From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAustria’s Steel Market Faces Downturn Amid Active Weather Disruptions

Recent developments in the steel market in Austria indicate a negative sentiment, primarily stemming from operational challenges at steel plants linked to weather conditions. Notably, the Australia’s Pilbara shuts LNG, iron ore ports on storm article highlights disruptions that could indirectly affect iron ore supply chains, while the reopening of Port Hedland mentioned in Australia’s Pilbara Ports reopens Port Hedland suggests a cautious return to normalcy, however, does not compensate for lost activity in the region crucial for European steel.

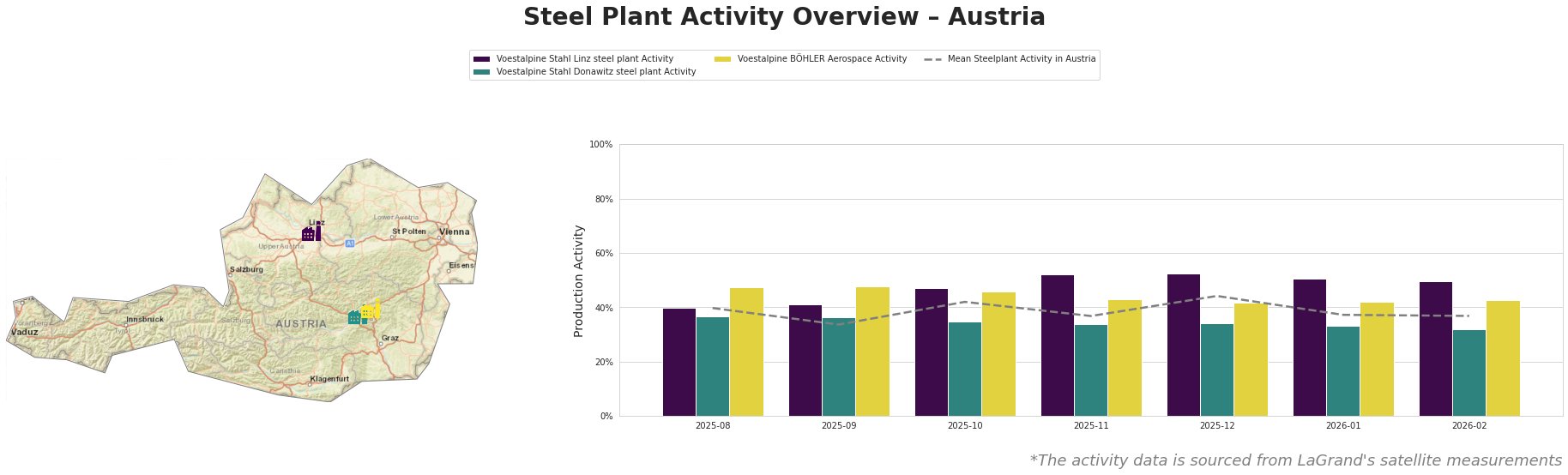

The satellite-observed activity data indicates that Austria’s steel plants faced significant drops. Specifically, Voestalpine Stahl Linz’s activity decreased from 52% in November 2025 to 50% in January and February 2026, reflecting a downward trend aligning with the overall mean activity reduction from 44% in December 2025 to 37% in February 2026. Voestalpine Stahl Donawitz also experienced a decline, dropping to 32% in February from 34% in December, while Voestalpine BÖHLER Aerospace remained relatively stable at around 43%.

Voestalpine Stahl Linz, with a BOF capacity of 6,000 tpa, has seen consistent demand for finished and semi-finished products; however, the activity drop of 2% from January reflects a wider industry strain amid tightening supply lines possibly influenced by disruptions in iron ore logistics as detailed in the aforementioned news articles. Voestalpine Stahl Donawitz, focusing on similar product categories, also recorded a drop of 1% in February, indicating a potential ripple effect from the supply chain challenges made evident by the storm’s impact on Australian exports.

A critical supply concern emerges at Voestalpine BÖHLER Aerospace, which operates without a dedicated crude steel capacity. Its activity levels remained stable at 43%, suggesting resilience against the wider market downturn but warning of potential vulnerabilities in the context of fluctuating raw material supply linked to global disruptions.

Given the data, procurement professionals should prepare for potential supply disruptions, particularly from the Pilbara region and its connection to European steel inputs. Steel buyers are advised to closely monitor developments around Australian exports as they could lead to increased pressure on local supply chains. It may be prudent to diversify sourcing strategies and consider securing contracts ahead of possible shortages stemming from unforeseen weather events impacting both import logistics and domestic operations.