From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAustrian Steel Market: Stable Production Amidst Global Iron Ore Price Concerns

Austria’s steel market shows steady production levels, despite external pressures highlighted in “Australia expects a $19 billion decline in iron ore export revenues by 2027“, which signals potentially lower input costs but also reflects reduced global demand. Satellite data reveals consistent activity across Austrian steel plants, but no direct correlation between Austrian plant activity and Australian export data can be established from the provided information alone.

The Austrian steel sector demonstrates relative stability in the face of evolving global dynamics. Plant activity is detailed in the following table:

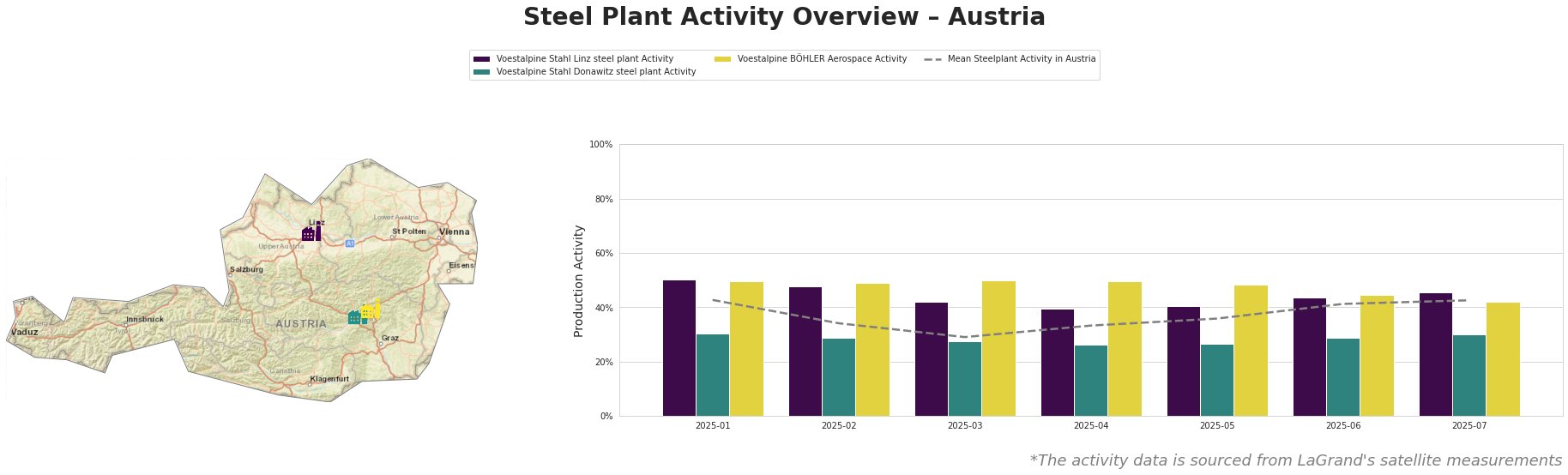

The Mean Steelplant Activity in Austria shows a low in March 2025 at 29%, increasing to 43% by July 2025.

Voestalpine Stahl Linz, an integrated steel plant with a 6 million tonne BOF capacity and production focus on flat steel products, showed a decrease in activity from 50% in January 2025 to 39% in April 2025, followed by a recovery to 45% in July. The mid-year decline may be linked to operational inefficiencies cited in the news article “Australia’s Gladstone port coal exports drop in FY25“, specifically in light of the plant’s reliance on the BOF process and thus coking coal. However, this is speculative as no direct evidence has been provided.

Voestalpine Stahl Donawitz, another integrated steel plant using BF/BOF technology with a 1.57 million tonne capacity, exhibited relatively stable activity, fluctuating between 26% and 30% from April to July 2025. The activity levels are considerably below the national average. There is no immediately identifiable connection between the observed Donawitz activity and the provided news articles.

Voestalpine BÖHLER Aerospace, with electric arc furnace (EAF) processing, has shown relatively steady activity that is consistently above the Austrian average, ranging between 42% and 50%. The reliance on EAF technology means it may be less susceptible to coking coal market fluctuations described in “Australia expects met coal exports to rise in 2025 despite trade uncertainty, softening prices“. No direct link can be established between its activity levels and the provided news articles.

Given the predicted decline in iron ore prices per “Australia expects a $19 billion decline in iron ore export revenues by 2027,” Austrian steel buyers should explore opportunities to negotiate more favorable iron ore supply contracts, particularly with Australian suppliers, to mitigate potential cost pressures. Monitor the trends in Australian coal exports, as described in “Australia’s Gladstone port coal exports drop in FY25” and “Australia expects met coal exports to rise in 2025 despite trade uncertainty, softening prices,” to anticipate potential impacts on BOF-dependent steel production in Austria, especially at Voestalpine Stahl Linz and Donawitz.