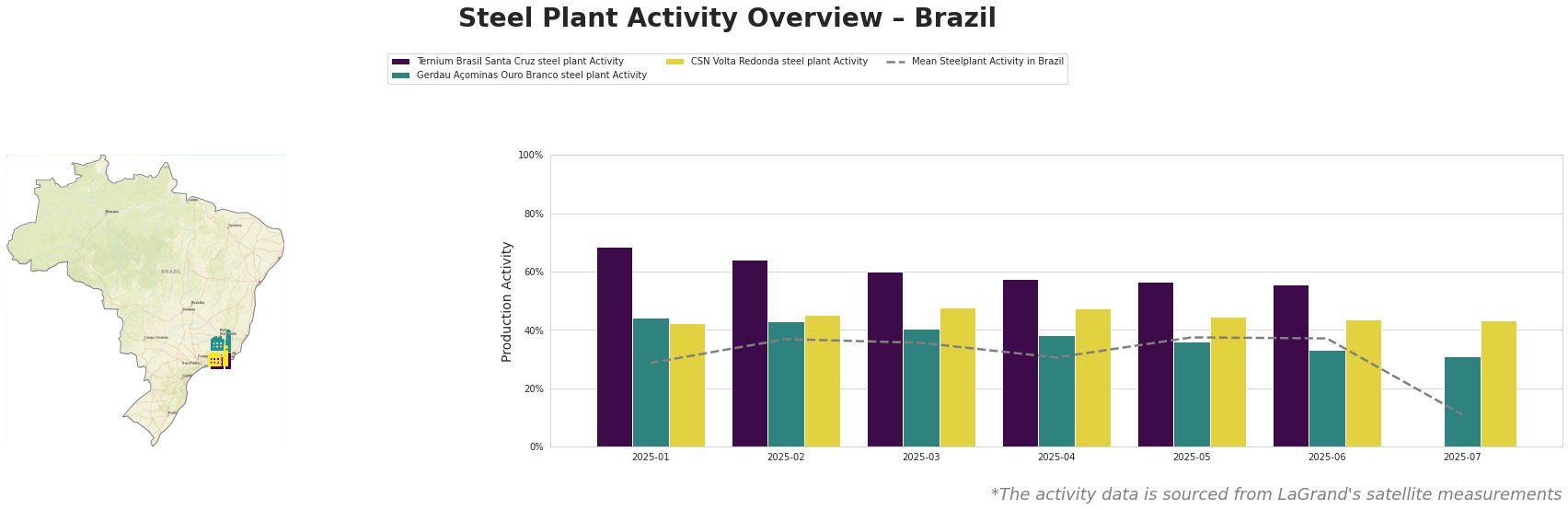

Overall, the mean steel plant activity in Brazil has fallen sharply in July, decreasing to just 11% compared to a stable level of 31-37% during the first half of the year.

Ternium Brasil’s Santa Cruz steel plant, an integrated BF-BOF facility producing 5.2 million tonnes of crude steel and 5.3 million tonnes of iron annually, primarily focuses on slabs for the automotive, construction, and energy sectors. The plant’s activity steadily decreased from 69% in January to 56% in June. Satellite data indicates that activity for the plant is unrecorded for July. This aligns with the “Trump imposes 50% tariff on imports from Brazil” article, which highlights the potential impact of tariffs on slabs, a key product of this plant.

Gerdau Açominas’ Ouro Branco steel plant, another integrated BF-BOF facility with a 4.5 million tonne crude steel capacity and 4.429 million tonne iron capacity, produces a range of semi-finished and finished rolled products. The plant sources iron ore from Gerdau’s Varzea do Lopes mine. While its activity showed relative stability between January and June, ranging from 44% to 33%, it fell to 31% in July. This decrease, taking place after the tariffs imposition, may be a sign of reduced overall activity for the company, however, this cannot be established beyond speculation.

CSN’s Volta Redonda steel plant, with a capacity of 6.25 million tonnes of crude steel and 5.658 million tonnes of iron, utilizes both BF-BOF and EAF technologies. It produces a diverse range of flat and long steel products. While its activity was stable between January and June (42-48%), the activity level only decreased slightly to 43% in July, showing more resilience compared to other plants. It is difficult to determine any possible cause and effect relationship with the news articles provided.

The newly imposed tariffs threaten supply chains and potentially impact pig iron prices, as per “Trump imposes 50% tariff on imports from Brazil“. Based on the observed decline in activity at Ternium Brasil’s Santa Cruz plant, coupled with the plant’s specialization in slab production, steel buyers who rely on Brazilian slabs should immediately diversify their supply sources and negotiate forward contracts with alternative suppliers outside of Brazil to mitigate potential disruptions. Given Brazil’s consideration of retaliatory tariffs as per “Brazil eyes retaliatory tariffs on US,” buyers should also assess the potential impact on other steel products and raw materials sourced from the US. Analysts should closely monitor trade policy developments and their impact on global steel prices.