From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAustralian Steel Market Bolstered by Iron Ore Investment Amidst Varying Plant Activity

Australia’s steel market exhibits a very positive sentiment, driven by significant iron ore investments aimed at sustaining production. The “Rio Tinto and partners invest $733 million in ore mining development in Pilbara,” “Robe River Joint Venture to invest $733 million to extend West Angelas iron ore mine in Western Australia,” and “Robe River JV to develop new iron ore deposits at West Angelas mine” all highlight commitments to maintaining iron ore supply. While these investments are substantial, no direct correlation to immediate changes in steel plant activity could be explicitly established from the provided data.

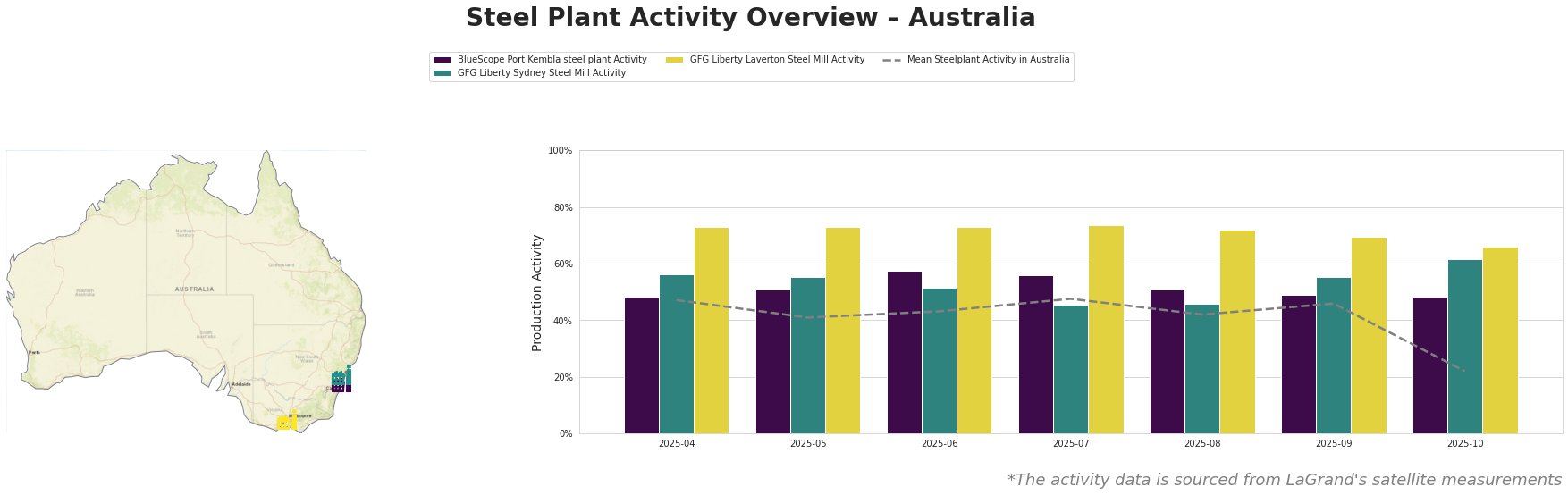

Overall, the mean steel plant activity in Australia experienced a significant drop to 22.0% in October, a sharp contrast to the consistent levels observed in the preceding months. BlueScope Port Kembla’s activity remained relatively stable, generally outperforming the national average, while GFG Liberty Laverton consistently operated at high activity levels, albeit with a decline in October. GFG Liberty Sydney showed some volatility but ended October with an increased activity of 62.0%. No explicit links between these plant-specific activity shifts and the cited news articles could be established.

BlueScope’s Port Kembla steel plant, an integrated BF-BOF facility in New South Wales with a crude steel capacity of 3.2 million tonnes per annum, primarily produces slabs, hot rolled coil, and plate for the building and infrastructure sectors. While its activity has remained consistently around the 50% mark, the sharp drop in overall Australian steel plant activity in October did not significantly affect it. No direct link can be established between this steady performance and the iron ore investment news, but the stability may reflect confidence in future raw material supply.

GFG Liberty’s Sydney Steel Mill, an EAF-based facility in New South Wales with a 750,000 tonnes per annum capacity, focuses on steel long products such as reinforcing bar and mesh. The mill’s activity has fluctuated, showing a marked increase to 62.0% in October, a rise against the mean. No direct connection between this increase and the news about iron ore investments is evident.

GFG Liberty’s Laverton Steel Mill, an EAF-based facility in Victoria with a 660,000 tonnes per annum capacity, also specializes in steel long products. It exhibited the highest activity levels of the observed plants, consistently above 70% until a decrease to 66.0% in October. As with the other plants, no direct link can be established between this decrease and the iron ore investment news.

Given the significant drop in overall Australian steel plant activity in October, despite the positive news surrounding iron ore investments, steel buyers and market analysts should:

- Closely monitor the October activity data for BlueScope Port Kembla (48.0%), GFG Liberty Sydney (62.0%), and GFG Liberty Laverton (66.0%) for any further declines in the coming weeks. A continued downward trend at any of these plants could signal potential supply constraints.

- Assess inventory levels and consider increasing short-term stock of hot rolled coil, plate, and steel long products to mitigate potential disruptions linked to the recent reduction in steel production.. While no explicit disruptions are yet confirmed, proactive measures are advised.

- Engage directly with BlueScope and GFG Liberty to understand the drivers behind the October activity changes. Gaining insights into their operational outlook will be crucial for informed procurement decisions.