From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAustrian Steel Production Rises Amidst Ukrainian Export Shifts; Monitor SEE Output Decline

Europe’s steel market presents a mixed landscape. While “Austria increased crude steel production in July,” Ukrainian steel exports are undergoing significant shifts, impacting the availability of semi-finished and flat rolled products, as seen in “Ukrainian steel companies reduced exports of semi-finished products by 36% y/y in January-July” and “Ukraine exported 971,700 tons of flat rolled products in January-July“. Simultaneously, “Southeast Europe’s July steel output falls on-year“, potentially tightening regional supply. While a clear direct relationship between the shifts in Ukrainian exports and Austrian increase cannot be explicitly established from these news articles, the timing suggests a potential interplay.

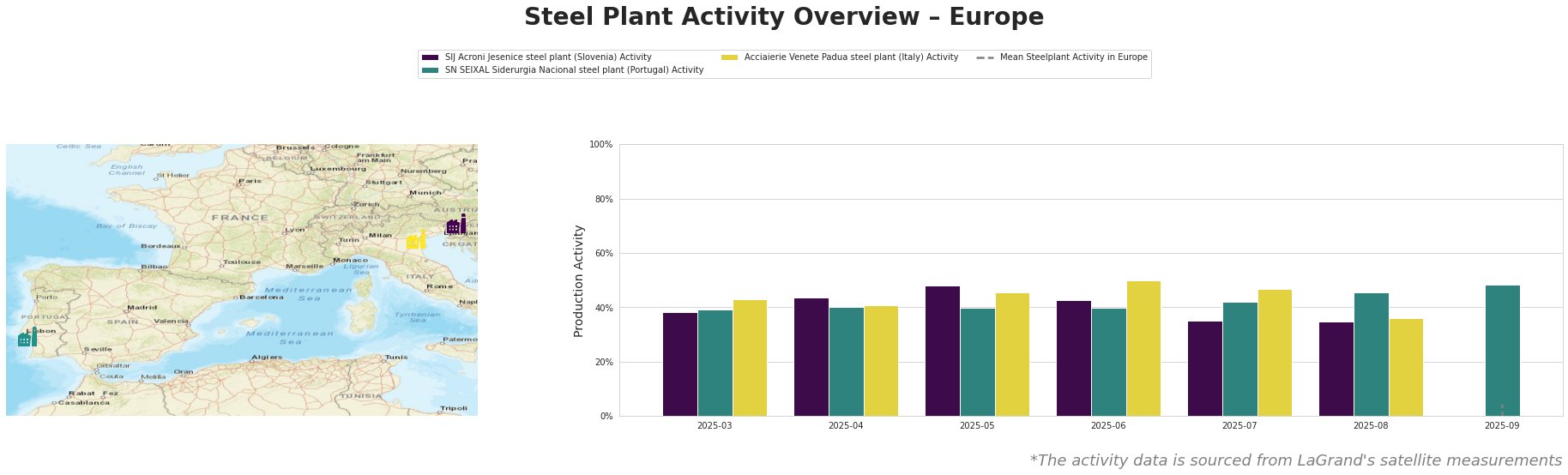

Measured Activity Overview

Across the observed plants, activity levels have fluctuated. SIJ Acroni Jesenice plant experienced a decline from a peak of 48% in May to 35% in both July and August. SN SEIXAL Siderurgia Nacional plant showed relative stability, with a recent uptick to 48% in September. Acciaierie Venete Padua plant experienced a notable drop to 36% in August after reaching 50% in June. Due to the negative values for the mean steel plant activity in Europe for each month except September, no real comparison of the individual plants to the mean activity levels can be made.

SIJ Acroni Jesenice, a Slovenian steel plant with a 726,000-tonne EAF-based crude steel capacity, focuses on flat rolled products. The observed decline in activity from May (48%) to July and August (35%) is significant. Given the plant’s specialization in flat rolled products and the news of decreased Ukrainian exports of “Ukraine exported 971,700 tons of flat rolled products in January-July“, this could potentially reflect a shift in market dynamics, although no direct causal relationship can be established based on the provided information alone.

SN SEIXAL Siderurgia Nacional, a Portuguese steel plant with a capacity of 1.1 million tonnes of crude steel via EAF, produces mesh, wire, hot-rolled coils, and bars. Activity levels have been relatively stable, increasing to 46% in August and 48% in September. Since the plant produces different products than those affected by the drop in Ukrainian Exports (“Ukrainian steel companies reduced exports of semi-finished products by 36% y/y in January-July” and “Ukraine exported 971,700 tons of flat rolled products in January-July“), there is no expectation that satellite observed activity data would be directly affected by the Ukrainian Export changes.

Acciaierie Venete Padua, an Italian steel plant with a 600,000-tonne EAF-based capacity, manufactures bars, round bars, wire rod, and hot re-rolled billets. Its activity reached a peak of 50% in June, dropping to 36% in August. Because this plant produces very different materials than SIJ Acroni Jesenice, no real conclusions can be drawn.

Evaluated Market Implications

The Austrian steel production increase, reported in “Austria increased crude steel production in July“, may offset some of the supply pressure from reduced Ukrainian exports (“Ukrainian steel companies reduced exports of semi-finished products by 36% y/y in January-July” and “Ukraine exported 971,700 tons of flat rolled products in January-July“). The news article “Poland reduced steel production by 14.7% m/m in July” could indicate a production decline that has broad market implications.

Recommended procurement actions:

* Steel buyers sourcing flat rolled products should closely monitor Austrian steel production and consider diversifying suppliers. This could mitigate risks associated with decreased Ukrainian exports, particularly given the Austrian production increase reported in “Austria increased crude steel production in July“.

* Steel buyers sourcing from Southeastern Europe need to carefully assess potential disruptions that might be caused by the regional production decline reported in “Southeast Europe’s July steel output falls on-year“. Consider increasing safety stock levels and exploring alternative suppliers to mitigate the risks.

* Monitor Polish production levels closely. If the drop reported in “Poland reduced steel production by 14.7% m/m in July” continues to fall, this can effect prices broadly.