From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAustria’s Steel Market Shows Positive Growth Amid Regulatory Changes and Increased Activity

Recent monitoring of Austria’s steel market indicates a positive sentiment, largely driven by increased activity levels across major steel plants. Notably, recent articles, such as “Australia should have CBAM on some commodities: Review“ and “Australia should consider introducing CBAM for certain goods – overview“, highlight an ongoing regulatory review that suggests a potential carbon border adjustment mechanism (CBAM) for steel. These proposed measures aim to mitigate carbon leakage risks, impacting market dynamics and operational strategies within the industry.

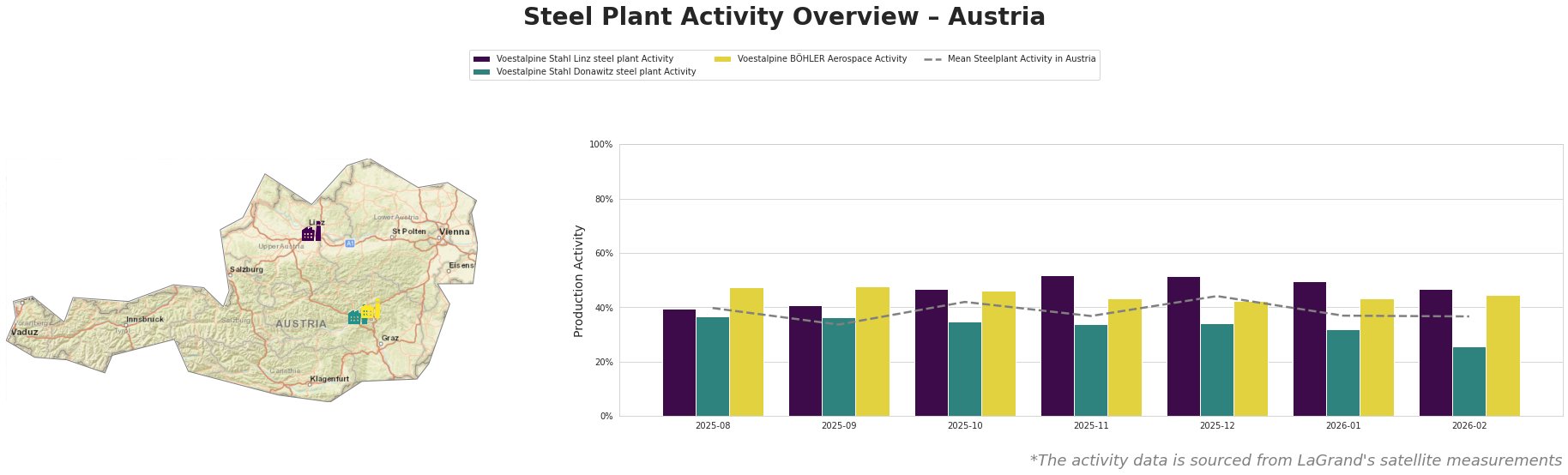

Activity at Voestalpine Stahl Linz exhibited a notable rise, peaking at 52% activity in November and December 2025, aligning with regulatory discussions highlighted in the news articles regarding emissions management. Voestalpine Stahl Donawitz faced a decline to 26% in February 2026, a drop that does not directly relate to any current news developments, making it a point of concern for stakeholders. Conversely, Voestalpine BÖHLER Aerospace maintained a relatively stable output, with activity staying between 42% and 48% throughout the observed period, reflecting resilience in their production.

The overall mean steel plant activity in Austria fluctuated, with a low of 34% in September 2025 and a high of 44% in December 2025, yet it remains positive, indicating a recovery trend.

Buyers should take note of the fluctuations related to the regulatory actions proposed for the steel sector. Given the potential for increased import scrutiny and market adjustments stemming from the CBAM recommendations, procurement strategies may require reassessment—especially for high-volume steel products facing these new regulations. Thus, engaging with suppliers on their emissions strategies and production capabilities will be vital for securing stable sourcing routes and prices amid expected industry shifts.