From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia’s Steel Market Highlights: Optimism from Strategic India-EU Developments Amid Plant Activity Shifts

The steel market in Asia, particularly India, is experiencing a very positive sentiment largely driven by recent developments linked to the India-EU Free Trade Agreement (FTA). Significant changes in plant activity have been recorded, notably highlighted in the articles “India-EU FTA lifts end-user outlook, steel impact muted” and “India and EU’s agenda revisits steel production priorities”, which detail enhanced long-term trade relations despite short-term challenges stemming from carbon regulations. The satellite data reflects dynamic shifts in plant activities align with these news updates, although not all changes exhibit direct correlations.

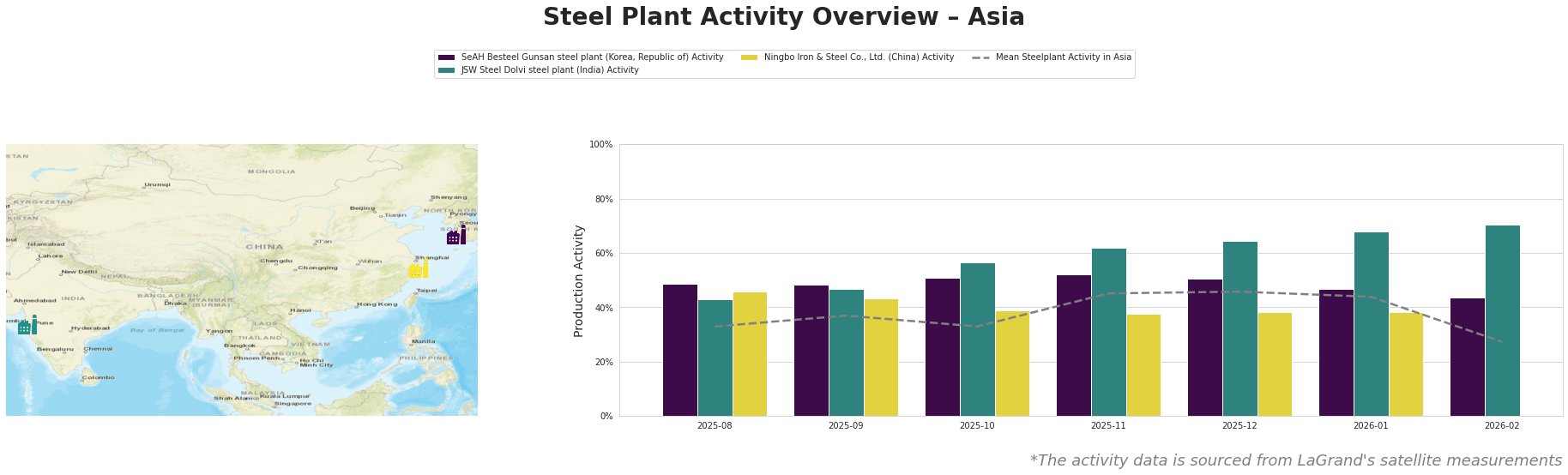

The JSW Steel Dolvi plant in Maharashtra shows remarkable growth, with activity rising from 62.0% in November 2025 to 70.0% by February 2026, corresponding with the positive sentiment surrounding engineering and automotive sectors influenced by the FTA, which is expected to boost domestic steel demand. In contrast, SeAH Besteel experienced a peak of 52.0% in November but dropped to 44.0% by February 2026. This decline may align with the uncertainty highlighted in “EU deal holds limited benefits for Indian steel market”, where carbon adjustment costs are looming over the Asian steel sector.

Conversely, Ningbo Iron & Steel has seen a steady decline from a stable 46.0% in August 2025 to an unobserved level in February 2026, although no direct links to recent news can be effectively established for this drop. This poses potential concerns for supply as shifts in regulatory frameworks and international trade relations evolve.

Strategically, steel buyers should consider procuring from JSW Steel Dolvi, which demonstrates increased production capacity aligned with favorable market conditions, indicated by both plant metrics and the anticipated growth in engineering and automotive sectors due to the FTA. Conversely, caution is warranted for sourcing activities involving SeAH Besteel, where recent declines could imply sporadic availability stemming from regulation challenges. This is compounded by potential pressures that may arise from the Carbon Border Adjustment Mechanism, as covered in “No CBAM exemption for Indian steel exports to EU under FTA”, which poses significant compliance hurdles for exporters, affecting supply dynamics in the region.