From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAustralian Steel Market: Green Steel Investments Fuel Optimism Amidst Production Shifts

Australia’s steel market exhibits a very positive sentiment, driven by substantial investments in green steel production. This report analyzes observed activity changes at key steel plants, linking them to recent industry news focusing on Western Australia, where significant developments in low-carbon steelmaking are underway. “Rio Tinto invests $22 million in Calix low-carbon steel project,” “Fortescue advances green iron project using Metso’s hydrogen-based DRI and electric smelting furnace,” and “Rio Tinto invests A$35 million in Calix’s Zesty™ plant to advance low-carbon steelmaking” signal a long-term shift towards sustainable practices. No direct relationship between these specific project announcements and the observed short-term activity data could be established.

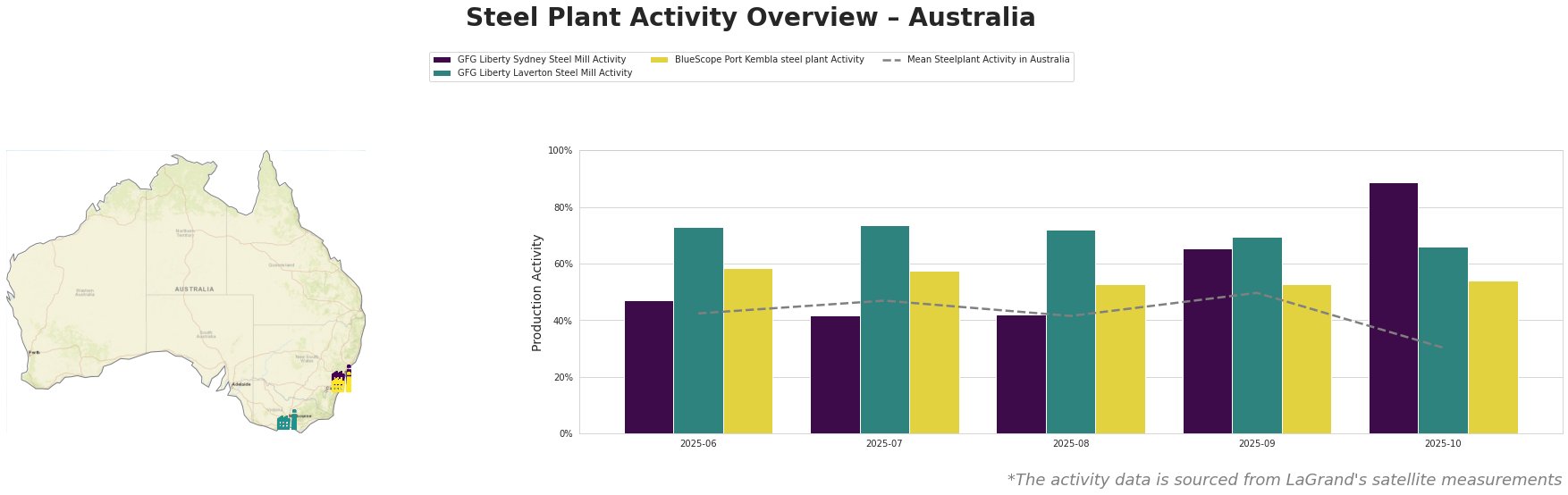

The mean steel plant activity in Australia fluctuated, dropping significantly to 30% in October after peaking at 50% in September. GFG Liberty Laverton consistently showed high activity, remaining above 70% until October, when it dipped to 66%. GFG Liberty Sydney experienced a sharp increase in October, reaching 89%, a considerable rise from its stable activity around 42-47% in previous months. BlueScope Port Kembla saw a slight decline, stabilizing around 53-58%.

GFG Liberty Sydney Steel Mill, an EAF-based plant producing long products, saw a surge to 89% activity in October, potentially indicating increased demand for its reinforcing bar and mesh products used in building and infrastructure. This peak is notable compared to its earlier months. No direct connection to the provided news articles could be established for this specific increase.

GFG Liberty Laverton Steel Mill, similarly equipped with an EAF and focused on long products, maintained a consistently high activity level, averaging around 72-74% until a drop to 66% in October. This suggests a stable operational capacity, but the recent slight dip could warrant monitoring. Again, there is no direct link to the low-carbon steel projects in Western Australia.

BlueScope Port Kembla steel plant, an integrated BF-BOF facility producing slab, hot rolled coil and plate for building and infrastructure, exhibited a gradual decline in activity, reaching a low of 53% in August and September before a slight recovery to 54% in October. This trend could indicate adjustments related to overall demand. Its operational profile is distinct from the EAF-based plants and is not directly impacted by the Western Australia-focused green steel initiatives discussed in the news articles.

The Rio Tinto and Fortescue projects, while not immediately influencing current production rates at existing plants based on available data, signal a strategic shift towards green steel using Pilbara iron ore. Fortescue advances green iron project using Metso’s hydrogen-based DRI and electric smelting furnace emphasizes the use of hydrogen-based DRI, potentially impacting future iron ore specifications and demand. The location of these projects in Western Australia (Rio Tinto invests $22 million in Calix low-carbon steel project and Rio Tinto invests A$35 million in Calix’s Zesty™ plant to advance low-carbon steelmaking) highlights a regional focus on sustainable steel production.

Evaluated Market Implications and Recommended Procurement Actions:

- Potential Shift in Iron Ore Demand: The news highlights a move towards utilizing lower-grade iron ore and hydrogen-based reduction. Steel buyers should monitor the development of these green steel projects in Western Australia, particularly Fortescue’s DRI plant, as successful implementation may lead to a gradual shift in iron ore demand towards ore types suitable for hydrogen reduction. Procurement strategies should consider diversifying iron ore sourcing to include suppliers capable of providing ore compatible with DRI processes.

- No immediate supply disruption from plant activity data: The observed activity data shows no immediate disruption to supply from the studied producers.

- Long-Term Strategic Positioning: Procurement analysts should closely track the progress of the Rio Tinto-Calix Zesty™ plant and Fortescue’s green iron project. The success of these initiatives will influence the future availability and cost competitiveness of green steel in the Australian market. Preparing for a potential transition to green steel procurement through research and supplier engagement is recommended.