From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAustrian Steel Market Shows Very Positive Sentiment Despite Mixed Plant Activity Amidst Global Green Steel Initiatives

Austria’s steel market maintains a very positive outlook, even though satellite data reveals mixed activity levels at key plants. This sentiment contrasts with global green steel initiatives, as seen in the news “Australia backs Calix’ project to pave way for green iron production,” “Tenova to Supply Technology for Australian Green Steelmaking Project,” and “Tenova to supply DRI technology to NeoSmelt’s project in Australia,” which highlight the steel industry’s growing commitment to decarbonization and innovation, but lack a direct link to current domestic activity. The articles reveal significant investments and technological advancements in green steel production overseas, but do not directly relate to any observed changes in domestic steel plant activity.

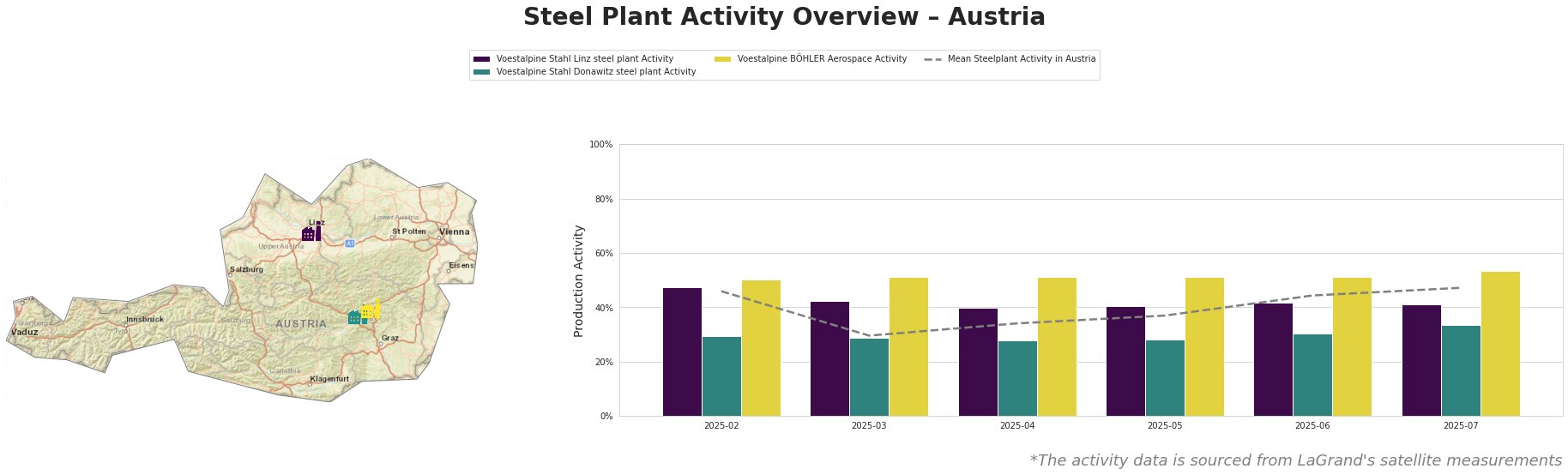

Measured Activity Overview:

The average steel plant activity in Austria has seen fluctuations, with a notable low of 30.0 in March and a peak of 47.0 in July. While Voestalpine Stahl Linz exhibited an activity level above the Austrian mean in February, activity dropped to 41.0 in July, underperforming compared to the national average of 47.0. Conversely, Voestalpine BÖHLER Aerospace consistently operated above the mean, reaching its highest activity level of 53.0 in July. Voestalpine Stahl Donawitz consistently remained below the mean activity level, seeing a slight increase from 29.0 in February to 33.0 in July. No direct connection can be established between these activity fluctuations and the provided news articles regarding Australian green steel initiatives.

Voestalpine Stahl Linz, an integrated steel plant in Upper Austria with a 6,000 thousand tonnes per annum (ttpa) BOF capacity and 5,000 ttpa BF capacity, primarily produces semi-finished and finished rolled products. Notably, its activity decreased to 41.0% in July, underperforming the Austrian mean. While holding ISO14001 certification and ResponsibleSteel Certification, there is no direct correlation between these certifications and the recent drop in activity. The news articles highlighting green steel initiatives in Australia do not explain the recent activity drop at the Linz plant.

Voestalpine Stahl Donawitz, also an integrated steel plant located in Styria, boasts a capacity of 1,570 ttpa for BOF and 1,650 ttpa for BF. Activity rose slightly to 33.0% in July. Similar to the Linz plant, the news regarding overseas green steel projects has no direct bearing on the activity level at the Donawitz facility. This plant holds both ISO14001 and ISO50001 certifications along with ResponsibleSteel Certification.

Voestalpine BÖHLER Aerospace, located in Kapfenberg, focuses on specialized steel products, but capacity for crude steel and iron production is not specified. It utilizes EAF technology. The plant’s activity level reached 53.0% in July. No direct connection to the news articles can be established. The plant has ResponsibleSteel Certification.

Evaluated Market Implications:

Despite the overall very positive market sentiment, Voestalpine Stahl Linz steel plant’s underperformance relative to the Austrian mean activity level might lead to short-term supply constraints for hot-rolled steel strip, cold-rolled steel strip, electrical steel strip, hot-dip galvanized steel strip, electrogalvanized steel strip, and organic-coated steel strip.

Recommended Procurement Action:

- Steel buyers relying on Voestalpine Stahl Linz should proactively engage with the supplier to understand the drivers behind the recent activity decrease, to ensure stable supply.

- Consider diversifying procurement sources to mitigate potential supply disruptions from Voestalpine Stahl Linz.