From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia’s Steel Market Thrives Amidst Strong Activity Metrics and Energy Trends

Recent developments in Asia’s steel market indicate a very positive sentiment, propelled by renewed activity levels across major steel plants. Notable news articles, such as “India extends directive to lift coal-fired generation” and “Coal instead of the sun: China invests in fossil fuels for BRICS partners”, have highlighted significant shifts in energy policy affecting operational capacities. The extension of coal-fired generation directives in India correlates with rising activity levels at key plants, though specific links to the satellite data may not be entirely clear.

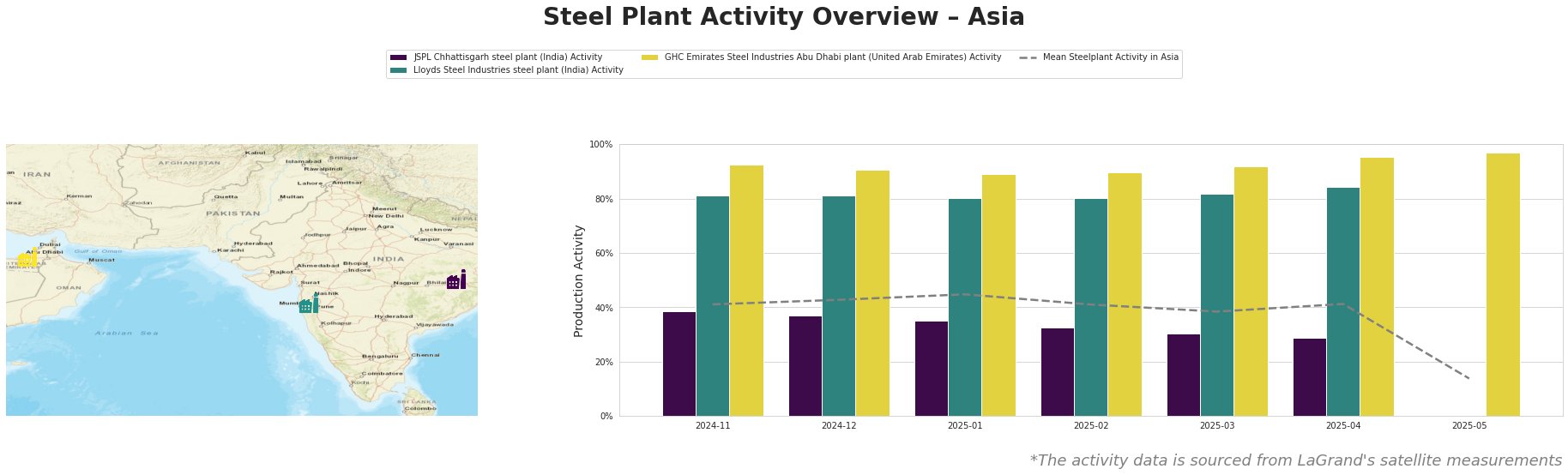

With the mean activity level hovering around 41%, a marked decline is observed at the JSPL Chhattisgarh steel plant, which dropped to 29% in April, likely affected by seasonal variations despite the extended generation directive. In contrast, Lloyds Steel Industries and GHC Emirates Steel show resilience, peaking at activity levels of 84% and 95% respectively in April, suggesting robust demand.

The JSPL plant, based in Chhattisgarh, has experienced a noticeable dip from 39% to 29% activity between November and April, yet aligns with policy moves such as “India extends directive to lift coal-fired generation”, which may indirectly impact coal availability and operational scales. However, the correlation between reduced activity and energy policies remains tenuous, as the plant’s operational shifts appear influenced by broader market conditions rather than solely energy directives.

Conversely, Lloyds Steel Industries in Maharashtra remains stable, maintaining an activity level of 84% as of April, attributed to its electric arc furnace (EAF) operations catering to energy and machinery sectors. GHC Emirates Steel in Abu Dhabi showcases a surge to 95%, possibly capitalizing on construction and infrastructure dynamics which can be indirectly linked to the broader trends discussed in the “Coal instead of the sun” article, highlighting fossil fuel dependencies.

In terms of market implications, the evident activity fluctuations warrant attention for procurement strategies. Steel buyers should consider the declining activity at JSPL as a potential supply disruption risk, particularly for products from this region. It would be prudent to secure additional supplies from Lloyds Steel and GHC Emirates Steel while assessing the implications of ongoing energy policies in India and China, which may impact future production and operational stability across Asia’s steel sector.

Recommendations for procurement professionals:

– Immediate sourcing from Lloyds Steel and GHC Emirates to mitigate potential disruptions stemming from JSPL.

– Monitor energy policy developments in India as further shifts may exacerbate supply dynamics from coal-dependent plants.

– Evaluate alternate supply routes from regions with rising activity metrics to ensure balance in procurement strategy amidst fluctuating market conditions.