From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineBrazil Steel Market Downturn: COP30 Turmoil and Production Slowdown Signals Supply Risks

Brazil’s steel market faces headwinds amidst climate summit disruptions and production declines. The COP30 climate summit, addressed in “COP 30 in Brasilien: Indigene Aktivisten stürmen Gelände der Klimakonferenz – Verletzte bei Zusammenstößen” and “Cop: Cop 30 braces for first test on divisive issues“, introduces uncertainty. While no direct link can be established between these summit-related events and steel plant activity, the overall negative sentiment, coupled with observed production decreases, warrants careful monitoring.

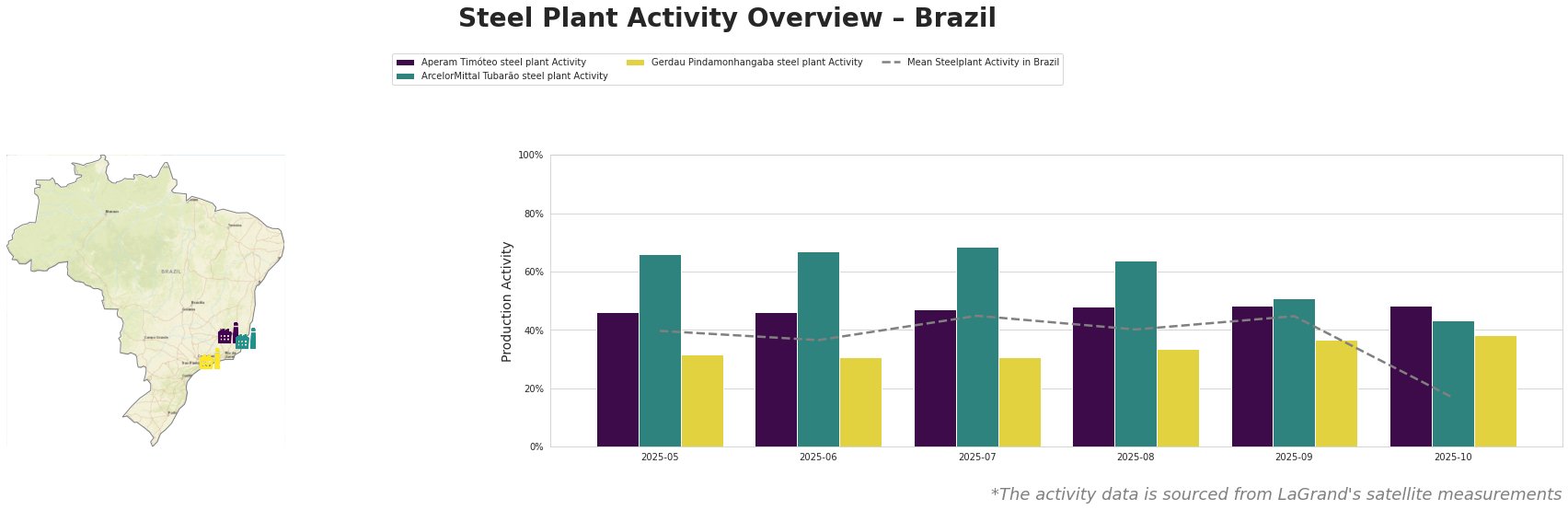

Monthly steel plant activity in Brazil is detailed below:

The mean steel plant activity in Brazil experienced a significant drop in October, falling to 17.0% from 45.0% in September. While Aperam Timóteo remained relatively stable, ArcelorMittal Tubarão and Gerdau Pindamonhangaba showed declines, contributing to the overall negative trend.

Aperam Timóteo, located in Minas Gerais, operates with both BOF and EAF technologies, producing 900 ttpa of crude steel, including stainless and electrical steels. The plant’s activity remained consistently around 46-48% throughout the monitored period, showing relative stability despite the broader market downturn. No direct connection to the COP30 news can be established.

ArcelorMittal Tubarão, situated in Espírito Santo, is a major integrated steel plant with a 7500 ttpa crude steel capacity, primarily using BOF technology. Activity decreased significantly from 51.0% in September to 43.0% in October, contributing to the overall drop in mean activity. While the plant holds ResponsibleSteel Certification, no direct relationship between this activity decline and the ongoing COP30-related discussions or commitments highlighted in “Cop 30 braces for first test on divisive issues” and “COP 30 in Brasilien: Läutet Belém das Ende des fossilen Zeitalters ein?” can be explicitly established.

Gerdau Pindamonhangaba in São Paulo, relies on EAF technology for its 620 ttpa crude steel production, focusing on bars and wires. The plant’s activity increased slightly from 37.0% to 38.0% between September and October, showing limited resilience against the market downturn. The increase is marginal compared to the overall trend. No direct link to the COP30 news can be established.

The significant drop in overall steel plant activity, especially at ArcelorMittal Tubarão, combined with the uncertainties surrounding the COP30 summit (as reflected in “Gipfel von Belém: Die Spielarten des Klima-Leugnens“), indicates a potential for supply chain disruptions.

Evaluated Market Implications & Recommendations:

Given the observed activity downturn and the potential for further disruption linked to climate policy discussions and protests (“COP 30 in Brasilien: Indigene Aktivisten stürmen Gelände der Klimakonferenz – Verletzte bei Zusammenstößen“), steel buyers should:

- Prioritize securing existing supply lines: Focus on maintaining communication and confirming delivery schedules with current suppliers, particularly those reliant on ArcelorMittal Tubarão, given its notable activity decline.

- Explore diversification: Evaluate alternative steel sources and suppliers outside of the directly affected regions to mitigate risks associated with potential production slowdowns or disruptions.

- Monitor COP30 outcomes: Closely track the developments and policy decisions emerging from COP30, as detailed in “Cop: Cop 30 braces for first test on divisive issues” and “COP 30 in Brasilien: Läutet Belém das Ende des fossilen Zeitalters ein?“, and assess their potential long-term impact on steel production costs and environmental regulations in Brazil. The potential focus on phasing out the use of fossil fuels, as discussed in “COP 30 in Brasilien: Läutet Belém das Ende des fossilen Zeitalters ein?“, could significantly affect integrated steel producers.

- Evaluate price risks: Conduct a price sensitivity analysis on planned steel orders. The possibility of import tariffs, potentially as a result of the climate debate, could cause local price increases.