From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineBrazil Steel Market: COP30 Climate Talks and Recent Steel Plant Activity Dip

Brazil’s steel market faces uncertainty as climate discussions at COP30 potentially influence future policies, compounded by a significant drop in overall steel plant activity in October 2025. A new UN report, as referenced in “Experte: Die wenigsten Länder haben vor der COP ihre Klimaziele festgelegt,” indicates that countries have missed climate target submissions, raising concerns that could affect the steel industry. This is potentially linked to the satellite-observed decline in mean steel plant activity in Brazil in October. While Mideast Gulf nations, as outlined in “Mideast Gulf bloc to push energy security at Cop 30,” advocate for a “dual-track” approach balancing renewables with oil and gas, the ultimate impact on Brazil’s steel sector remains unclear.

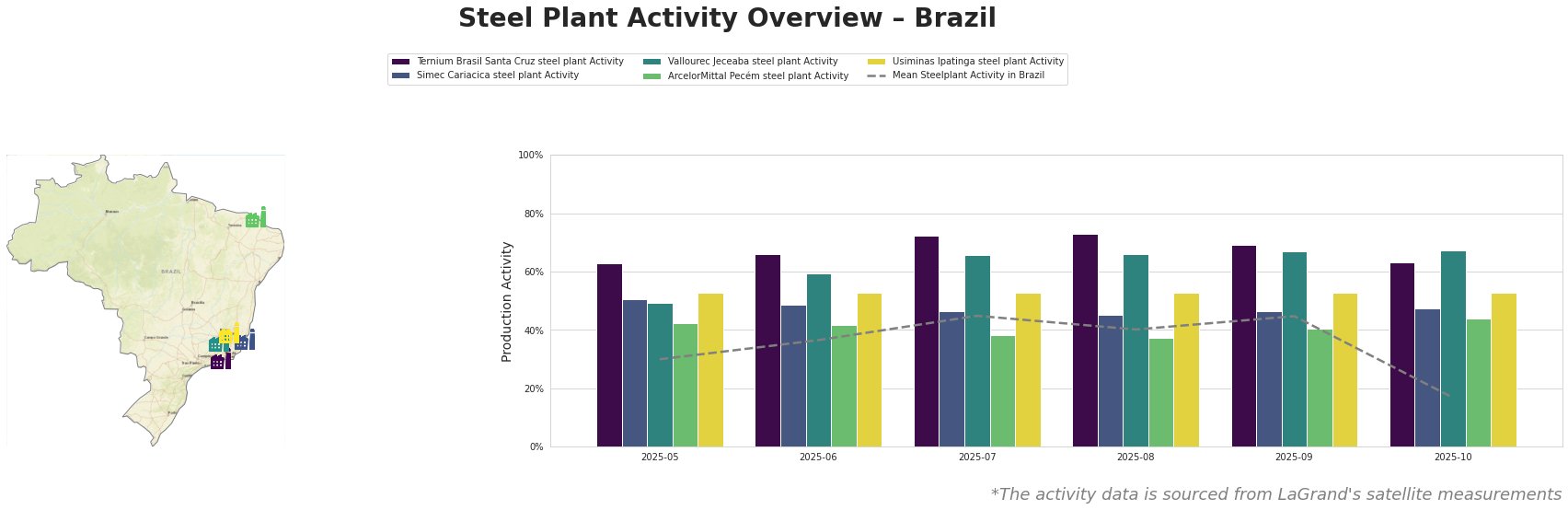

The mean steel plant activity in Brazil showed a notable decrease in October, dropping to 17.0% from 45.0% in September. Ternium Brasil Santa Cruz, Simec Cariacica, Vallourec Jeceaba, ArcelorMittal Pecém and Usiminas Ipatinga steel plants show the same trend, but to a less significant degree. Ternium Brasil Santa Cruz steel plant, producing semi-finished slabs using integrated BF/BOF processes, consistently shows activity levels significantly above the Brazilian average, remaining at 63.0% in October, despite the general trend. Simec Cariacica, an electric arc furnace (EAF) steel plant focused on finished rolled products like rebar, exhibited relatively stable activity levels, showing a mild decrease to 48.0% in October, compared to 51.0% in May. Vallourec Jeceaba steel plant, with integrated BF/EAF processes producing seamless steel pipes, maintained high activity levels, reaching 67.0% in October, which is considerably above the national average. ArcelorMittal Pecém, using integrated BF/BOF processes to produce slabs, plates, and rolled steel, saw a moderate fluctuation but generally underperformed compared to the national average, with activity increasing to 44.0% in October. Usiminas Ipatinga steel plant, another major integrated producer of semi-finished and finished rolled products, demonstrated stable activity at 53.0% throughout the observed period, consistently exceeding the national average. No direct connection between the news articles and specific plant activity levels can be established, except for the general impact that uncertainty surrounding climate goals may have on overall steel production.

Given the overall uncertainty surrounding climate policies and a marked decrease in steel plant activity, coupled with individual plant performance variations, steel buyers should consider the following procurement actions:

- Prioritize Vallourec Jeceaba for seamless steel pipe needs: The Vallourec Jeceaba steel plant maintained high activity levels throughout the period, suggesting it can reliably supply seamless steel pipes, particularly crucial for the energy sector, aligning with the focus on energy security discussed in “Mideast Gulf bloc to push energy security at Cop 30“.

- Monitor ArcelorMittal Pecém for potential disruptions: Though its activity increased in October, ArcelorMittal Pecém’s lower-than-average activity and its reliance on integrated BF/BOF processes make it potentially vulnerable to future carbon regulations. Therefore, actively seek alternative suppliers for plates and rolled steel, and carefully assess their quotations and delivery timelines.