From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia’s Steel Market Thrives: Positive Activity Shifts Amid US Economic Developments

Recent observations in Asia’s steel industry reflect a strong market sentiment, driven by a spike in production activity. This follows insights from The US Federal Reserve has cut its key interest rate for the third time this year and US labor cost growth moderates in third quarter amid easing labor market conditions, which have indirectly encouraged increased steel production rates across selected plants.

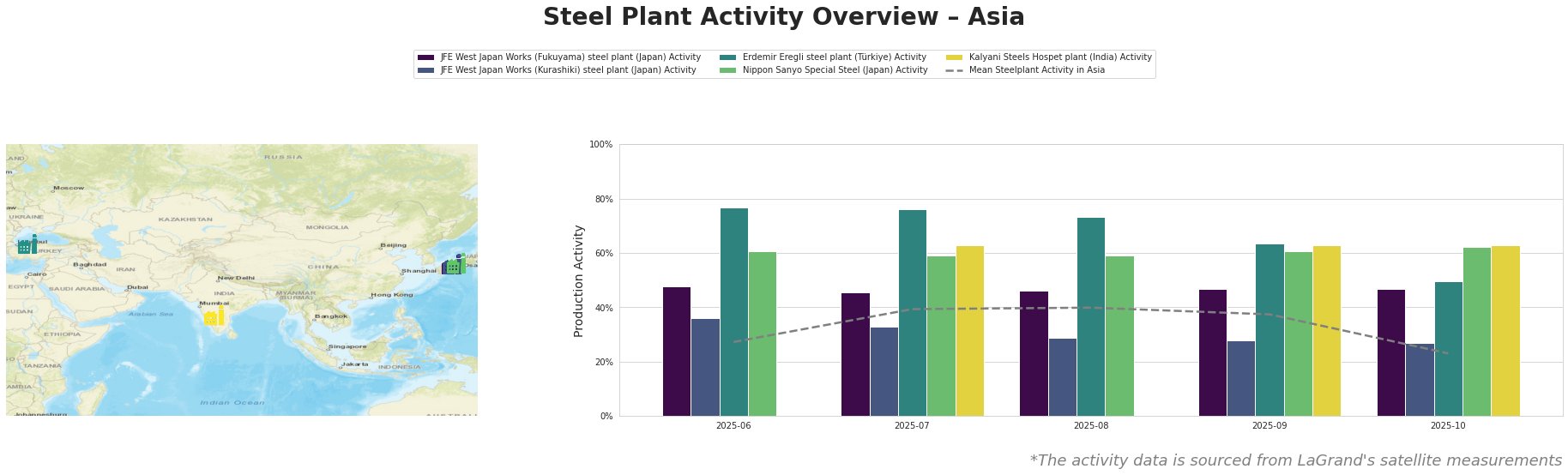

In Japan, the JFE West Japan Works (Fukuyama) plant recorded a notable increase in activity, rising to 48% in July 2025. Similarly, the JFE West Japan Works (Kurashiki) plant stayed steady at 33% during the same month, only slightly declining to 29% in August. Activity levels at both plants are above the mean of 39%, suggesting robust operational capacities that may be encouraged by favorable economic indicators from the US.

In Türkiye, Erdemir Eregli’s activity peaked at 77% in July 2025, maintaining a solid position relative to the mean activity. With growing demand in construction and infrastructure, this aligns well with the US’s economic flashpoints discussed in US adds 64,000 jobs in November, jobless rate climbs which highlight industrial resilience.

The Kalyani Steels Hospet plant recorded activity at 63% consistently from July through October, reflecting stable operational flows and a robust procurement stance. Meanwhile, the Nippon Sanyo Special Steel plant’s activity remains limited, which makes its alignment with recent reports unclear.

The current positive shifts underscore that plants in Asia are adapting favorably amid shifting economic landscapes influenced by US interest rates and labor market dynamics. Steel procurement professionals should prioritize suppliers exhibiting high activity levels like Erdemir and Kalyani Steel for reliable sourcing.

Recommendations:

– Target High-Activity Suppliers: Focus procurement on Erdemir and Kalyani Steels, characterized by above-average activity levels, suggesting reliable output and stability.

– Monitor Economic Trends: Stay updated with US economic signals as they may lead to shifts in demand and pricing strategies across the region.

– Diversify Procurement Strategies: Implement flexible sourcing strategies, adjusting for fluctuations indicated by the ongoing labor and interest rate changes in the US, which may influence the overall steel market dynamics in Asia.