From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia’s Steel Market Activity Surges Amid Positive Sentiment: Insights for Buyers

The steel market in Asia is experiencing a notably positive shift, driven by increased activity levels in key steel plants. The satellite data reveals significant trends correlating with recent news, such as “EU policy to boost Asia spec tanker demand”, which underscores heightened demand for biofuels, positively impacting steel production related to energy infrastructure.

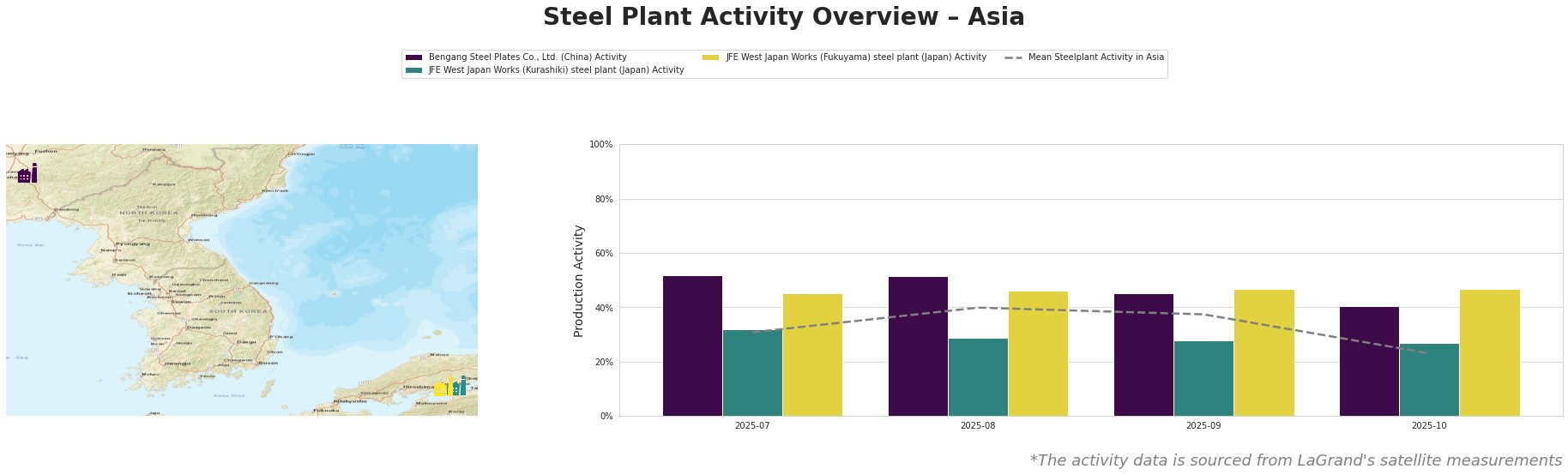

Bengang Steel Plates Co., Ltd. recorded a peak activity of 52.0% in July and August 2025, maintaining this level, indicative of stable production for its automotive and energy sector products. The plant employs integrated BF processes and accounts for a substantial workforce of 19,150, aligning with the reported increased demand for infrastructure development linked to EU tankers.

Contrastingly, JFE West Japan Works (Kurashiki) and (Fukuyama) plants exhibited decreasing trends, particularly visible by October 2025, where Kurashiki fell to 27.0% and Fukuyama remained at 47.0%. The sustained activity in Fukuyama may connect with ongoing robust demand in the automotive sector, although no direct news link can be established for the drop in Kurashiki.

Overall, while the mean steel plant activity saw a decline to 23.0% in October, the activity in Bengang remains significantly higher, attributing to increased regional steel demands driven by the biofuel transport sector as highlighted in the EU legislation.

In light of these developments, steel buyers should prioritize sourcing from Bengang Steel due to its consistent activity and output for automotive and energy infrastructure projects. It’s prudent to monitor JFE plants closely for recalibrated supply chains due to the downturn and potential procurement from Bengang may prove beneficial for consistent quality and supply reliability. If demand for biofuels continues to rise, establishing contracts with both JFE facilities could provide leverage against potential dips in production rates.

Steel procurement strategies should thus encompass both immediate sourcing from high-performing zones while assessing concerns over fluctuations to optimize supply chain reliability and cost efficiencies.