From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineBrazil Steel Market: Biofuel Policy Shift & Amazon Concerns Amidst Stable Steel Production

Brazil’s steel market exhibits a positive sentiment despite challenges in the energy sector and environmental concerns. Activity data indicates relatively stable production, although specific policy shifts regarding biofuels and Amazon rainforest preservation could indirectly impact future demand and operational costs for steel producers. While specific connections to plant activity levels are not immediately apparent, the news articles “Brazil court halts Renovabio sanctions” and “Some Brazil transition projects pose Amazon risk: Study” signal potential medium-term shifts in energy policy and environmental regulation that warrant monitoring.

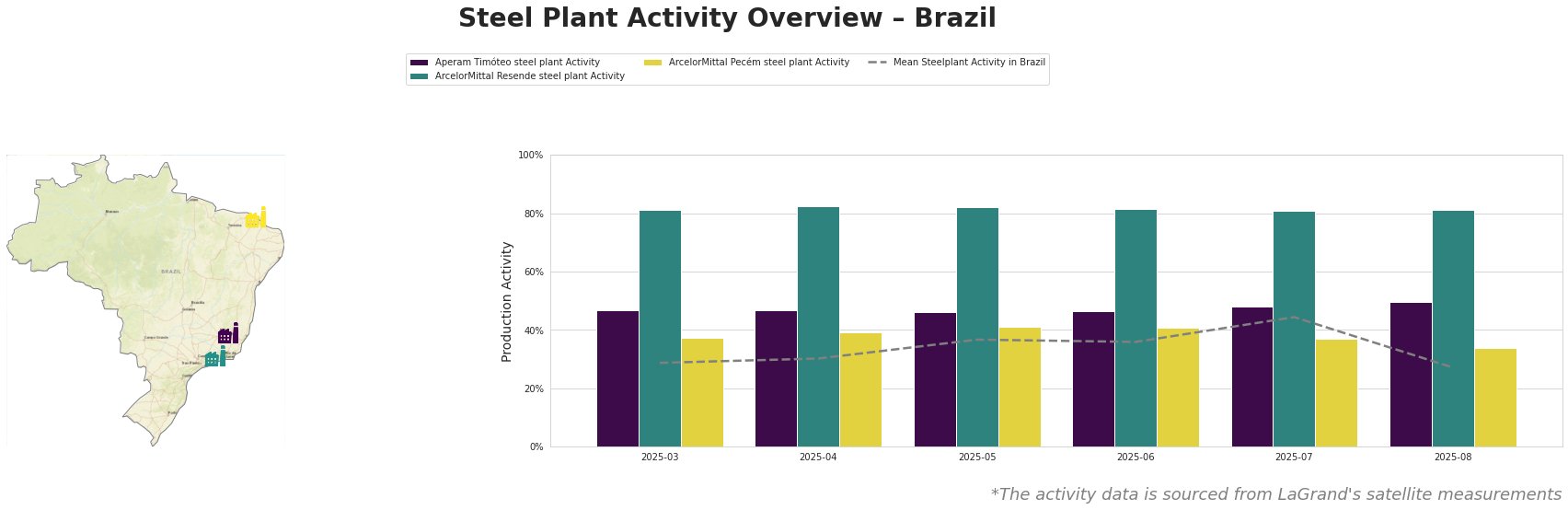

Recent steel plant activity is presented below:

The average steel plant activity across Brazil saw a noticeable peak in July at 44%, followed by a sharp decline to 27% in August.

Aperam Timóteo steel plant, located in Minas Gerais, shows relatively stable activity, ranging from 46% to 50% with a peak in August. This integrated BF/BOF/EAF plant produces finished rolled products including stainless and electrical steels. Its activity levels are consistently above the national average, particularly in August when the average steel plant activity faced a sharp decline, suggesting sustained demand for its specialized steel products, potentially linked to the automotive and energy sectors. No direct relationship can be established between its activity and the named news articles.

ArcelorMittal Resende steel plant in Rio de Janeiro, an EAF-based producer of rebar and wire rod for building and infrastructure, has maintained high activity levels, consistently around 81-82%. This is significantly above the national average and suggests strong demand in its specific market segment. No direct connection can be established between its stable activity and the named news articles.

ArcelorMittal Pecém steel plant in Ceará, an integrated BF/BOF plant producing slabs and plates, experienced some activity fluctuation, ranging from 34% to 41%, with a small dip in July and August. While it showed consistent behavior until June, its activity remains below the national average for most of the period. The news article “Some Brazil transition projects pose Amazon risk: Study” highlights concerns about the environmental impact of energy transition projects, which could indirectly affect infrastructure development and, consequently, demand for ArcelorMittal Pecém’s products. No direct causal relationship can be established between the identified articles and the observed steel plant activity.

Evaluated Market Implications:

The federal court’s decision to halt sanctions related to the Renovabio program, as reported in “Brazil court halts Renovabio sanctions,” introduces uncertainty in the biofuel market. The Aperam Timóteo steel plant uses charcoal (biomass) from cultivated eucalyptus forests as a substitute for coke, and the Renovabio program encourages biofuel use. Therefore, steel buyers should monitor the future developments in the Renovabio program, as potential shifts can affect the cost structure of Aperam Timóteo and prices for specialized steel products. The environmental concerns raised in “Some Brazil transition projects pose Amazon risk: Study” could lead to stricter regulations, particularly for infrastructure projects in the Amazon region. Since ArcelorMittal Pecém’s activity is below average, steel buyers should carefully review their procurement strategies for slabs and plates, considering potential project delays or cancellations in the Amazon region due to increased environmental scrutiny, which may further decrease the steel plant’s activity and influence its supply dynamics.