From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAustria Steel Market Update: Activity Trends Hold Steady Amid External Supply Resilience

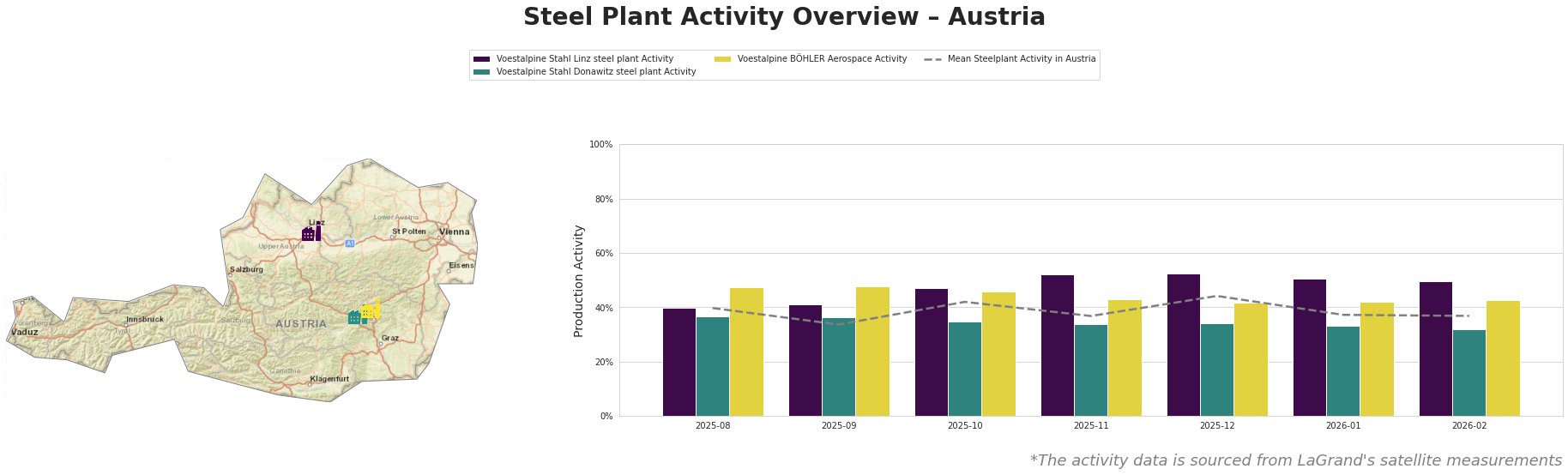

Rising activity at Austrian steel plants remains stable despite external supply fluctuations. Recent developments such as Australia’s Pilbara Ports reopens WA ports: Update, which indicates renewed iron ore flow, have not directly correlated with Austrian plant activity. Consequently, satellite-observed data from February show a consistent activity level across Austria’s key steel facilities, indicating a neutral market sentiment.

Voestalpine Stahl Linz steel plant has experienced a noteworthy drop to 50% activity in February from 52% in December, aligning with broader stability but not directly attributable to external supply shifts like the reopening of Australian ports. This facility, operating an integrated blast furnace and basic oxygen furnace processes, continues to produce a diverse range of finished and semi-finished steel products.

Voestalpine Stahl Donawitz exhibited a larger decline to 32% in February from 34% the previous month, reflecting broader trends in semi-finished product output likely influenced by supply chain comforts from banks of iron ore restarts—though no direct link to the articles can be made. This facility’s operations also center on integrated blast furnace methods, focusing on hot-rolled and cold-rolled steel strips.

Voestalpine BÖHLER Aerospace remains relatively stable, achieving 43% activity levels despite the mining sector’s adjustments and fluctuations in global commodity traffic. Forming part of an electric arc furnace operation, its contributions to the aerospace sector continue undeterred by supply limitations observed elsewhere.

Given the recent neutral sentiment and activity data, steel buyers in Austria should consider locking in procurement to mitigate potential supply delays derived from overseas markets, specifically in anticipation of fluctuations due to intermittent disruptions in regions like Australia, which could affect future iron ore availability. Regular reviews of plant outputs and responsiveness to changes in external supply channels are essential for informed purchasing decisions.