From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia’s Steel Market Faces Severe Contraction Amid Rising Geopolitical Tensions

Recent reports highlight significant downturns in steel plant activities across Asia, primarily driven by geopolitical instability. Notable articles such as US to blockade Venezuela oil flows: Trump suggest an intensifying blockade that could impact various sectors, alongside broader market anxiety stemming from these disruptions. However, no direct connection to steel production shifts was established in these reports.

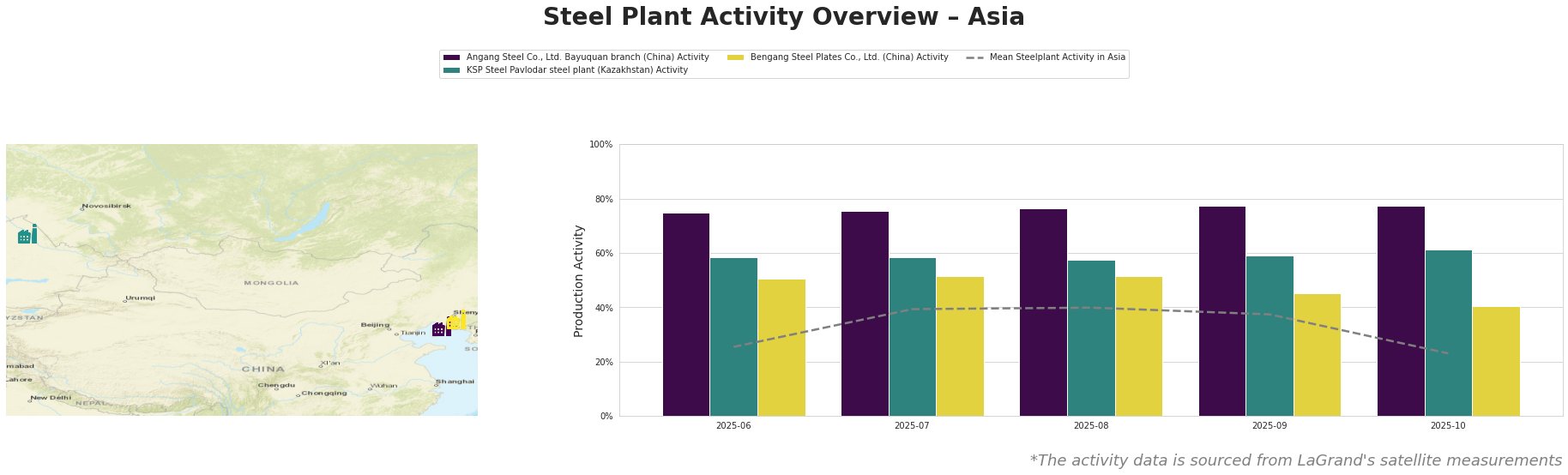

The data indicates a notable decline in mean steel plant activity, dropping to 23% in October from 40% in August. Particularly, Angang Steel Co. maintained relatively stable activity at around 77%, but this is in stark contrast to the 23% mean across all observed plants, with KSP Steel showing fluctuations between 58% and 61%. Notable declines in Bengang’s activity to 40% in October indicate heightened vulnerability.

Angang Steel Co., located in Liaoning, is primarily focused on integrated operations with a crude steel capacity of 6,500 tonnes. Despite an activity level of 77% in October, the sea of uncertainty in energy markets may pressure operating costs and downstream production capability. Moreover, the US to blockade Venezuela oil flows: Trump report raises concerns over supply chain vulnerabilities that could indirectly affect steel production.

KSP Steel Pavlodar operates with an 800 tonnes capacity and engages in electric arc furnace (EAF) operations. Its capacity utilization remains relatively high, but geopolitical tensions suggest potential for resource disruptions that stakeholders should monitor closely.

Bengang Steel, the largest on record, revealed a significant drop in activity to 40%, directly signaling softening demand and potential downstream impact due to macroeconomic pressures detailed in the Seized oil tanker likely heading to Houston article, highlighting broader global instability.

In light of these findings, steel buyers are recommended to:

- Diversify sourcing technologies to mitigate risks from potential supply chain disruptions, particularly from regions highlighted in the news articles.

- Monitor geopolitical developments daily, especially in relation to oil flows that could indirectly impact steel pricing and availability.

- Consider locking in contracts with stable suppliers now, as future increases in demand against existing disruptions may lead to skyrocketing prices.

This comprehensive analysis should guide strategic purchasing decisions amidst the challenging steel market climate throughout Asia.