From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia’s Steel Market Surges: India’s Coking Coal Strategy and Plant Activity Propel Positive Outlook

India is making substantial strides in its steel sector as it recently classified coking coal as a critical mineral. This is reported in “India has declared coking coal a critical mineral“ and “India Classifies Coking Coal As Critical Mineral To Boost Output“, which underline the government’s efforts to reduce import dependency. Observed satellite data indicates a corresponding increase in activity levels at major steel plants, particularly in the context of this policy shift.

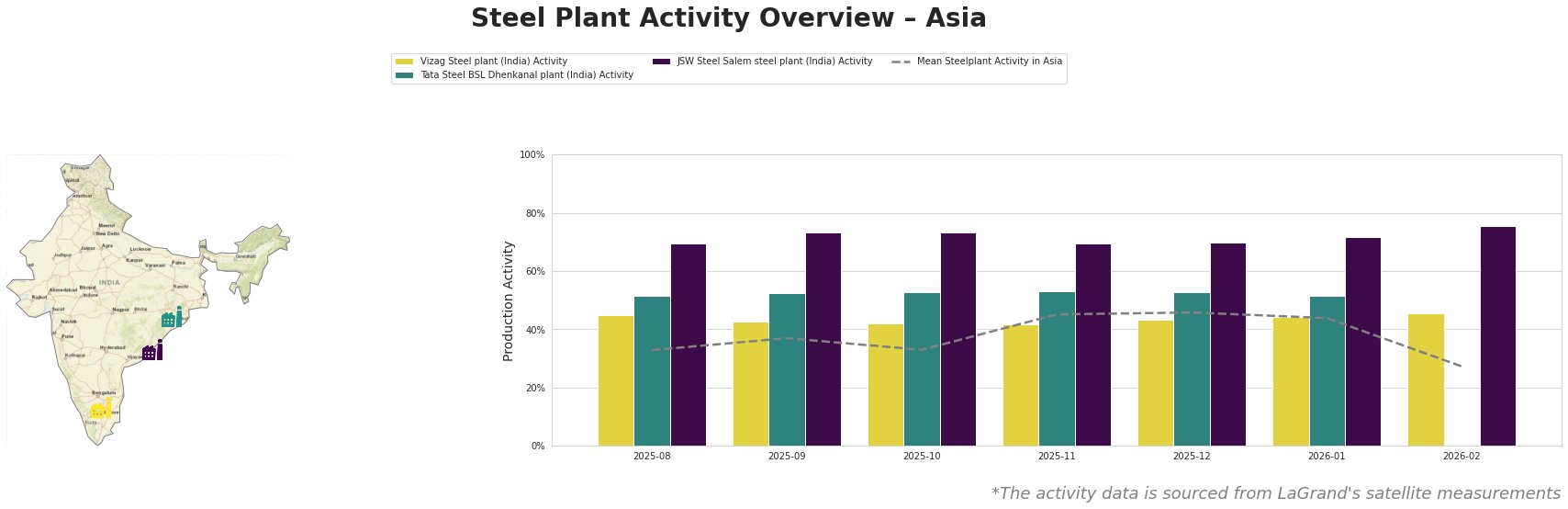

The Vizag Steel plant’s activity recorded a stable output with fluctuations, peaking at 45% in August 2025 and showing a steady output of 44% by January 2026. This aligns with the strong coking coal reserves and the support from government initiatives as described in “India declares coking coal to be critical and strategic mineral“. The Tata Steel BSL Dhenkanal plant has shown consistent activity, maintaining around 52-53% in recent months, slightly decreasing in February; however, no clear direct link to recent coking coal developments can be established for this plant.

The JSW Steel Salem plant exhibits significant growth, peaking at 76% in February 2026 after a stable performance of 69-73% in the preceding months. The timing of this increase suggests adaptation to favorable conditions fostered by the government’s recognition of coking coal as vital, although it remains unclear how closely this correlates with specific operational adjustments.

Given the significance of coking coal as emphasized in recent articles, steel buyers should act to secure contracts for domestic coking coal sources and closely monitor the developments in plant procurement and production strategy. The burgeoning activity levels may signal a shift in the supply chain dynamics with potential opportunities for alignment with domestic suppliers.

It is recommended that procurement teams consider diversifying their coal sources while navigating the expected rise in domestic production capacity, which will enhance resilience against future supply disruptions. Monitoring the coal policy’s implementation and its impact on steel production may provide actionable insights into operational adjustments at the level of individual plants, particularly in regions heavily dependent on coal imports.