From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAustrian Steel Market Strong Despite Australian Coal Sector Challenges: Monitor Voestalpine Aerospace Activity

Austria’s steel market exhibits a very positive outlook despite challenges in the Australian coal sector, a key raw material source. While the provided news does not specifically mention Austria, developments in Australia directly influence the global steel supply chain and raw material costs. The news “Australia’s QCoal to keep producing after mine closure” signals potential instability in coking coal supplies, relevant to integrated steel plants in Austria. There is no direct relationship between this news article and the satellite observed changes in the Voestalpine plants’ activity levels. “Australia’s Qld coal exploration falls for fifth time” further reinforces the concern regarding long-term coking coal availability, with implications for steel production costs. No direct relationship can be established between this article and Voestalpine activity levels.

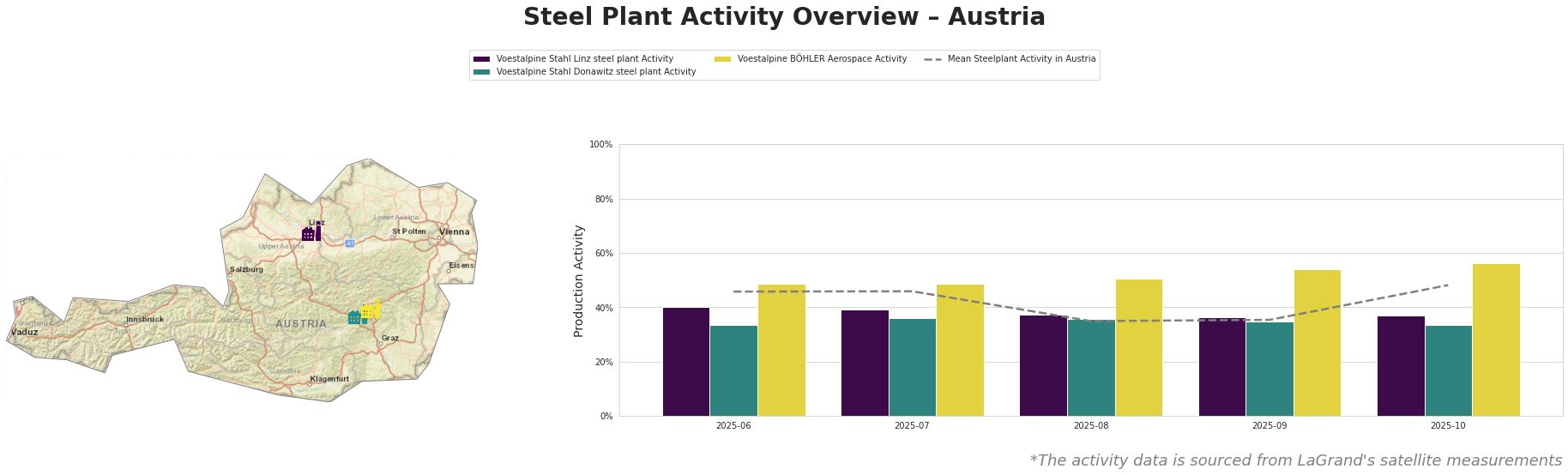

Overall, activity levels were varied over the observed time. The mean steel plant activity in Austria shows fluctuation, dropping to 35% in August and September before rising to 48% in October. Voestalpine Stahl Linz remained relatively stable, while Voestalpine BÖHLER Aerospace shows a more consistent upward trend.

Voestalpine Stahl Linz, located in Upper Austria, is an integrated steel plant with a capacity of 6 million tonnes of crude steel produced via the BOF process. Its main products are hot-rolled, cold-rolled, and coated steel strips. Activity at the Linz plant remained relatively stable at around 36-40% during the observed period, with a slight dip from 40% in June to 37% in October. No direct link can be established between this activity and the Australian news articles.

Voestalpine Stahl Donawitz, situated in Styria, is another integrated steel plant using BF/BOF technology, with a capacity of 1.57 million tonnes of crude steel. Its product portfolio mirrors Linz, including hot-rolled and coated steel strips. Activity at Donawitz fluctuated slightly, from a high of 36% in July to a low of 33% in June, before rising to 34% in October. No direct link can be established between this activity and the Australian news articles.

Voestalpine BÖHLER Aerospace, located in Kapfenberg, relies on the EAF process. Activity at this plant showed an upward trend, rising from 49% in June/July to 56% in October. Given the reliance on EAF technology, this plant is less directly affected by coking coal market dynamics discussed in the Australian news.

The news “Australia’s safeguard demand at 13.4mn, new SMCs at 7mn” highlights Australia’s push for decarbonization, potentially increasing costs for Australian coal producers, although no direct impact on Voestalpine steel plants can be identified. “Australia’s CS delays gas-fired generator to 2028” suggests potential delays in transitioning to alternative energy sources for mining operations, possibly affecting long-term stability of coal supply, but a direct impact on Austrian steel production is uncertain. “Inside Australia’s mining decarbonisation push” emphasizes decarbonization challenges, including technological and financial hurdles, which may translate into higher raw material costs, although no immediate direct impact on Austrian plants.

Despite stable activity levels at the two integrated Voestalpine plants, the news from Australia related to coking coal production warrants a cautious approach.

Evaluated Market Implications:

The news articles from Australia highlight potential vulnerabilities in the coking coal supply chain, which are essential for the BOF-based steelmaking processes at Voestalpine Stahl Linz and Donawitz. While no immediate supply disruption is apparent from the satellite data, the combination of declining exploration (“Australia’s Qld coal exploration falls for fifth time”) and cost pressures on Australian producers (“Australia’s QCoal to keep producing after mine closure”) could lead to future price increases or supply constraints. The increasing activity observed at Voestalpine BÖHLER Aerospace, which utilizes EAF technology, suggests a possible strategic shift towards less carbon-intensive steel production.

Recommended Procurement Actions:

- For steel buyers: Given the potential for coking coal price volatility, negotiate longer-term contracts with Voestalpine Linz and Donawitz to secure stable pricing. Consider diversifying steel sourcing to include EAF-produced steel, potentially from Voestalpine BÖHLER Aerospace, to mitigate risks associated with coking coal supply disruptions. Closely monitor coking coal prices.

- For market analysts: Track Australian coking coal production and export data closely. Analyze the impact of the safeguard mechanism (“Australia’s safeguard demand at 13.4mn, new SMCs at 7mn”) on Australian coal producers’ cost structures. Monitor Voestalpine’s investment in and strategic shift toward alternative steelmaking technologies.