From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia’s Steel Market: Driving Growth Amid Import Duties and Regulatory Changes

In Asia, the steel market sentiment remains very positive following regulatory changes impacting imports, as noted in several key announcements. The India Imposes Duties on Steel Imports from China and India extends import duties on flat steel to 3 years reveal significant government action aimed at bolstering domestic production against foreign competition. This sentiment is echoed by the Turkey has introduced anti-dumping measures against imports of cold-rolled stainless steel from China, further fueling regional market optimism. Consequently, satellite observation data indicates notable changes in plant activities, particularly in India, although direct links to every news update are not always established.

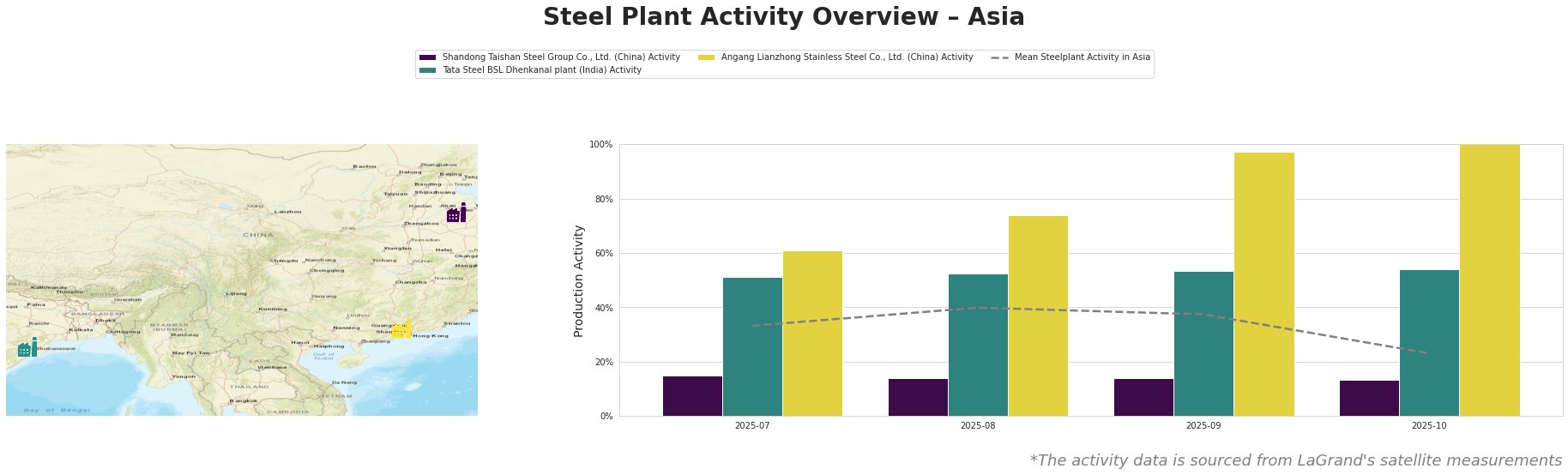

The overall steel plant activity in Asia peaked at 40.0% in August 2025, with significant peaks observed at 74.0% for Angang Lianzhong in September and a striking 100.0% in October, indicating a robust production response possibly linked to the supportive regulatory environment. In contrast, Shandong Taishan Steel shows declining activity from 15.0% in July to 13.0% in October, which hints at less favorable conditions in the Chinese market although no explicit connection to the news is established here.

For the Tata Steel BSL plant, activity levels remained consistently above the mean, stabilizing at 54.0% as the Indian market adjusts to ongoing tariffs designed to protect local production (as seen in the India Imposes 12% Safeguard Tariff on Steel Imports from China and Others to Protect Domestic Producers). This support, coupled with rising prices, encourages competitive stance towards imports.

Shandong Taishan Steel Group Co., Ltd.

With a crude steel production capacity of 5000 MT, Shandong Taishan principally uses an integrated process involving a blast furnace (BF) and basic oxygen furnace (BOF). The plant’s activity fell from 15.0% in July 2025 to 13.0% in October, indicating potential challenges despite the positive sentiment surrounding steel prices. Limited alignment with recent news suggests the plant may be feeling external pressures beyond local regulatory actions.

Tata Steel BSL Dhenkanal Plant

This facility boasts a crude steel capacity of 5600 MT, integrating BF and direct reduced iron (DRI) technologies. The Dhenkanal plant saw a slight increase in activity from 51.0% in July to 54.0% by October. The introduction of safeguard duties as per India extends import duties on flat steel to 3 years has likely supported the stability and confidence of ongoing operations here.

Angang Lianzhong Stainless Steel Co., Ltd.

Located in Guangdong, this plant specializes in electric arc furnace (EAF) production with a capacity of 3219 MT. Notably, activity surged from 61.0% in July to a maximum of 100.0% in October, likely fueled by the cautious optimism triggered by governmental export licensing reported in China Implements Export Licensing for 300 Steel Products from Jan 1 Sparking Cautious Optimism in Asian Markets.

In summary, procurement strategies should focus on markets like India and Turkey, where import duties are safeguarding local manufacturers and may further elevate domestic steel prices. Vigilance is essential regarding Chinese regulatory adaptations as they may cause localized supply constraints. Steel buyers may benefit from purchasing ahead, particularly from Indian and Turkish sources where market conditions are increasingly favorable.